Dependents, Child Tax Credit and Earned Income Credit: Who Can Claim Whom?

Join us this March to learn about a foundational aspect of individual tax returns - claiming dependents. Tax law lays out two types of dependents – qualifying children and qualifying relatives. The rules have some overlap but there are significant differences between the two. A qualifying child opens the door for more tax benefits and credits than a qualifying relative.

We will also discuss the oddities relating to divorce and claiming kids. We then shift into covering some of those benefits, namely the child tax credit and the earned income credit, as well as head of household filing status. These credits can help low-to-moderate income families and workers reduce the tax they owe.

We close with a discussion of Form 8867 – tax preparer due diligence relating to various credits and head of household filing status.

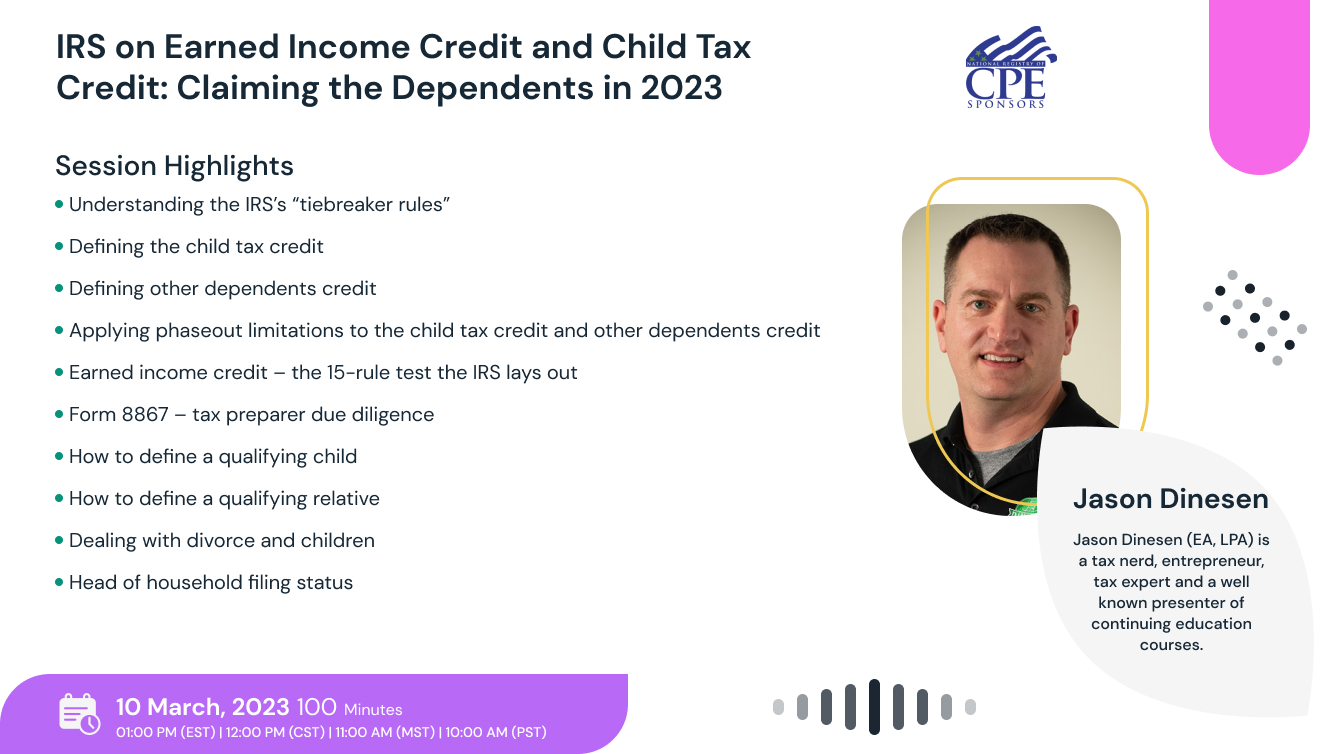

Session Highlights

-Understanding the IRS’s “tiebreaker rules”

-Defining the child tax credit

-Defining other dependents credit

-Applying phaseout limitations to the child tax credit and other dependents credit

-Earned income credit – the 15-rule test the IRS lays out

-Form 8867 – tax preparer due diligence

Takeaways

-How to define a qualifying child

-How to define a qualifying relative

-Dealing with divorce and children

-Head of household filing status

Who will Benefit

-Business owners

-Office managers

-Controllers

-Bookkeepers

-Managers

-CFOs

-Accountants

-EAs

Jason Dinesen

Jason Dinesen (EA, LPA) is a tax nerd, entrepreneur, tax expert and a well-known presenter of continuing education courses. Known for his sharp tax interpretations, he is one of the quickest to bring the analysis of the latest tax updates and IRS guidance to the professional community.

Jason has coached over 200,000 accounting, tax, and HR professionals on various topics of accounting, individual taxation, corporate taxation, professional ethics and much more. He has presented over dozens of webinars on Form 1099 (for 10 years on this subject!); marriage in the tax code; tax updates; the new Form W-4, payroll updates, filing status, tax credit and other issues relating to the modern-day household setting. He also teaches 2 classes at Simpson College, Individual Income Tax and Business Analytics.

Jason always had a knack for radio shows and has and regularly features as an anchor for Radio Iowa. He was born and raised in Iowa and has a degree in corporate communications from Simpson College in Indianola. He has a big family that includes his wife, two sons, 4 cats and 2 dogs. His other hobbies include being a season ticket holder to University of Iowa football.

Standeagle Webinar Certification - Standeagle rewards you with Standeagle Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Standeagle Courses and Webinars or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Standeagle is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its web site: www.nasbaregistry.org.

Standeagle doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

ACCREDITATIONS