Overview:

Withholding, filing, and remitting payroll taxes can be complicated tasks, but they are ones that you as a business owner must get right. Employers have several mandatory tasks in handling payroll taxes. In addition to your obligation to file payroll tax returns with your taxing authorities, you have a reporting obligation to your employees and your independent contractors.

This webinar will review the complete cycle from determining taxable income to final quarterly reporting to the IRS. Participants will learn how to review taxable income according to the IRS standards. Details about the form W-4 and how is a critical part of the employee tax withholding calculation. Review of the W-4 for 2024 that includes new electronic requirements on employers.

Areas Covered in this Training:

· Withholding Taxes

o Calculating Taxable Earnings

· IRS definition of taxable earnings

· Fair Market Value

· Fringe Benefit Taxation

o Form W-4

· Basic W-4 Requirements

· Electronic W-2 requirements

o Social Security and Medicare Taxes

o Tax Calculations

o Tax Calculation examples

· Depositing and Reporting Taxes

o 941 Basic Requirements

· Reporting Requirements

· 941 Due Dates

· Electronic Filing

· Signing Requirements

o Form 941 Line by line review

o Schedule B and Payroll Depositing requirements Reconciliation of Form 941 and W-2’s at year end

· Year-end Best Practices

Why Attend this Training:

After attending this webinar, you will better understand the changes and how it will impact payroll tax calculations, reporting and remitting. There will be a full review of the withholding depositing schedule and why completing deposits and reporting the deposits properly are critical to avoid IRS notices. Finally, a discussion about year-end best practices that will also avoid timely and challenging disputes with the IRS. At the end, you will be able to-

· Understand proper payroll tax withholding

· Understand payroll taxes from the Form W-4 all the way to the Form 941

· Understand Fringe Benefit taxation and the golden rule of taxation

· How employers should handle non cash taxable benefits

Who should attend:

· Payroll Professionals

· HR professionals

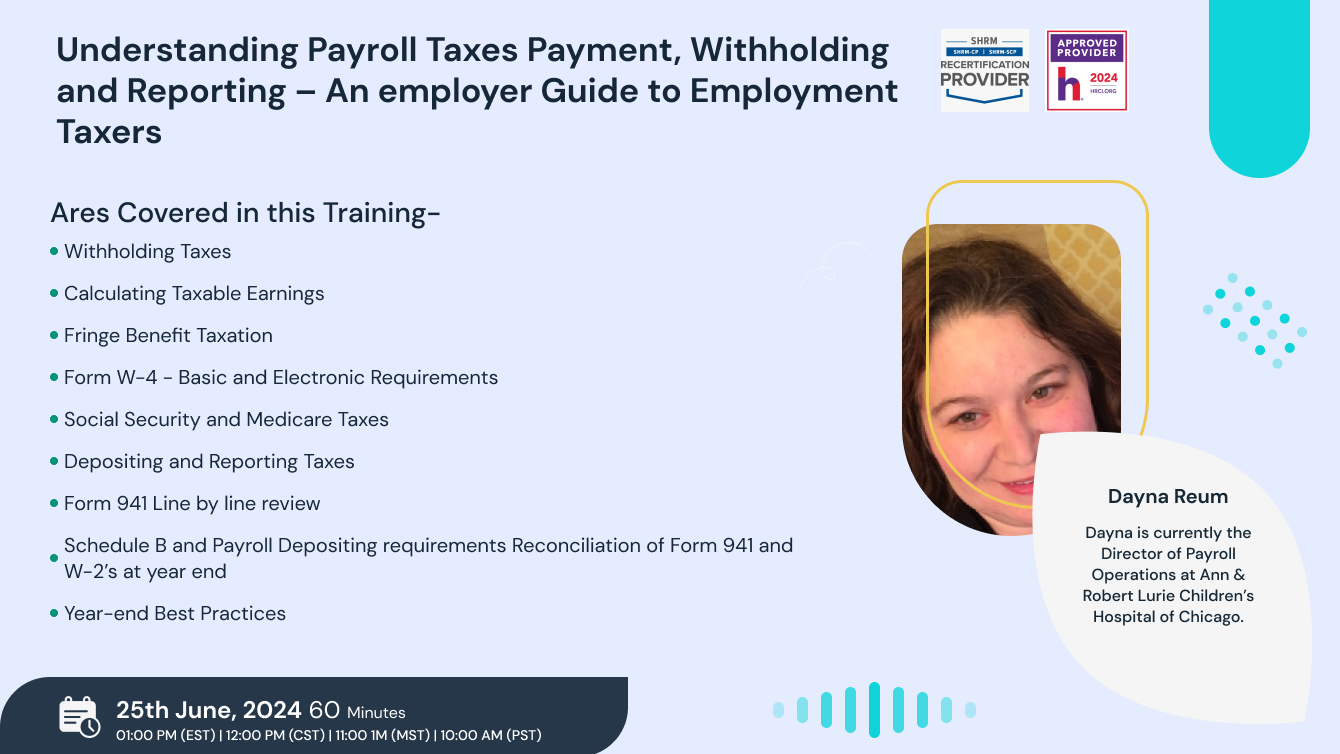

Dayna Reum

Dayna is currently the Director of Payroll Operations at Ann & Robert Lurie Children’s Hospital of Chicago. Dayna has been heavily involved in the payroll field for over 17 years. Starting as a payroll clerk at a small Tucson company, Dayna moved on to be a Payroll Team Leader at Honeywell Inc. During Dayna’s time at Honeywell she obtained her FPC (Fundamental Payroll Certification) through the American Payroll Association. She also received several merit awards for Customer Service and Acquisitions and Divestitures.

Dayna is no stranger to teaching she has taught at the Metro Phoenix American Payroll Association meetings and at the Arizona State Payroll Conference. Topics including Payroll Basics, Global/Cultural Awareness, Immigration Basics for the Payroll Professional, Multi-State and Local Taxation and Quality Control for Payroll, International and Canadian payroll. Dayna has her CPP (Certified Payroll Professional) through the APA. She also serves on the National American Payroll Association on the National Strategic Leadership Task Force, Government Affairs Task Force (PA Local tax subcommittee). Dayna has received a Citation of Merit for her service along with being a Gold Pin member of the APA. Besides her payroll accomplishments, Dayna is certified in HR hiring and firing practices and is a Six-Sigma Greenbelt.

SHRM -

StandEagle is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please visit - portal.shrm.org.

HRCI -

This webinar has been approved for 1.0 HR (General) re-certification credit hours toward California, GPHR, HRBP, HRMP, PHR, and SPHR recertification through the HR Certification Institute.

The use of this seal is not an endorsement by the HR Certification Institute of the quality of the activity. It means that this activity has met the HR Certification Institute’s criteria to be pre-approved for re-certification credit.

ACCREDITATIONS