Overview:

Overtime and Minimum wage have been a hot topic over the last couple of years, but on April 23rd, 2024 the Department of Labor (DOL) released final regulations that begin to go into effect on July 1, 2024. The released final rules raise the salary thresholds for certain overtime exemptions under the federal Fair Labor Standards Act (FLSA).

Are you ready do you know what all these changes mean to your organization? There has been a big push for the federal government to update the minimum wage and overtime coverage for employees across the United States. As this continues to evolve including updates to how tip credit can be handled employers have to stay on top of these updates. Employers must therefore either raise the salaries paid to such employees to maintain the exemption or reclassify their positions to non-exempt, paying them an hourly wage and overtime, where applicable.

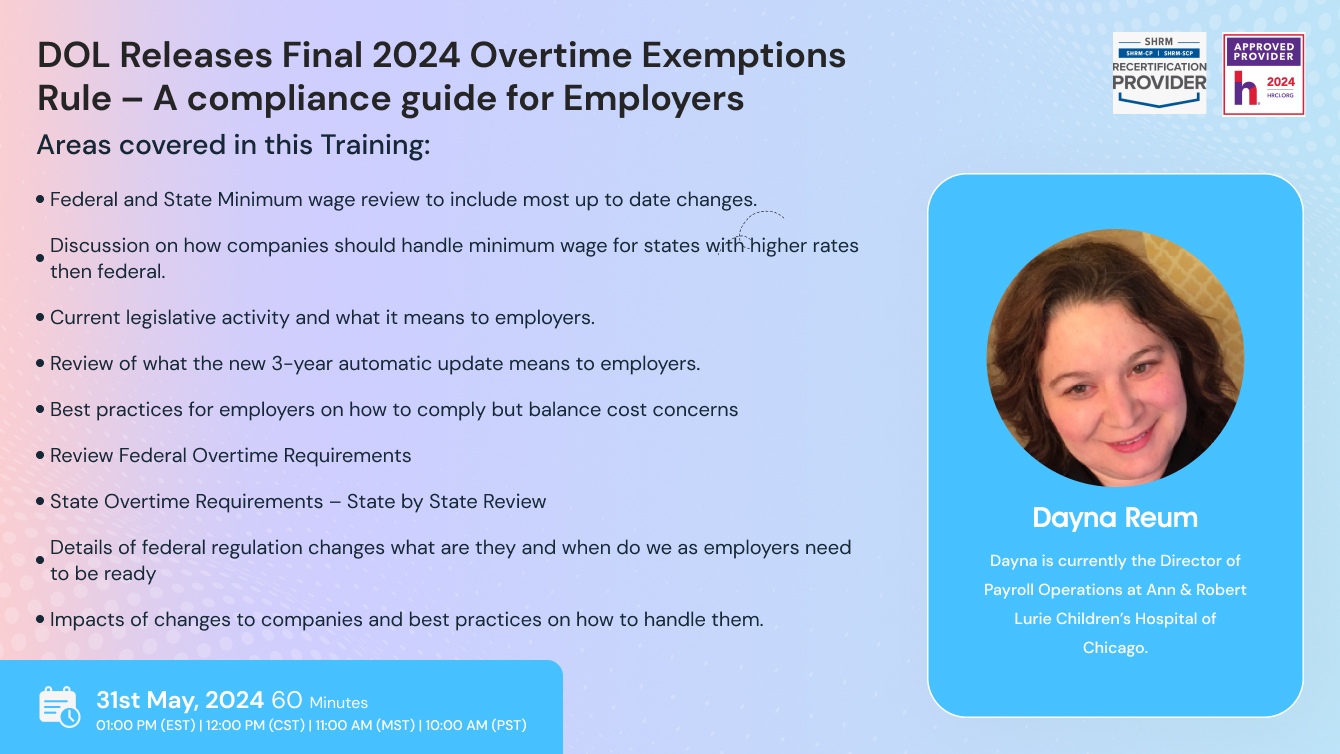

Areas covered in this training:

• Federal and State Minimum wage review to include most up to date changes.

• Discussion on how companies should handle minimum wage for states with higher rates then federal

• Current legislative activity and what it means to employers.

o Review of what the new 3-year automatic update means to employers.

o Details of what employers need to do to comply by July 1, 2024 and Jan 1 ,2025

o Best practices for employers on how to comply but balance cost concerns

• Review Federal Overtime Requirements

o Exempt vs. non-exempt.

o Overtime Concerns

o Regular Rate of Pay why it is important and how to calculate.

• State Overtime Requirements – State by State Review

• Details of federal regulation changes what are they and when do we as employers need to be ready

• Impacts of changes to companies and best practices on how to handle them.

Why attend this training:

Overtime and minimum wage have been a hot topic for the last several years, legislation almost went into in effect in 2017 but was stopped by several states coming forward with legal action. But new legislation was put into effect as of 1/1/2020, are you aware of the changes and are you in compliance with the new exempt requirements. In Aug of 2023 once again we received proposed legislation, if passed do you know what that means and how it will impact you as an employer. Now on April 23rd, 2024 we have final overtime updates that could make millions of Americans eligible for overtime pay. As an employer be prepared for the changes that happen as soon as July 1st, 2024. This webinar will be the most up to date information for employers and how to manage the changes against cost. Many states have also updated their overtime rules that are more generous to employees. This webinar will explain how the balance the federal overtime rules with the state overtime rules. The most up to date Overtime requirements and review legislative attempts to make sure employers have the correct overtime calculation.

Suggested Attendees:

• Payroll Professionals

• HR professionals

Dayna Reum

Dayna is currently the Director of Payroll Operations at Ann & Robert Lurie Children’s Hospital of Chicago. Dayna has been heavily involved in the payroll field for over 17 years. Starting as a payroll clerk at a small Tucson company, Dayna moved on to be a Payroll Team Leader at Honeywell Inc. During Dayna’s time at Honeywell she obtained her FPC (Fundamental Payroll Certification) through the American Payroll Association. She also received several merit awards for Customer Service and Acquisitions and Divestitures.

Dayna is no stranger to teaching she has taught at the Metro Phoenix American Payroll Association meetings and at the Arizona State Payroll Conference. Topics including Payroll Basics, Global/Cultural Awareness, Immigration Basics for the Payroll Professional, Multi-State and Local Taxation and Quality Control for Payroll, International and Canadian payroll. Dayna has her CPP (Certified Payroll Professional) through the APA. She also serves on the National American Payroll Association on the National Strategic Leadership Task Force, Government Affairs Task Force (PA Local tax subcommittee). Dayna has received a Citation of Merit for her service along with being a Gold Pin member of the APA. Besides her payroll accomplishments, Dayna is certified in HR hiring and firing practices and is a Six-Sigma Greenbelt.

SHRM -

StandEagle is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please visit - portal.shrm.org.

HRCI -

This webinar has been approved for 1.0 HR (General) re-certification credit hours toward California, GPHR, HRBP, HRMP, PHR, and SPHR recertification through the HR Certification Institute.

The use of this seal is not an endorsement by the HR Certification Institute of the quality of the activity. It means that this activity has met the HR Certification Institute’s criteria to be pre-approved for re-certification credit.

ACCREDITATIONS