Overview:

The "One Big Beautiful Bill," formally known as the One Big Beautiful Bill Act (OBBBA), significantly impacts the workplace through tax cuts, changes to deductions, and potential impacts on employment and the economy. It extends or modifies elements of the Tax Cuts and Jobs Act (TCJA) and introduces new provisions like no tax on tips and overtime pay, while also impacting payroll and HR departments due to the need to track and report these changes.

The "One Big Beautiful Bill" is a comprehensive piece of legislation with significant implications for the American economy and the workplace. It aims to boost the economy through tax cuts and business incentives, but it also introduces changes to federal spending programs and potentially increases the national debt, says the Committee for a Responsible Federal Budget. Both employers and employees will need to adapt to the changes introduced by this bill.

Areas covered in this training:

· Learn what the OBBB states and when it will start

· Learn how the “No taxes on Overtime and Tips actually will work and how long it will last

· Learn how the tax provisions will help small businesses and some industries

· Learn how payroll will need to be adjusted to track how tips and overtime are tracked and the increase in HR/payroll administrative work.

· Learn how job growth will be increased and in which industries

· Learn how increased deductions will be a benefit for small businesses and partnerships

· Learn about the challenges with Medicaid cuts and how Employers can mitigate them

· Learn how the IRS tax codes will change to accommodate the new provisions

Why Attend this Training:

Employers should prepare for what the new OBBB is and how it impacts the workplace. Many of the laws will impact employees as well as Employers. This training will identify all the twists and turns of how the law will impact Employers, and they need to quickly explain how these taxes will play out to gain the positive aspects of the law while downplaying the negative implications.

The One Big Beautiful Bill is a comprehensive piece of legislation with significant implications for the workplace. While it offers potential benefits like increased take-home pay and job creation, it also presents challenges for employers in terms of payroll administration and navigating new tax regulations

Suggested Attendees:

· All Employers

· Business Owners

· Company Leadership

· Compliance professionals

· HR Professionals

· Managers/Supervisors

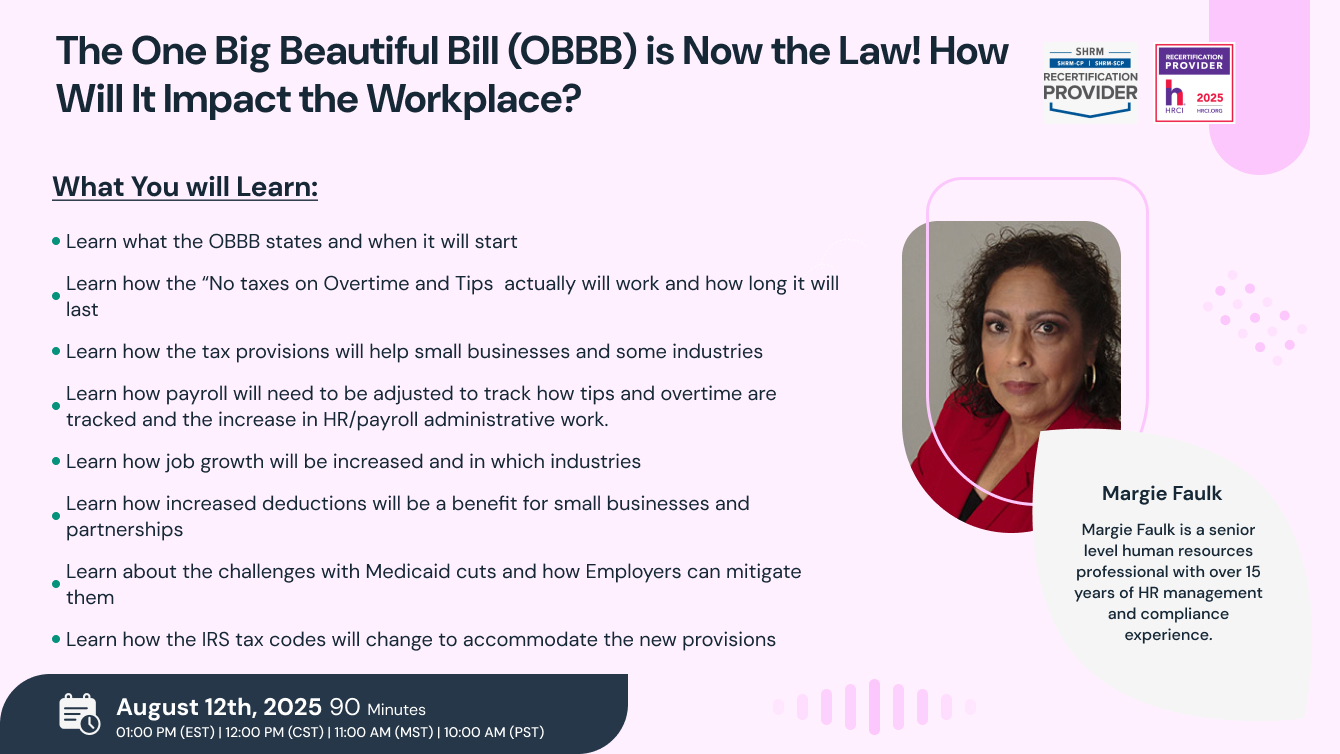

Margie Faulk

Margie Faulk is a senior level human resources professional with over 15 years of HR management and compliance experience. A current Compliance Advisor for HR Compliance Solutions, LLC, Margie, has worked as an HR Compliance advisor for major corporations and small businesses in the small, large, private, public, Non-profit sectors and International compliance. Margie has provided small to large businesses with risk management strategies that protect companies and reduces potential workplace fines and penalties from violation of employment regulations. Margie is bilingual (Spanish) fluent and Bi-cultural. Margie’s area of expertise includes Criminal Background Screening Policies and auditing, I-9 document correction and storage compliance, Immigration compliance, employee handbook development, policy development, sexual harassment investigations/certified training, SOX regulations, payroll compliance, compliance consulting, monitoring US-based federal, state and local regulations, employee relations issues, internal investigations, HR management, compliance consulting, internal/external audits, and performance management. Margie’s unique training philosophy includes providing free customized tools for all attendees. These tools are customized and have been proven to be part an effective risk management strategy. Some of the customized tools include the I-9 Self Audit. Correction and Storage program, Ban the Box Decision Matrix Policy that Employers can provide in a dispute for allegations, Family Medical Leave Act (FMLA) Compliance Guide, Drug-Free Workplace Volatile Termination E-Book and other compliance program tools when attendees register and attend Margie’s trainings. Margie holds professional human resources certification (PHR) from the HR Certification Institution (HRCI) and SHRM-CP certification from the Society for Human Resources Management. Margie is a member of the Society of Corporate Compliance & Ethics (SCCE).

SHRM -

StandEagle is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.5 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please visit - portal.shrm.org.

HRCI -

This webinar has been approved for 1.5 HR (General) re-certification credit hours toward California, GPHR, HRBP, HRMP, PHR, and SPHR recertification through the HR Certification Institute.

The use of this seal is not an endorsement by the HR Certification Institute of the quality of the activity. It means that this activity has met the HR Certification Institute’s criteria to be pre-approved for re-certification credit.

ACCREDITATIONS