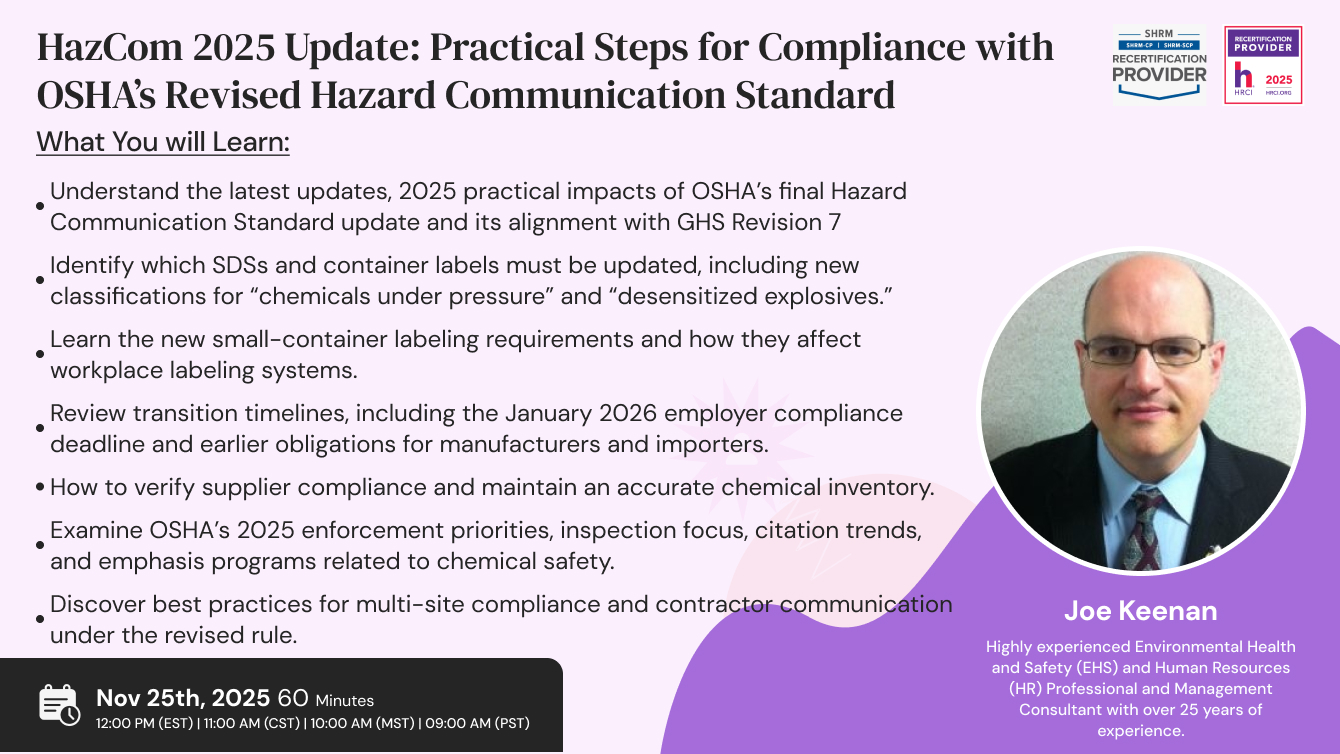

HazCom 2025 Update: Practical Steps for Compliance with OSHA’s Revised Hazard Communication Standard

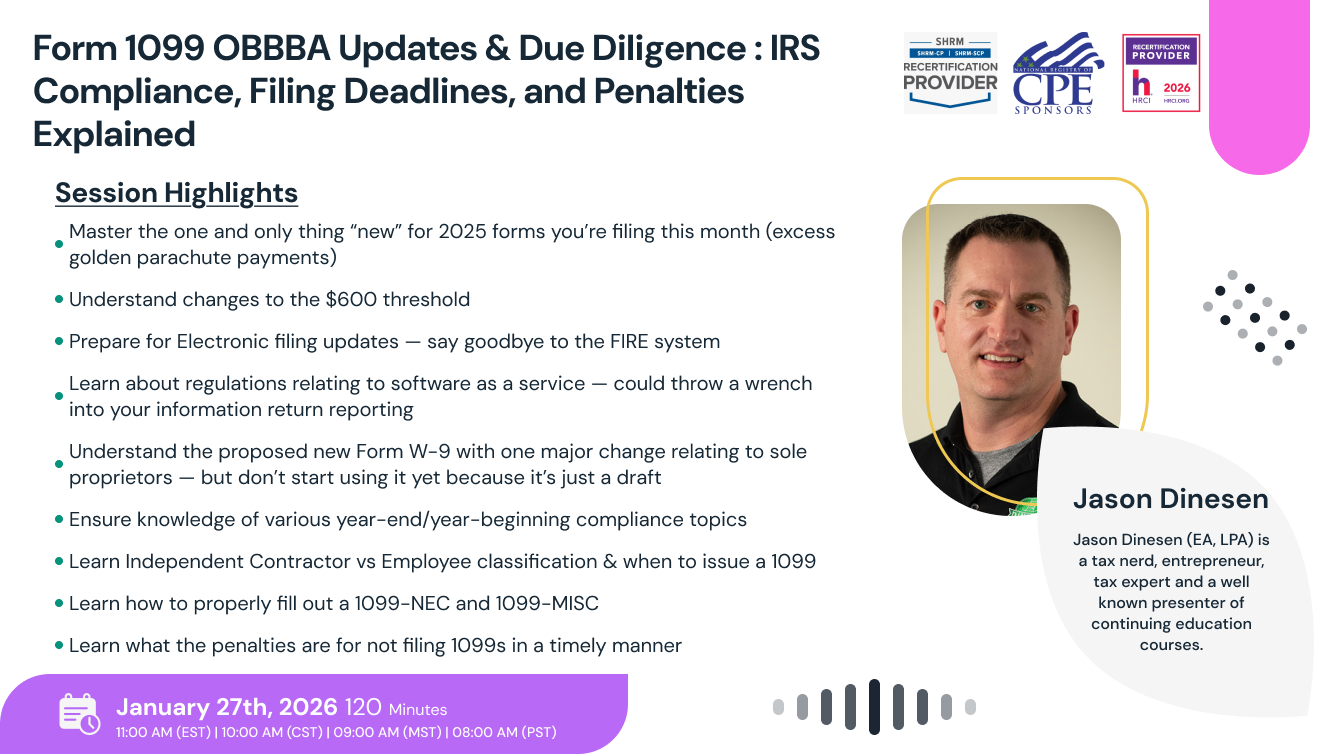

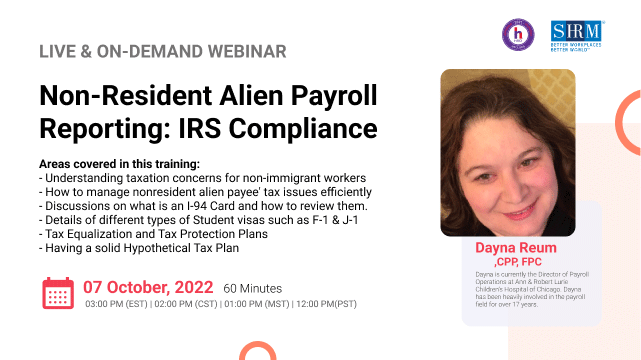

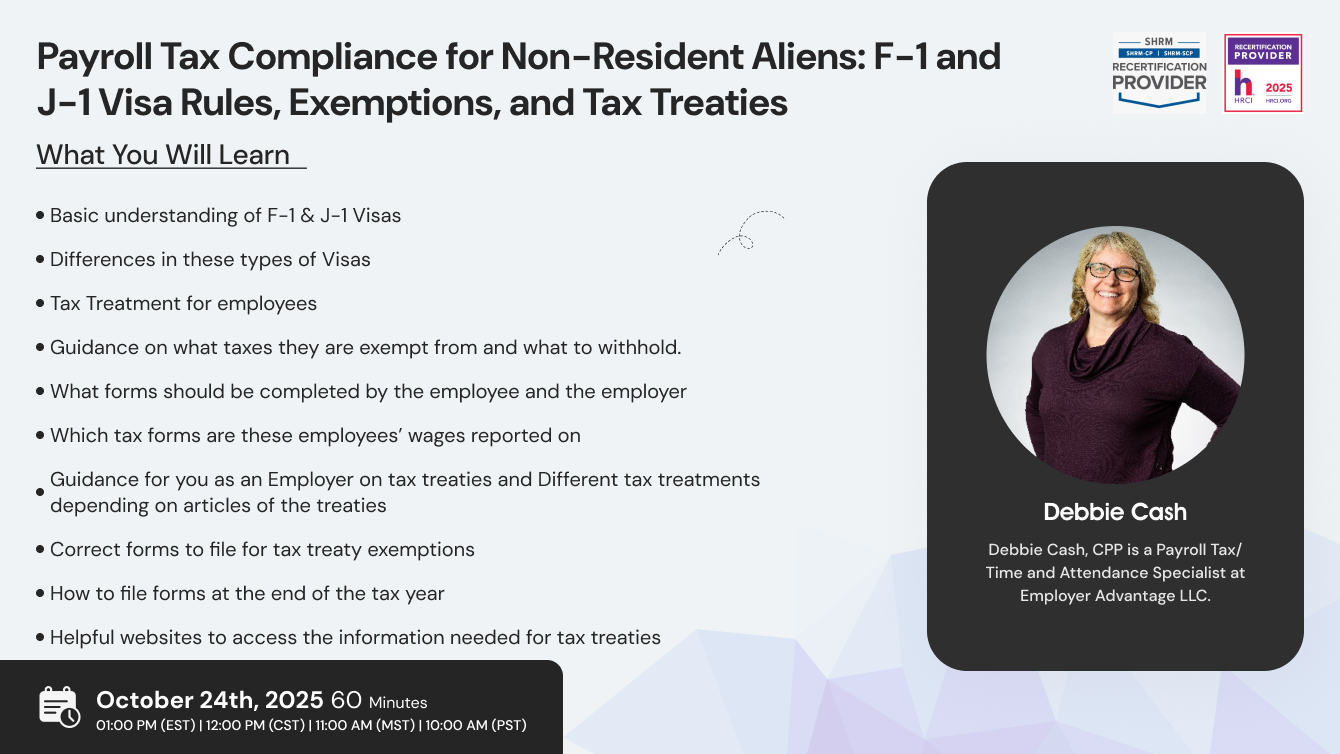

Payroll Tax Compliance for Non-Resident Aliens: F-1 and J-1 Visa Rules, Exemptions, and Tax Treaties

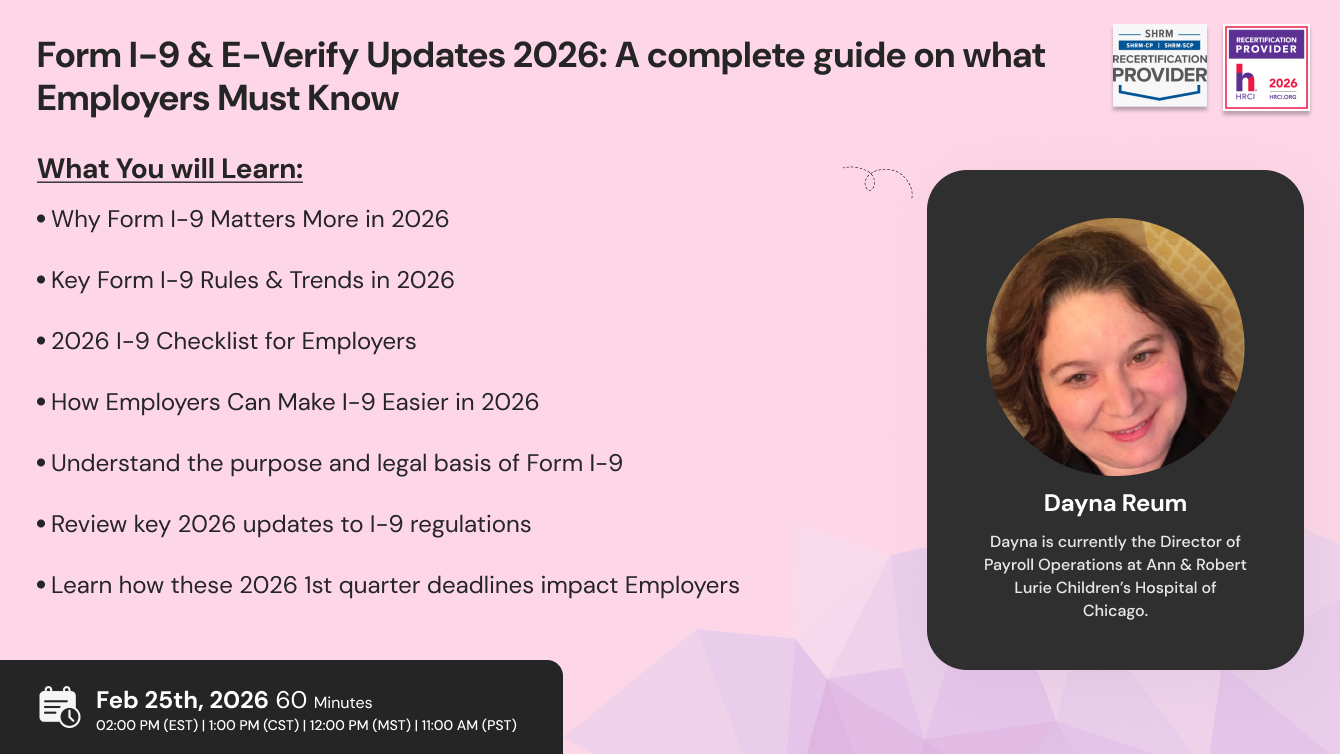

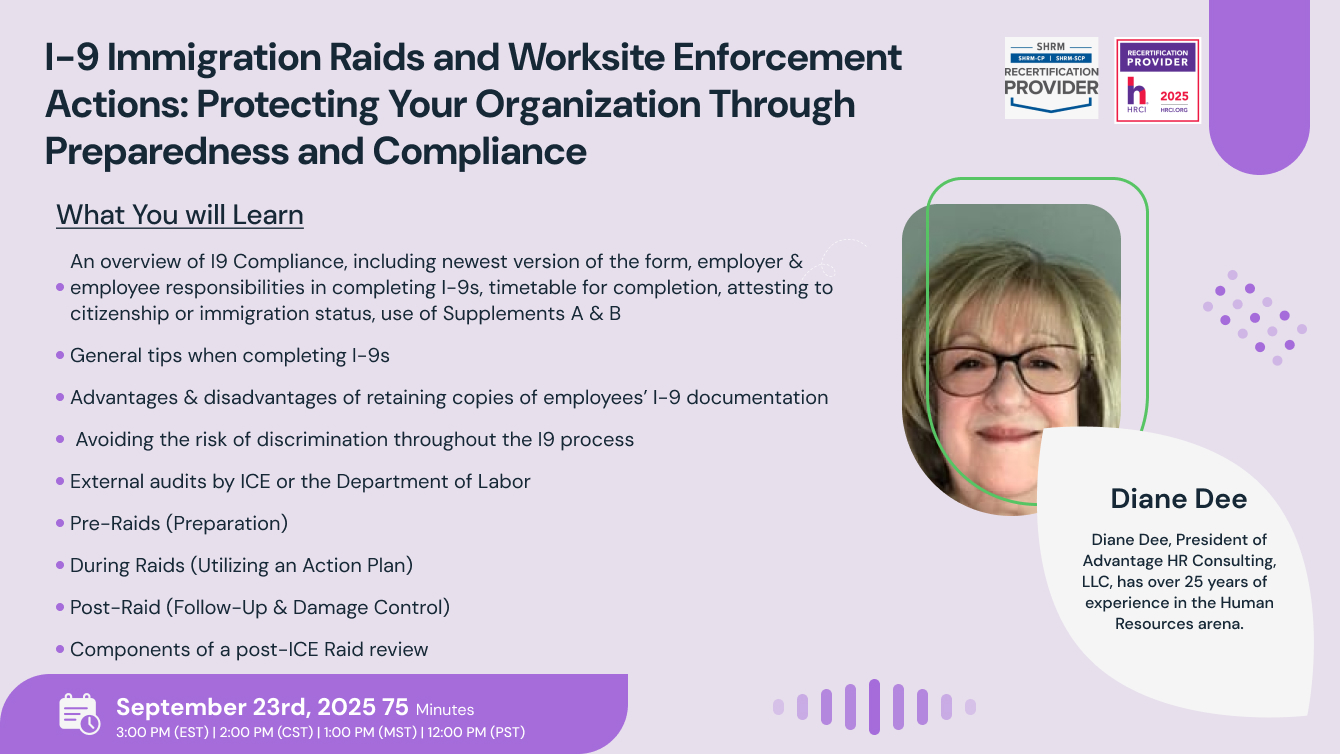

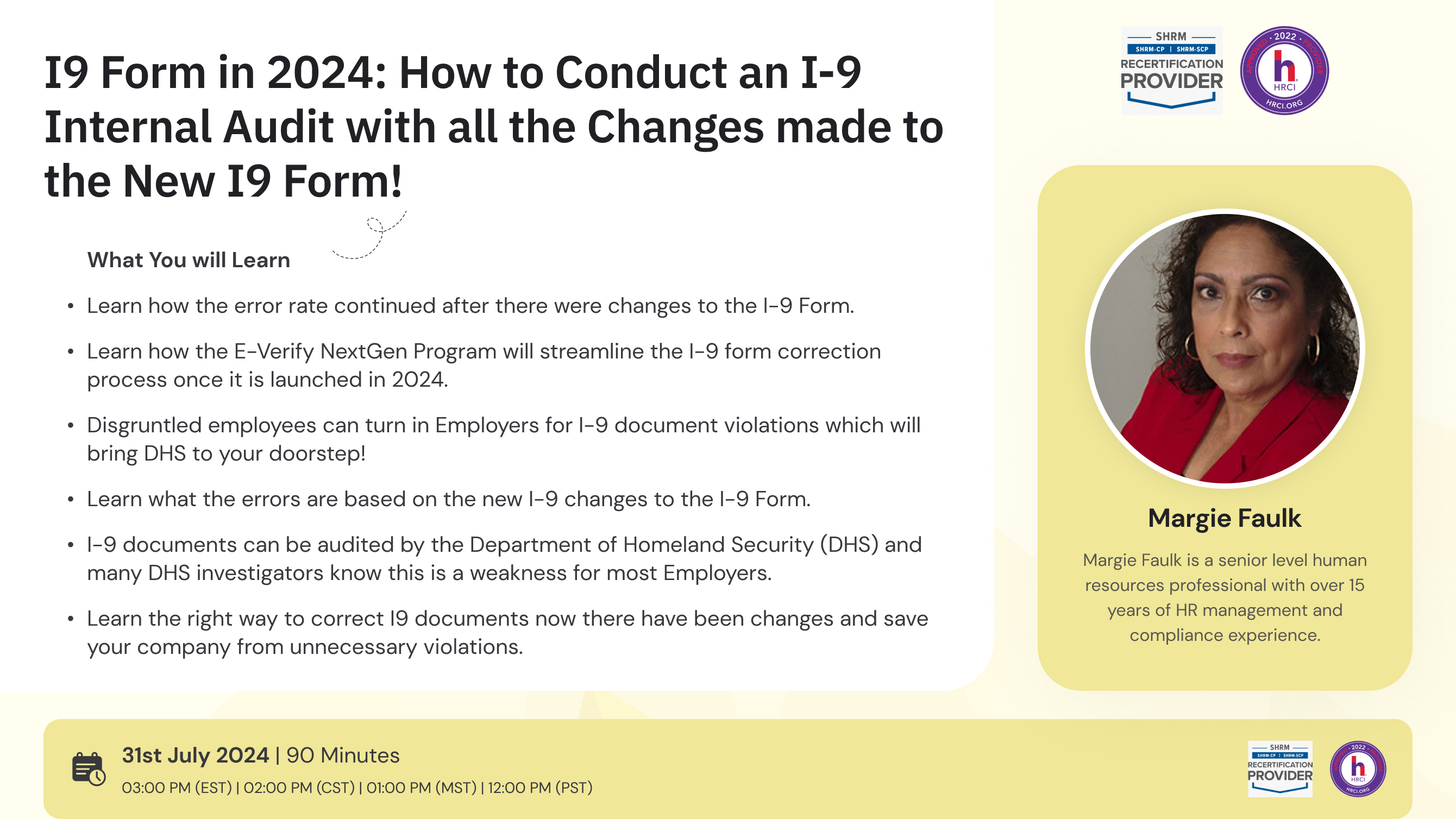

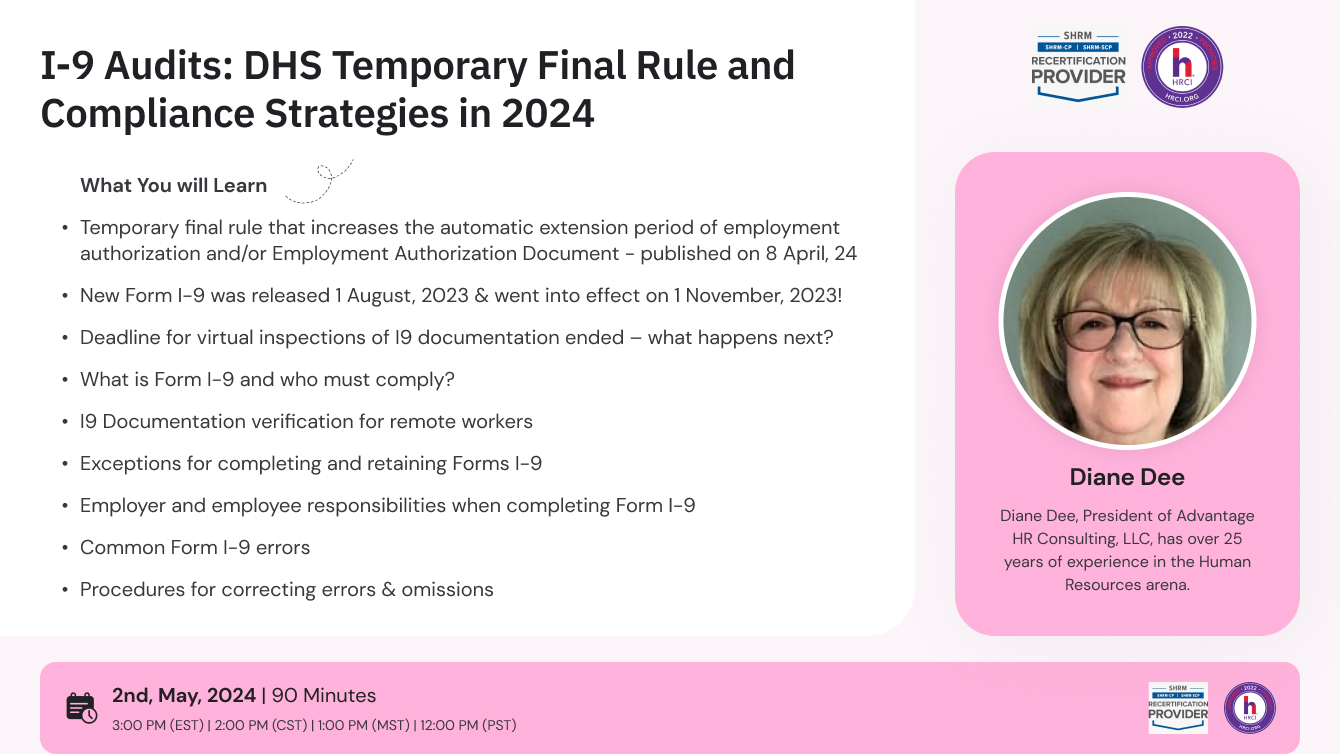

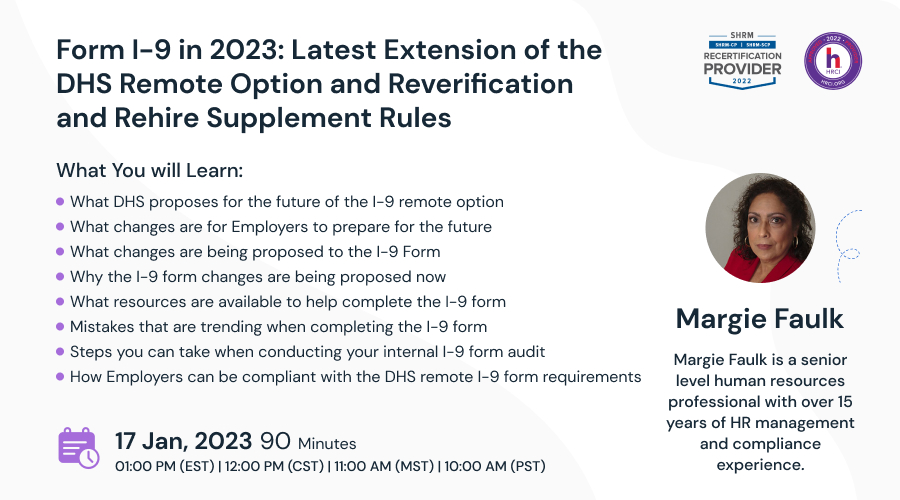

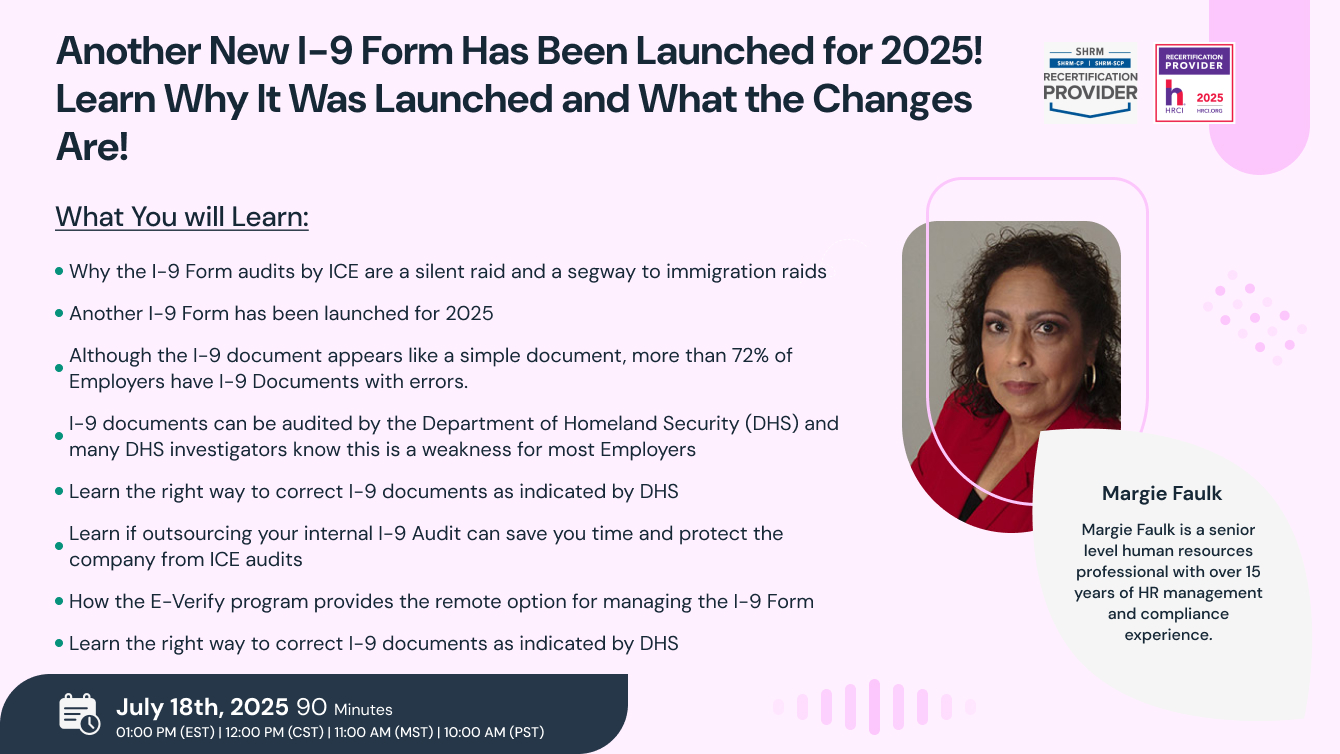

Another New I-9 Form Has Been Launched for 2025! Learn Why It Was Launched and What the Changes Are!

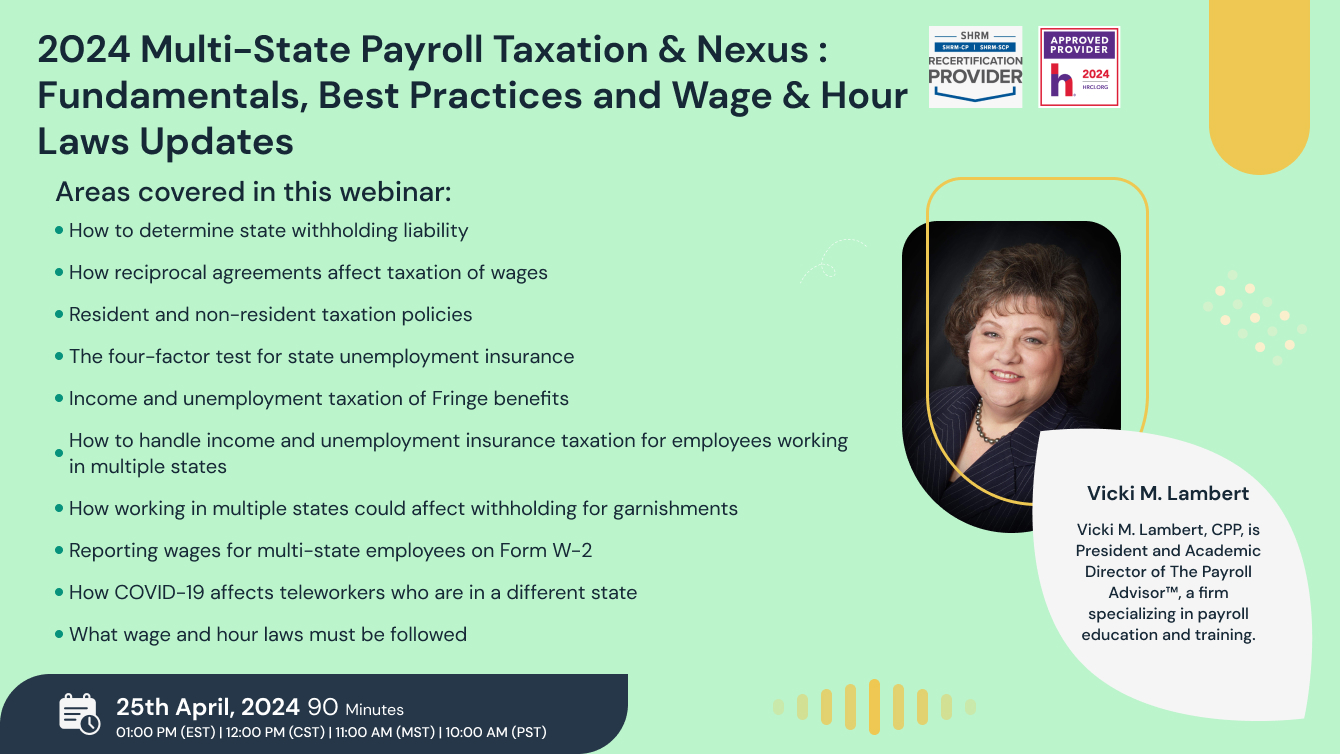

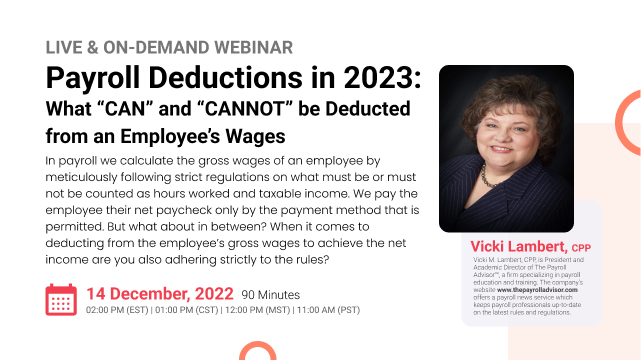

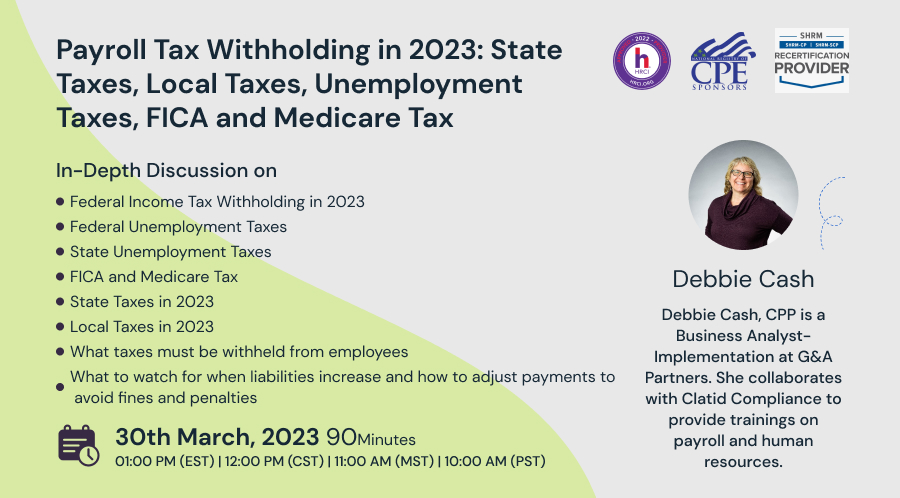

Payroll Tax Withholding in 2023: State Taxes, Local Taxes, Unemployment Taxes, FICA and Medicare Tax

ACCREDITATIONS