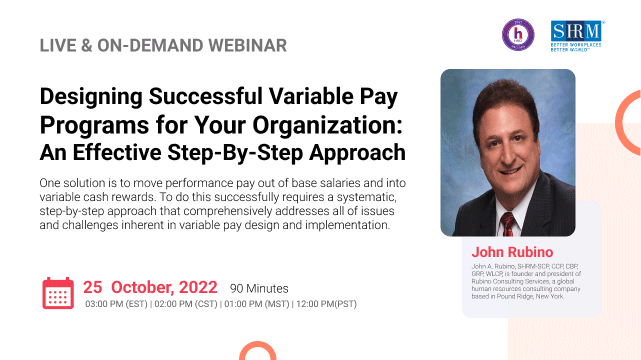

Designing Successful Variable Pay Programs for Your Organization: An Effective Step-By-Step Approach

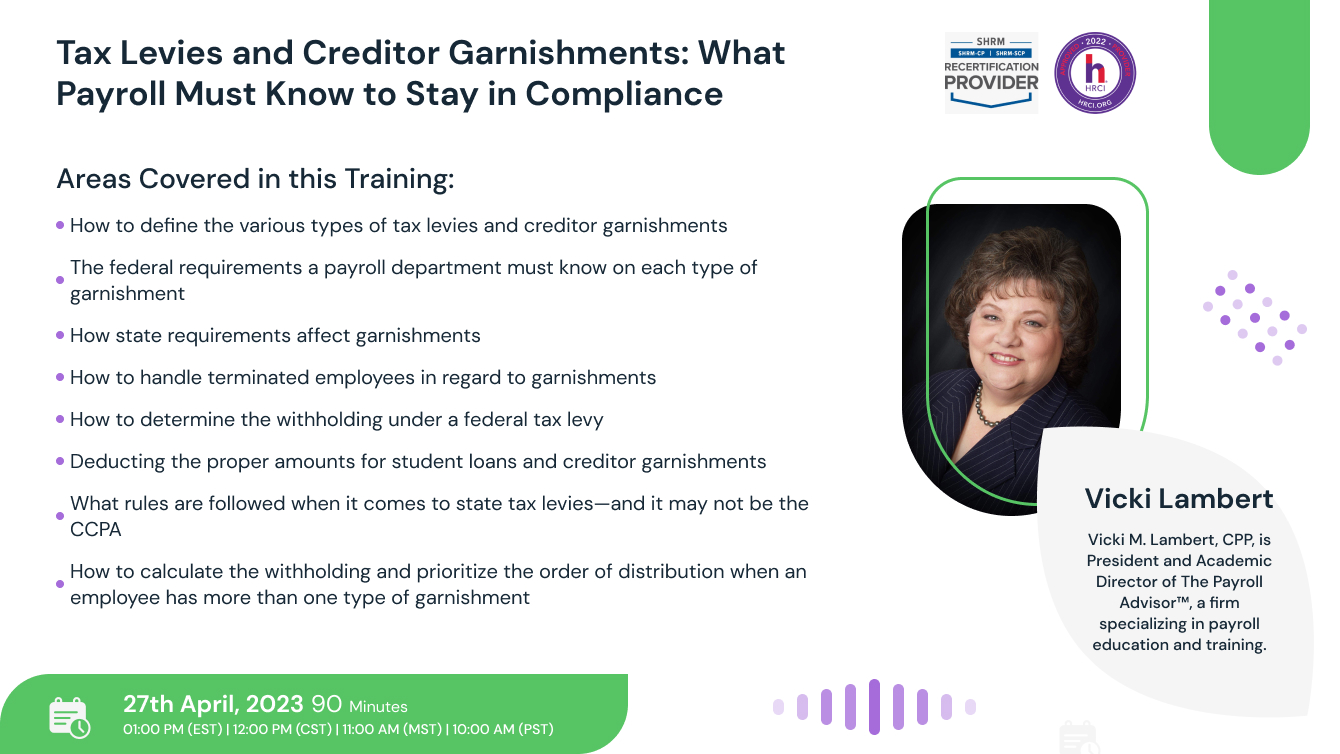

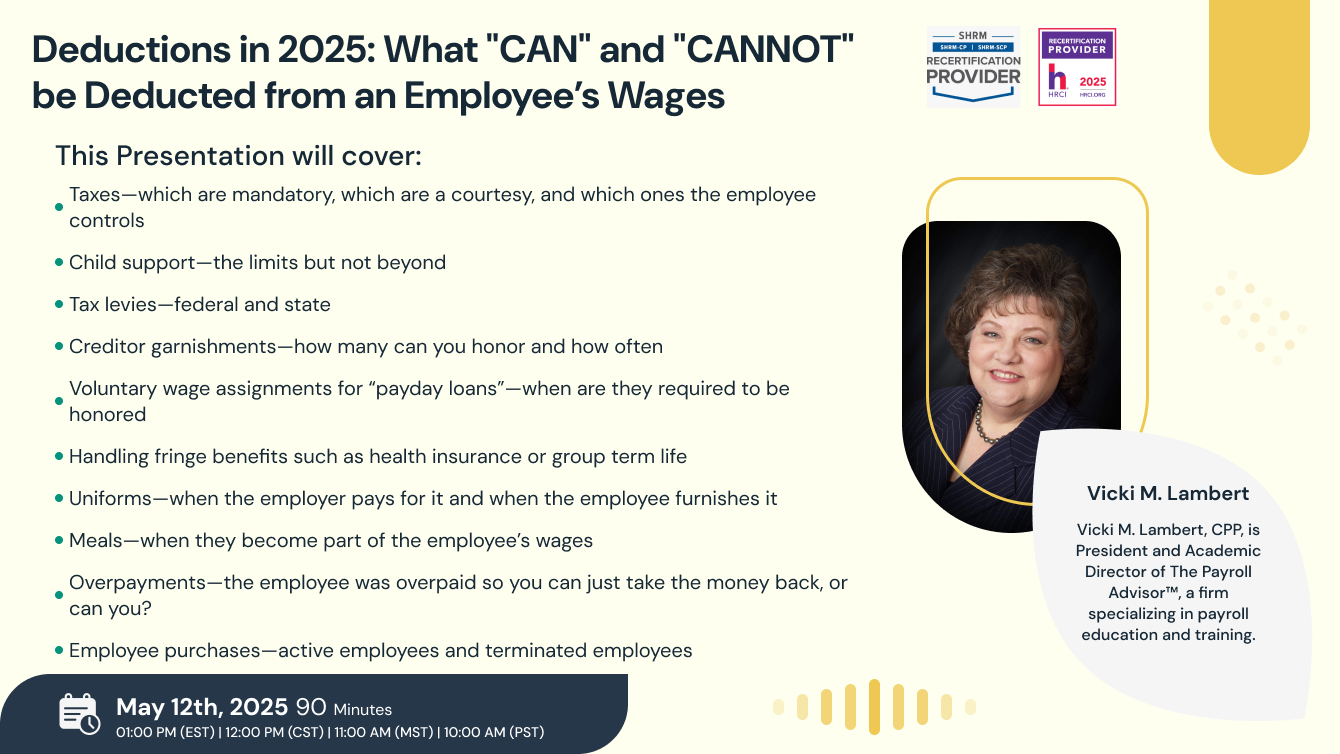

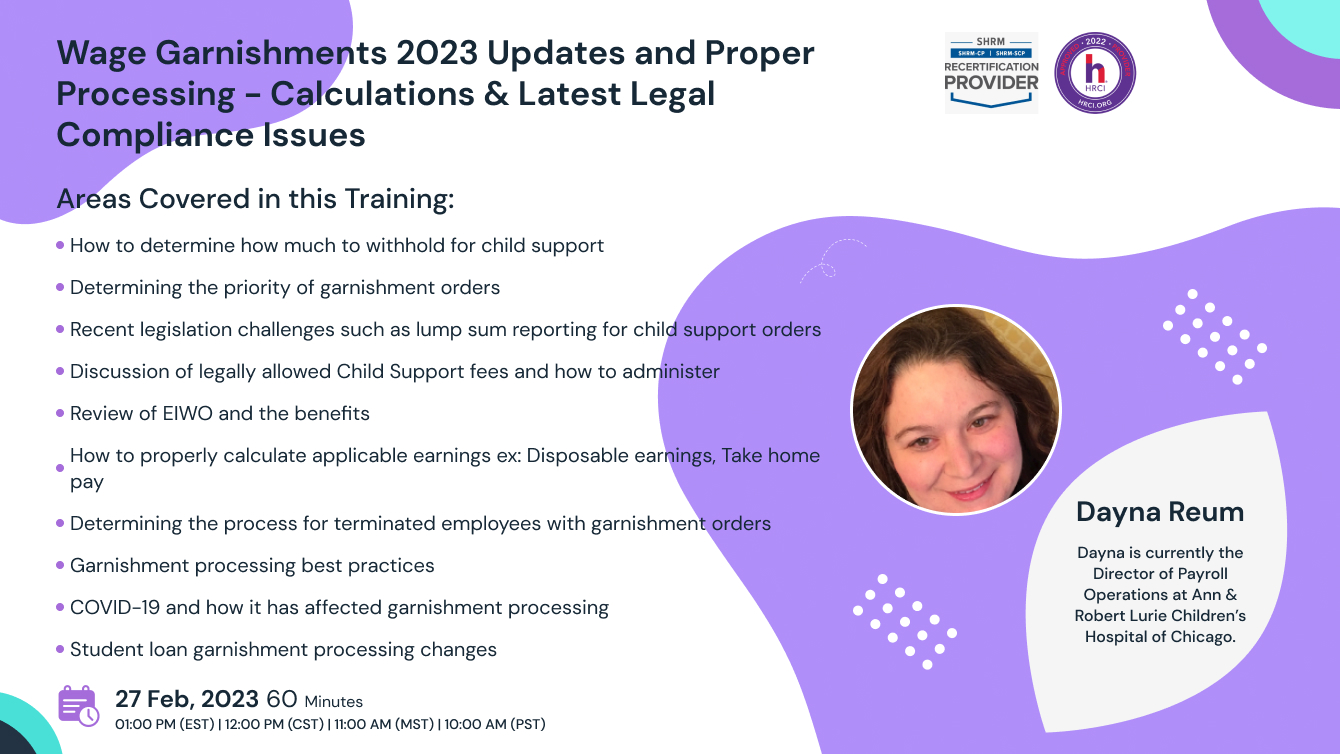

Wage Garnishments 2023 Updates and Proper Processing - Calculations & Latest Legal Compliance Issues

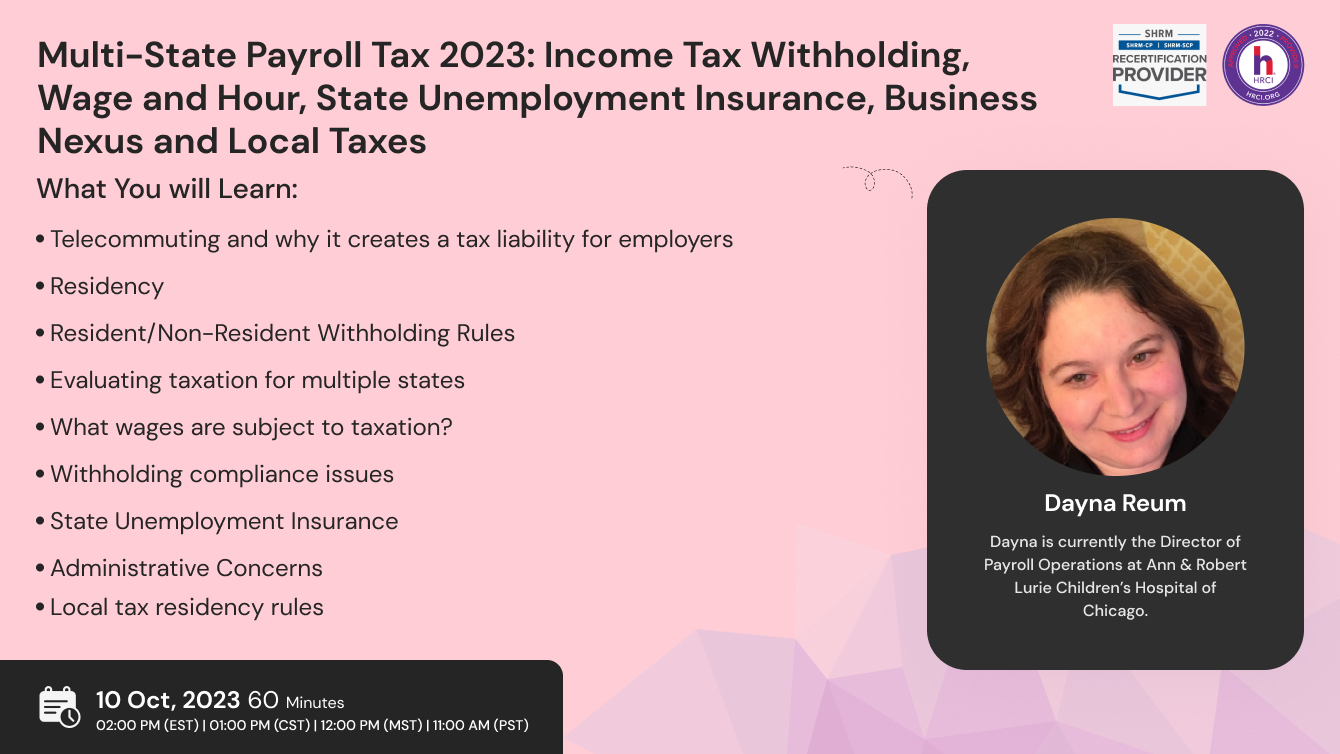

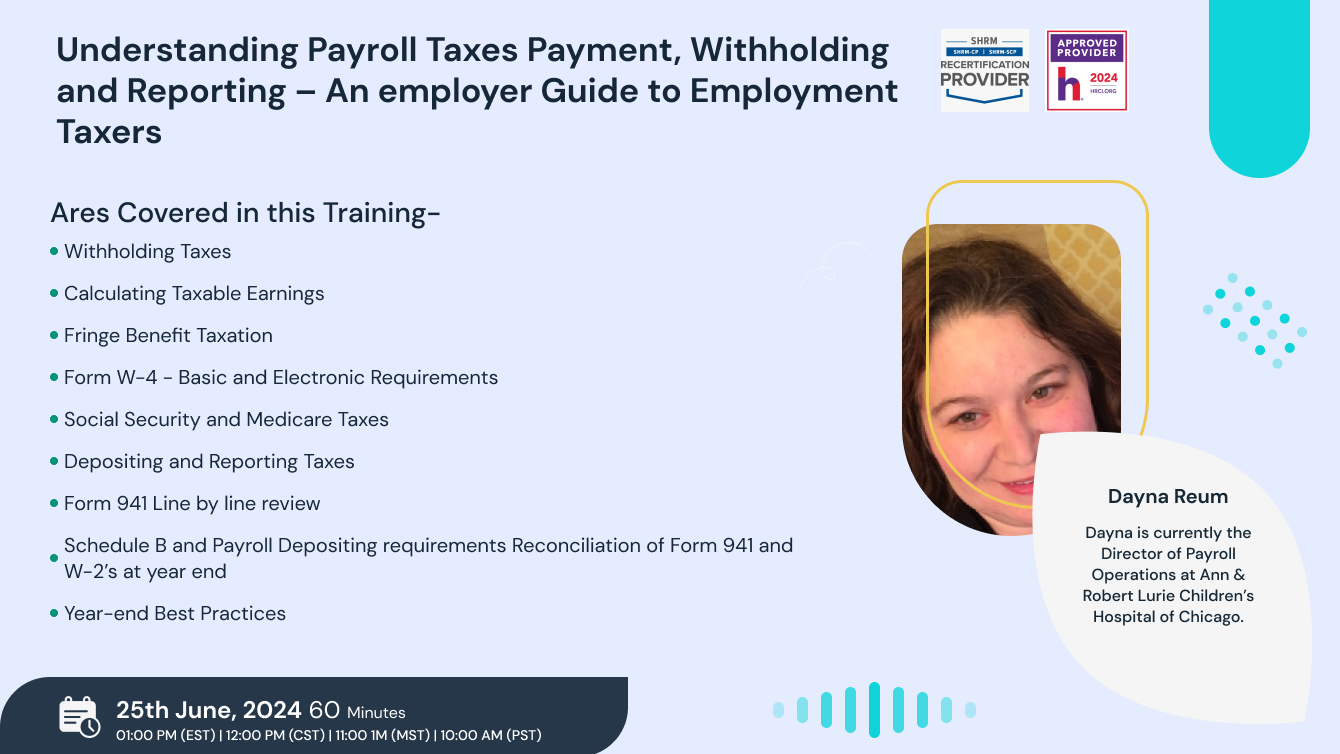

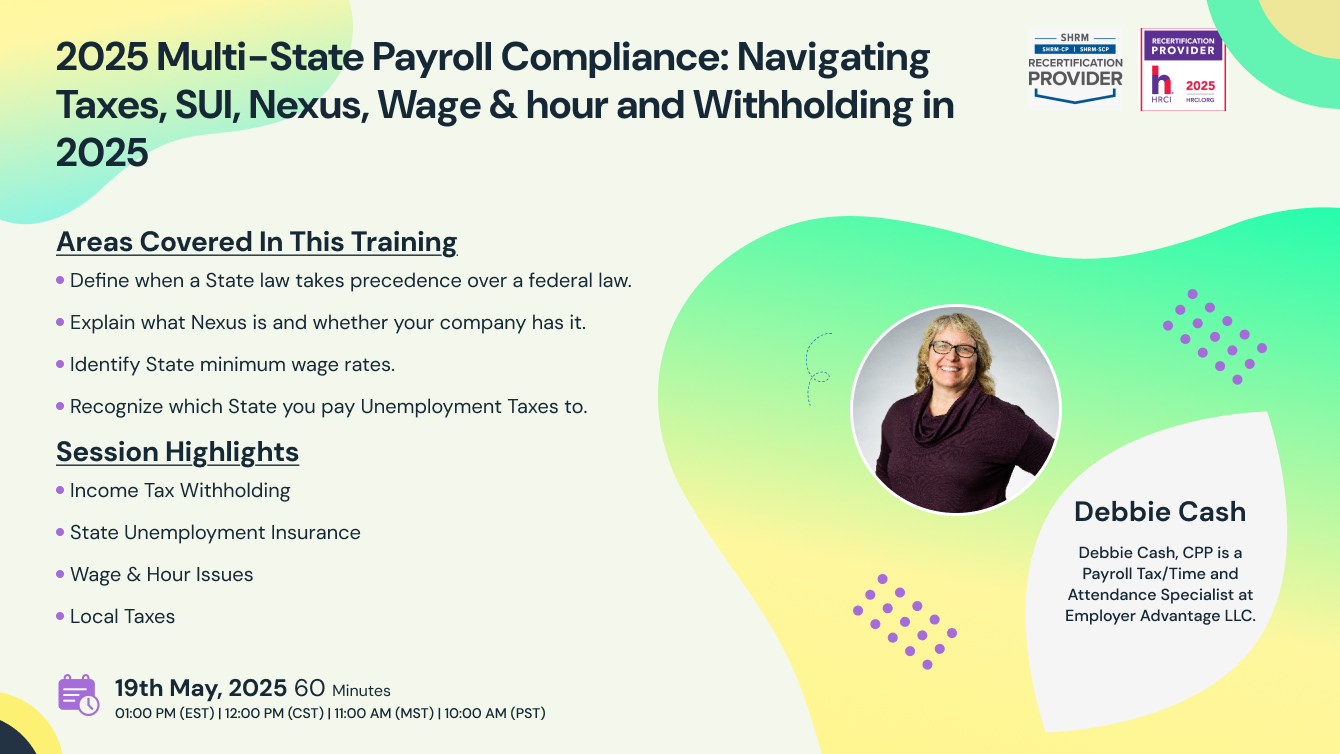

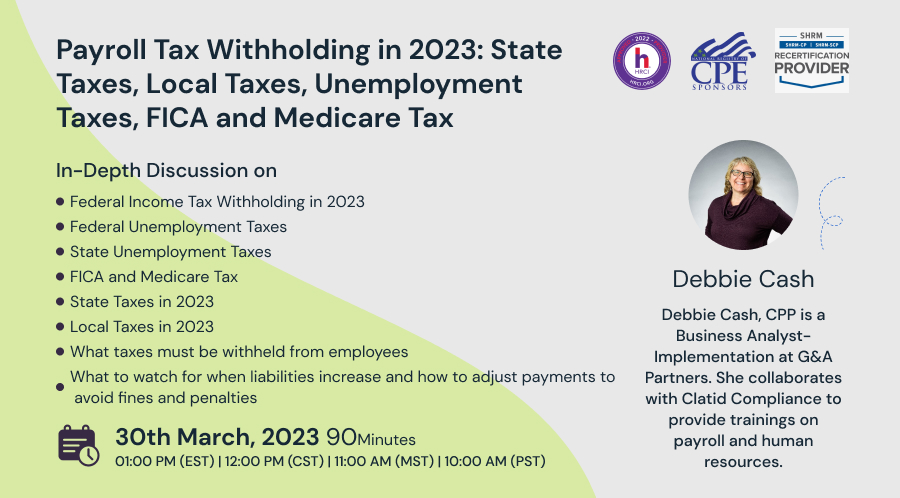

Payroll Tax Withholding in 2023: State Taxes, Local Taxes, Unemployment Taxes, FICA and Medicare Tax

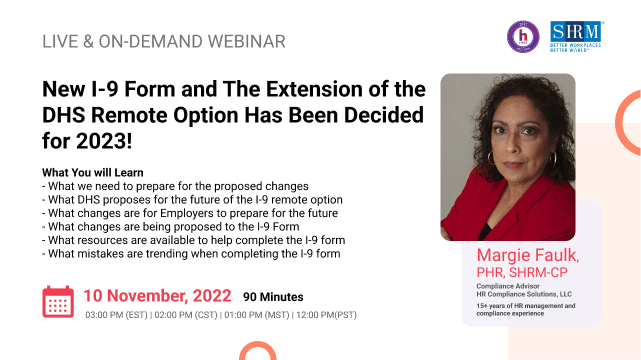

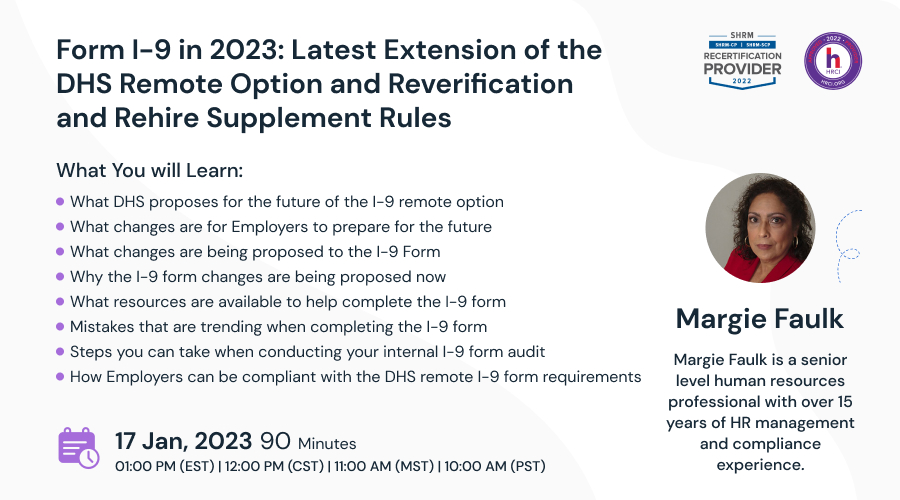

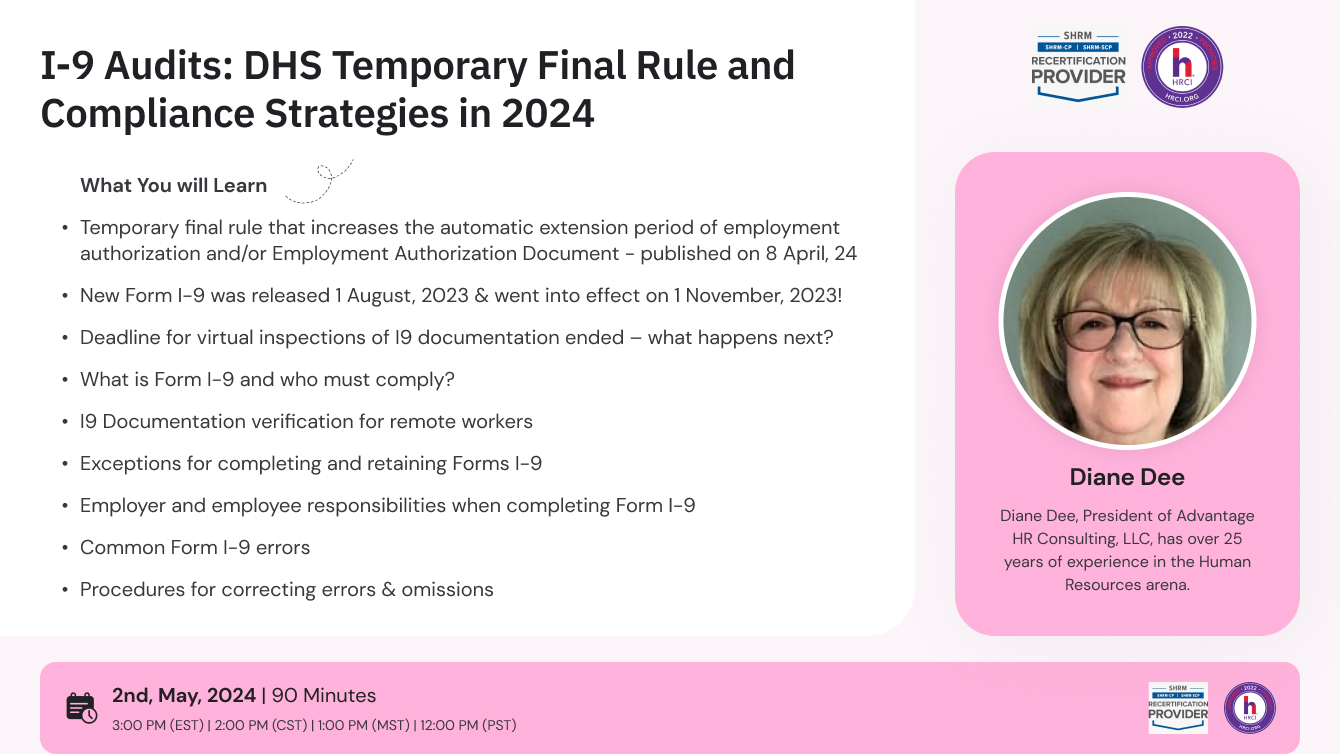

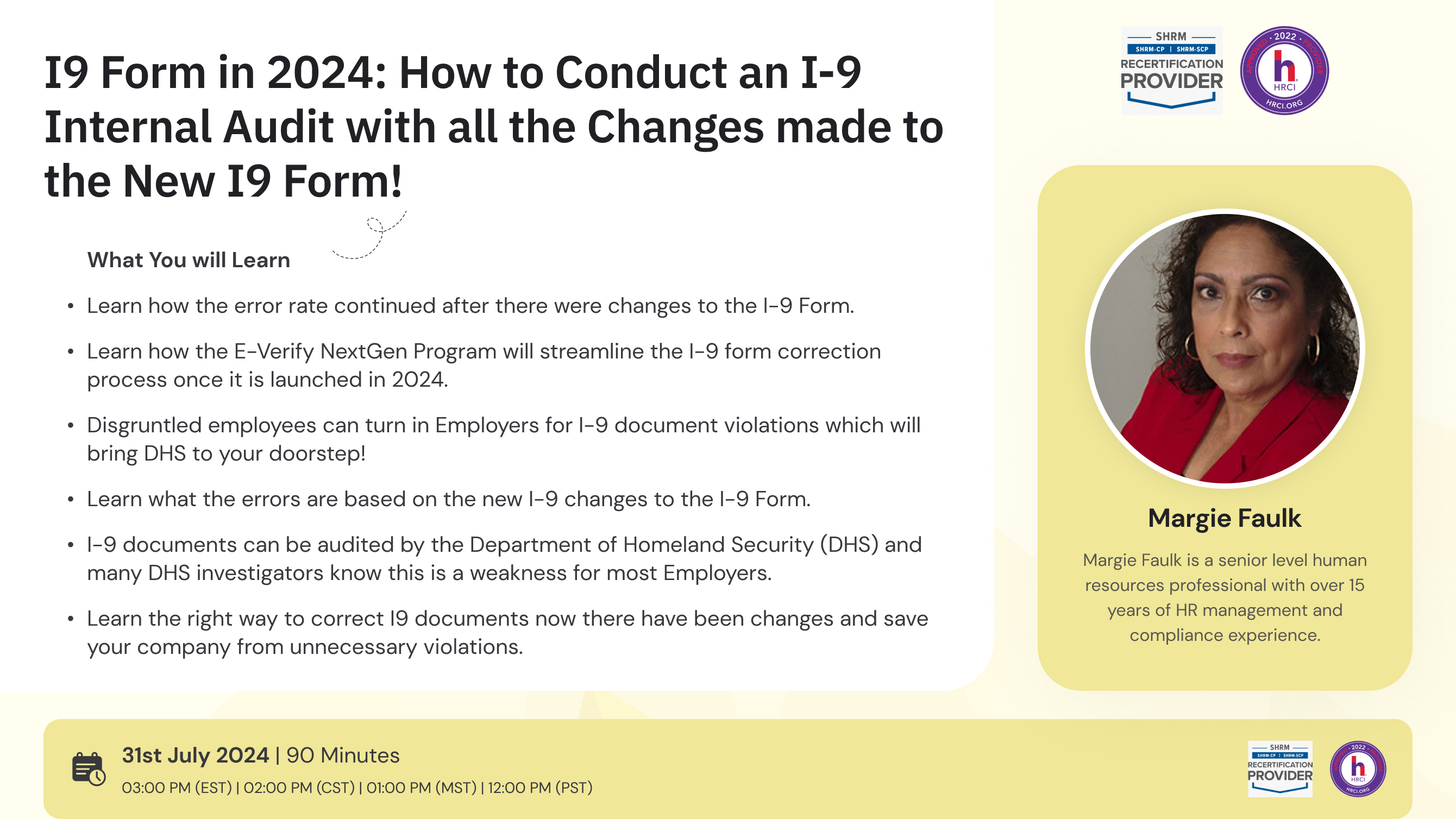

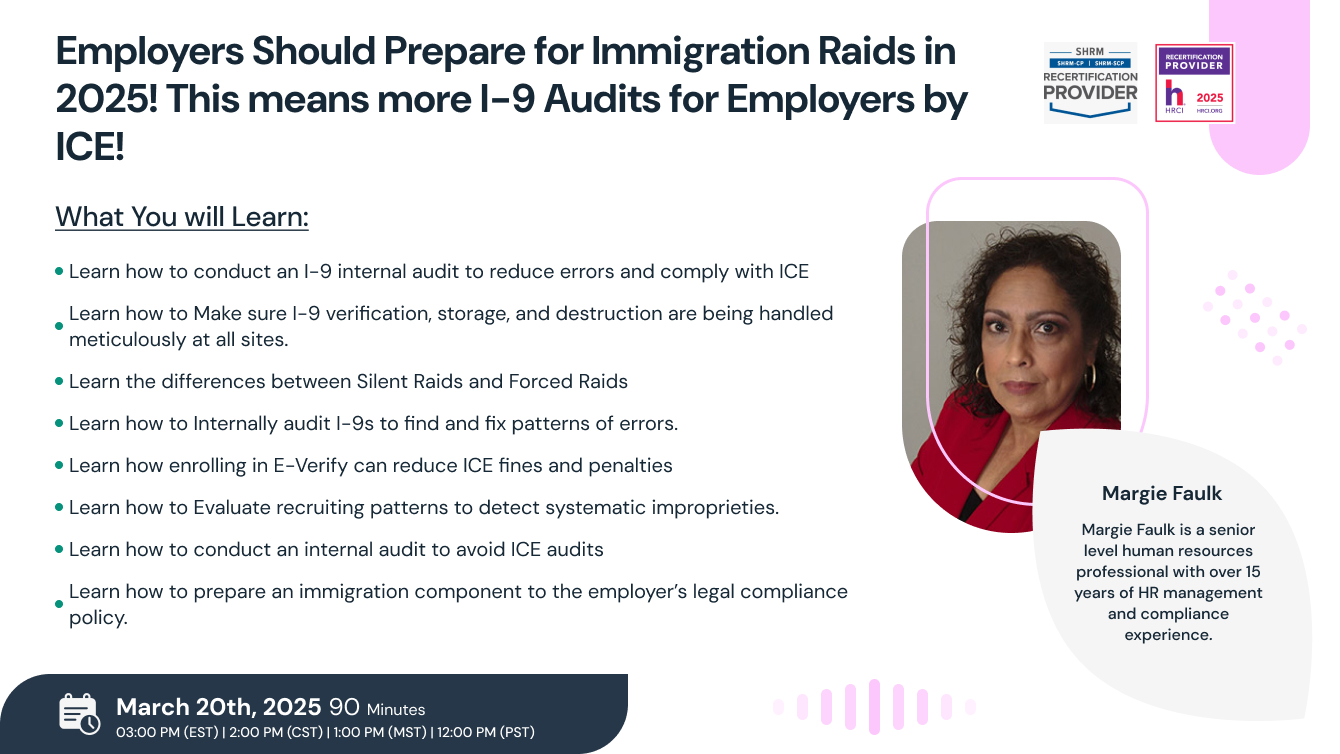

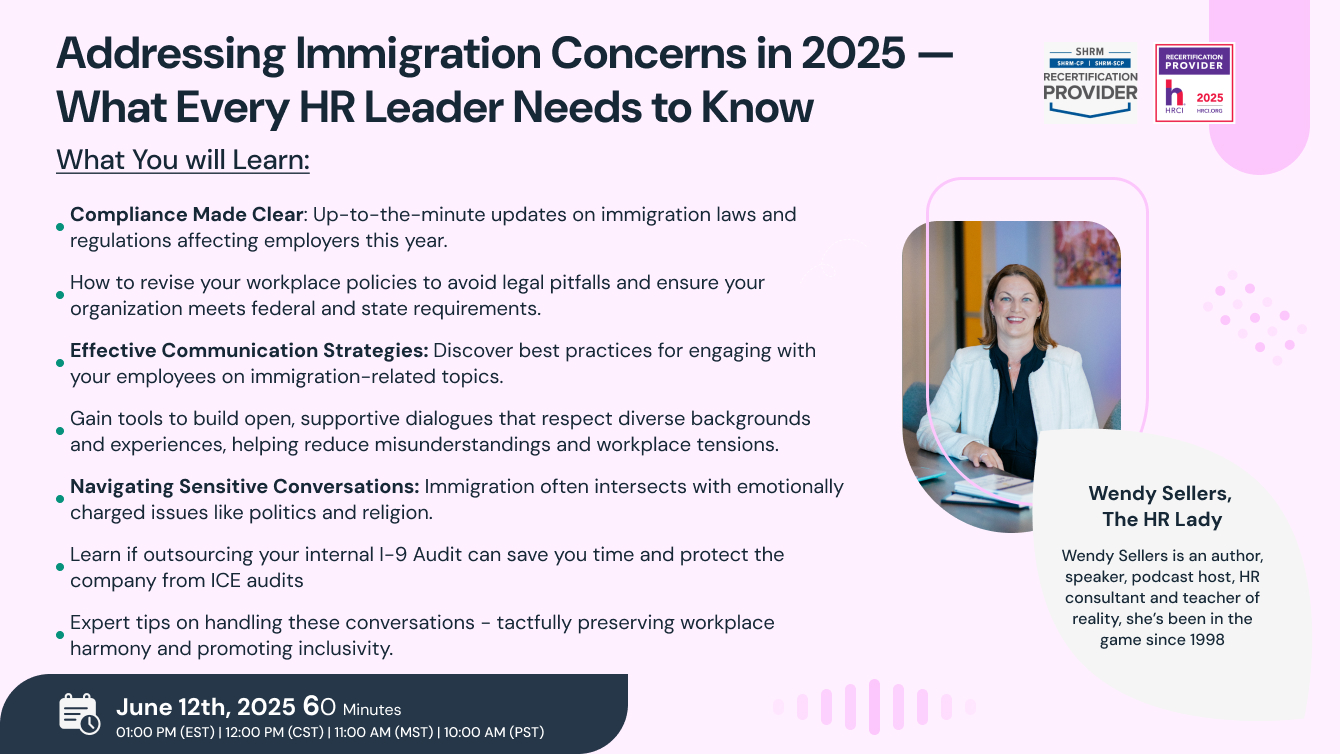

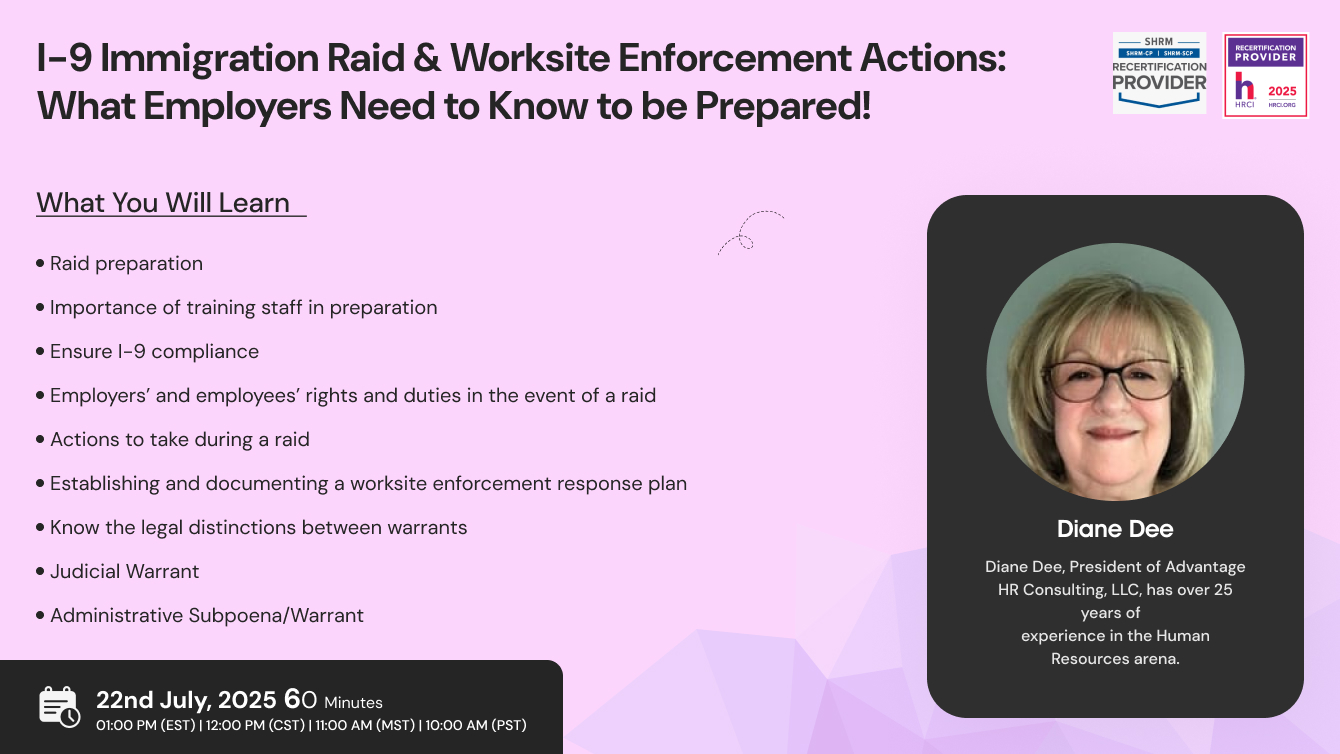

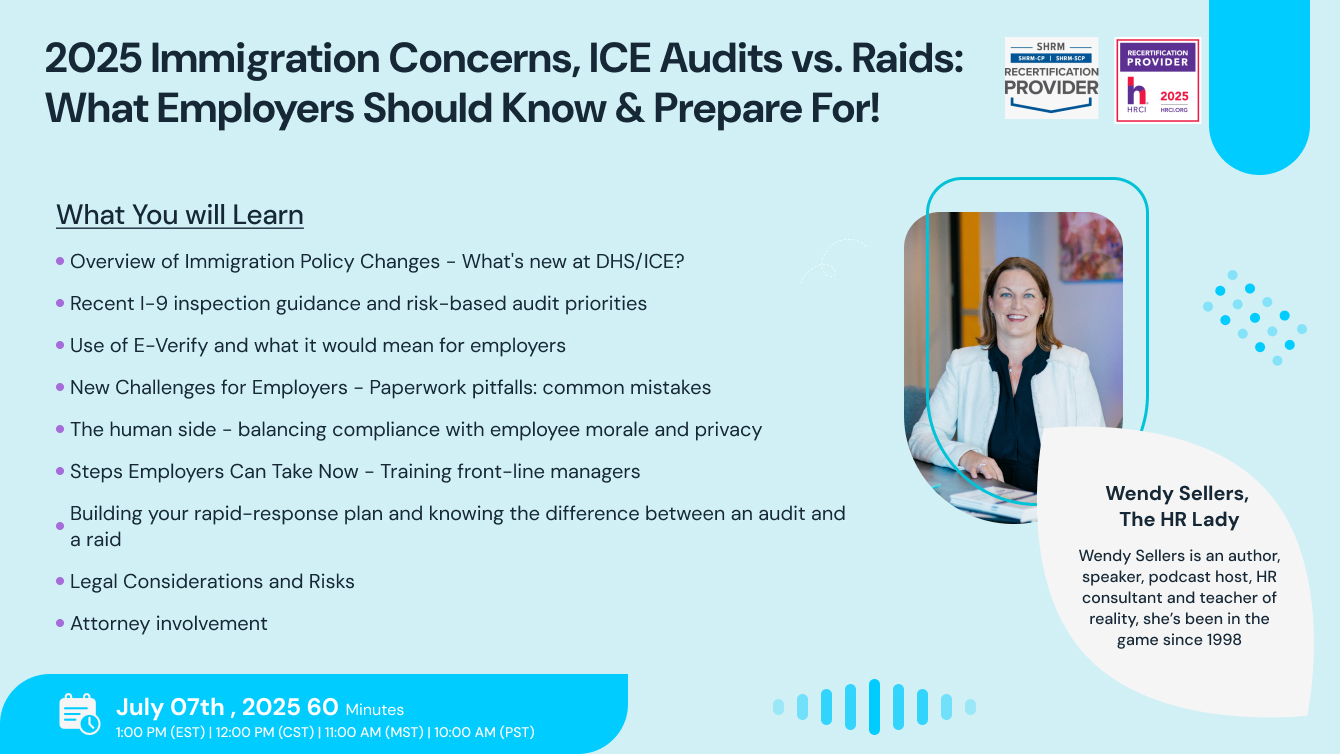

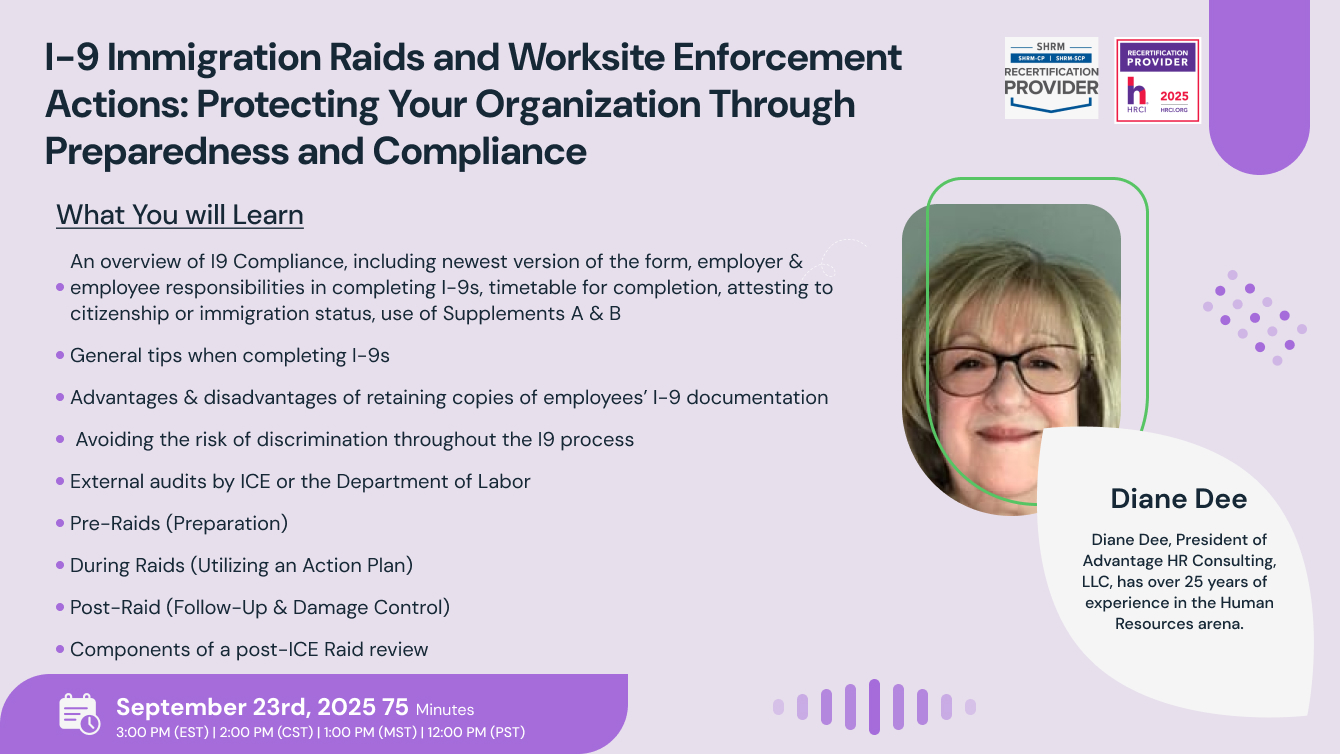

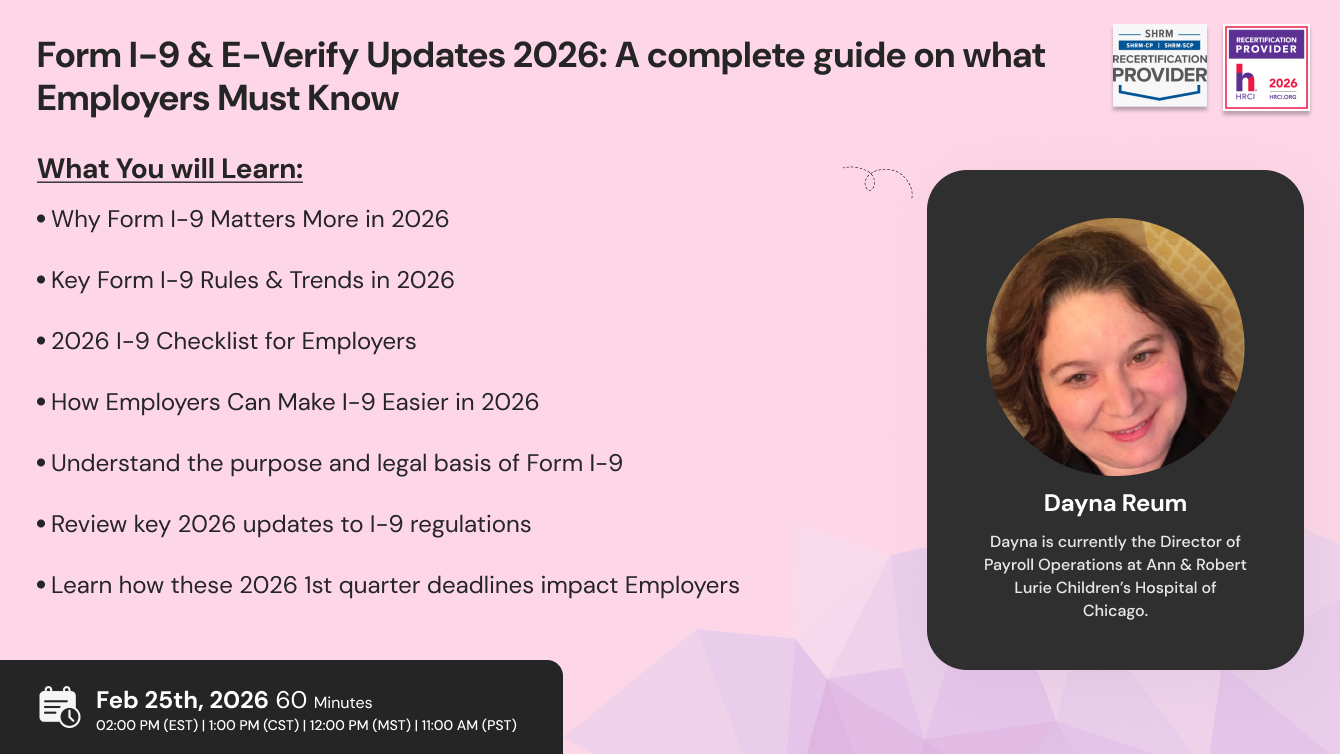

Another New I-9 Form Has Been Launched for 2025! Learn Why It Was Launched and What the Changes Are!

Payroll Tax Compliance for Non-Resident Aliens: F-1 and J-1 Visa Rules, Exemptions, and Tax Treaties

ACCREDITATIONS