2022 Fair Labor Standards Act: Wage and Hour Laws

The U.S. Department of Labor (DOL) recently announced with the issuance of its spring regulatory agenda that its proposed overtime rule is now tentatively slated to be released in October 2022. The proposed rule is expected to recommend how to implement the exemption of bona fide executive, professional and administrative employees that fall under the Fair Labor Standards Act's (FLSA's) overtime and minimum wage requirements. How it affects the salary level increments and duties test is yet to be finalized.

The Fair Labor Standards Act (FLSA), commonly referred to as the Wage and Hour Act, was passed in 1938 and since then has been amended many times. The major provisions of the FLSA are concerned with minimum wage rates and overtime payments, child labor, and equal rights. The minimum age standards for employment and the child labor regulations have become of great importance as the year's last quarter approaches.

The US Department of Labor, Wage and Hour Division, oversees federal labor laws. Additionally, State DOLs administer state labor laws. Failure to comply with Wage and Hour laws may result in the employer paying the employee back wages, damages, penalties, attorney fees and court costs, plus the prospect of civil and criminal penalties from federal and/or state governments. Therefore, Wage and Hour compliance is of the utmost importance.

Join us on Standeagle this October to learn about the current FLSA provisions and the anticipated changes. Register now!

Areas Covered in the Session:

-What is the Fair Labor Standards Act and how to comply with it in the last quarter of 2022?

-What are the anticipated changes to the Act in 2022?

-What are the child labor regulations?

-What are the tests you can use to determine if an employee is exempt from FLSA?

-What is the importance of determining the primary duty of a job?

-What are the six FLSA exemptions?

-How to determine when to pay overtime?

-How to calculate overtime pay?

-What are the minimum wage provisions under FLSA?

-What are the equal pay provisions under FLSA?

-What are the recordkeeping requirements?

Bonus Topics

-Exempt vs. Non-Exempt status

-Salary Level and Salary Basis tests

-Repercussions of FLSA non-compliance

Why You Should Attend

Join us to learn the groundwork for determining whether your employees are properly classified as Exempt or Non-exempt and ensuring that wage and hour laws are being followed properly.

Who Will Benefit

Human Resources Professionals

Compensation Professionals

Compliance professionals

Managers & Supervisors

Employees

You may ask your Question directly to our expert during the Q&A session.

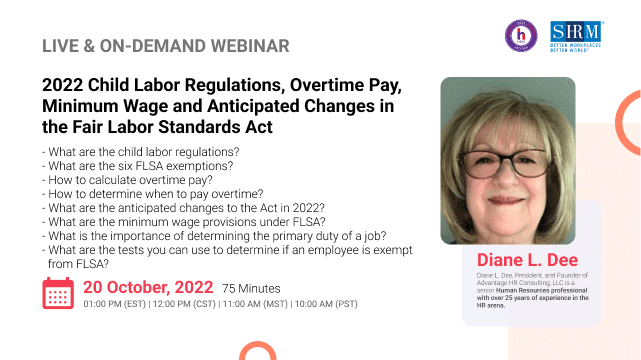

Diane L. Dee

Diane holds a Master Certificate in Human Resources from Cornell University’s School of Industrial and Labor Relations and has attained SPHR, SHRM-SCP, sHRBP, and HRPM® certification.

Diane is a member of the National Association of Women Business Owners and the Society for Human Resource Management. Additionally, Diane performs pro bono work through the Taproot Foundation, assisting non-profit clients by integrating their Human Resources goals with their corporate strategies.

Standeagle is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org.

Standeagle is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org.

Standeagle Webinar Certification - Standeagle rewards you with Standeagle Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Standeagle Courses and Webinars or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Standeagle doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

ACCREDITATIONS