Schedule C Updates in 2024

Join us to learn various aspects of Schedule C, filed by sole proprietors. The topics range from basic “what’s new” to a discussion of accounting methods and issuing 1099s. We spend a great deal of time on Form 1099-K, which is a form sole proprietors can expect to receive, and which has had proposed changes in recent years. We then move into more-advanced topics such as hiring family members and choosing a retirement plan for a sole proprietor.

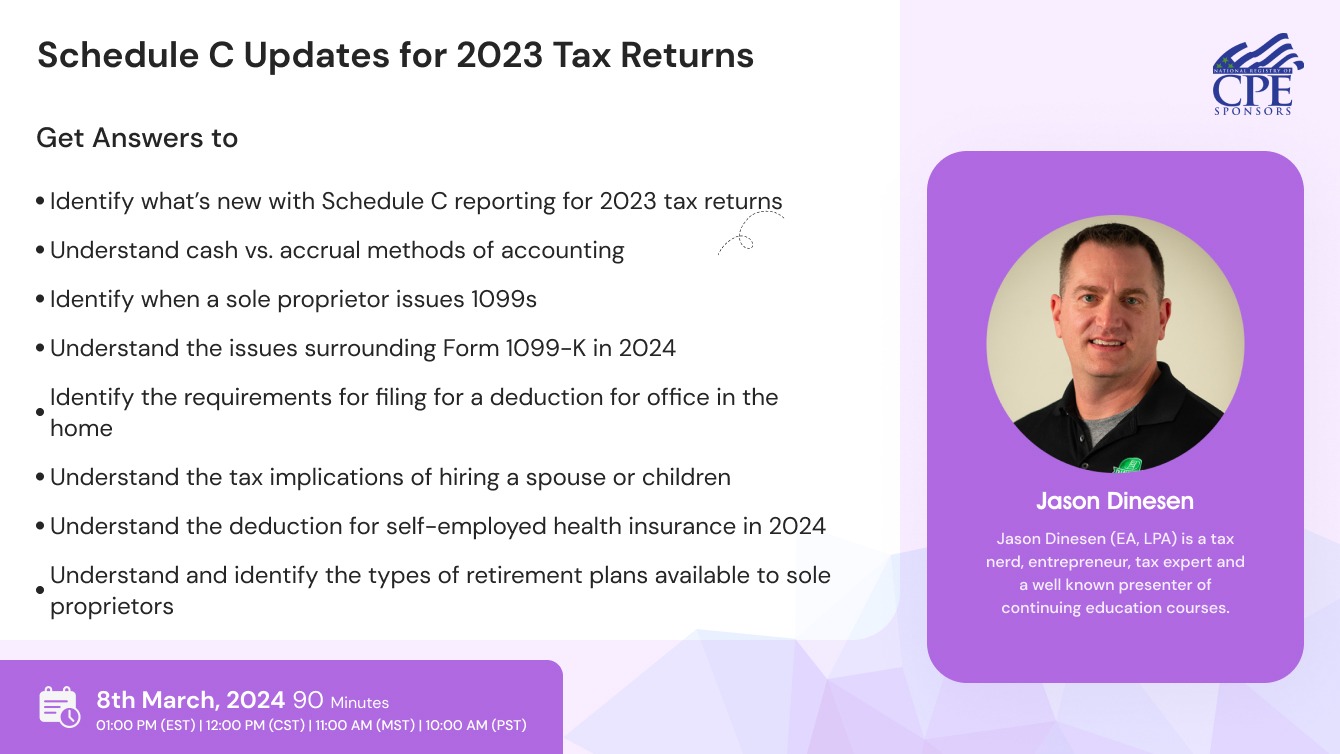

What You will Learn

- Identify what’s new with Schedule C reporting for 2023 tax returns

- Understand cash vs. accrual methods of accounting

- Identify when a sole proprietor issues 1099s

- Form 1099-K in 2024

- Understand the issues surrounding Form 1099-K in 2024

- Identify the requirements for filing for a deduction for office in the home

- Understand the tax implications of hiring a spouse or children

- Understand the deduction for self-employed health insurance in 2024

- Understand and identify the types of retirement plans available to sole proprietors

- Understand the hobby vs. business issue

Who Will Benefit

- Accountants

- Payroll professionals

- HR professionals

- Accounts Director

- Tax professionals

- Tax Managers

- Accounting Practice Owners

- Accounting Managers

- Bookkeeper

- Tax Director (Industry)

- Tax Pros

- Tax Accountant (Industry)

- Senior Accountant

- Tax Practitioners

- CPA Mid & Small Size Firm CPA

- CPA in Business

- Young CPA

- Enrolled Agent

- Entrepreneurial CPA

- Tax Preparer

- Tax Firm

Jason Dinesen

Jason Dinesen (EA, LPA) is a tax nerd, entrepreneur, tax expert and a well-known presenter of continuing education courses. Known for his sharp tax interpretations, he is one of the quickest to bring the analysis of the latest tax updates and IRS guidance to the professional community.

Jason has coached over 200,000 accounting, tax, and HR professionals on various topics of accounting, individual taxation, corporate taxation, professional ethics and much more. He has presented over dozens of webinars on Form 1099 (for 10 years on this subject!); marriage in the tax code; tax updates; the new Form W-4, payroll updates, filing status, tax credit and other issues relating to the modern-day household setting. He also teaches 2 classes at Simpson College, Individual Income Tax and Business Analytics.

Jason always had a knack for radio shows and has and regularly features as an anchor for Radio Iowa. He was born and raised in Iowa and has a degree in corporate communications from Simpson College in Indianola. He has a big family that includes his wife, two sons, 4 cats and 2 dogs. His other hobbies include being a season ticket holder to University of Iowa football.

NASBA -

StandEagle is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its web site: www.nasbaregistry.org.

ACCREDITATIONS