Overview:

On July 4, 2025, the President signed the One Big Beautiful Bill Act (OBBBA) into law, representing one of the most sweeping legislative changes affecting U.S. taxation, payroll compliance, and employer reporting in recent years.

While the Act touches nearly every sector of the U.S. economy, its most immediate and complex impacts fall on employers, payroll departments, and HR professionals. The law introduces retroactive changes effective January 1, 2025, along with forward-looking compliance requirements that will significantly alter payroll and tax reporting in 2026 and beyond.

Key areas impacted include:

· Employee and employer taxation

· Wage and hour reporting

· Tip income and overtime taxation

· Expanded and modified IRS reporting thresholds

· Updates to core payroll forms including Forms 941, W-2, W-4, 1099-MISC, and 1099-NEC

· Revisions to personal exemptions, child tax credits, and fringe benefit taxation

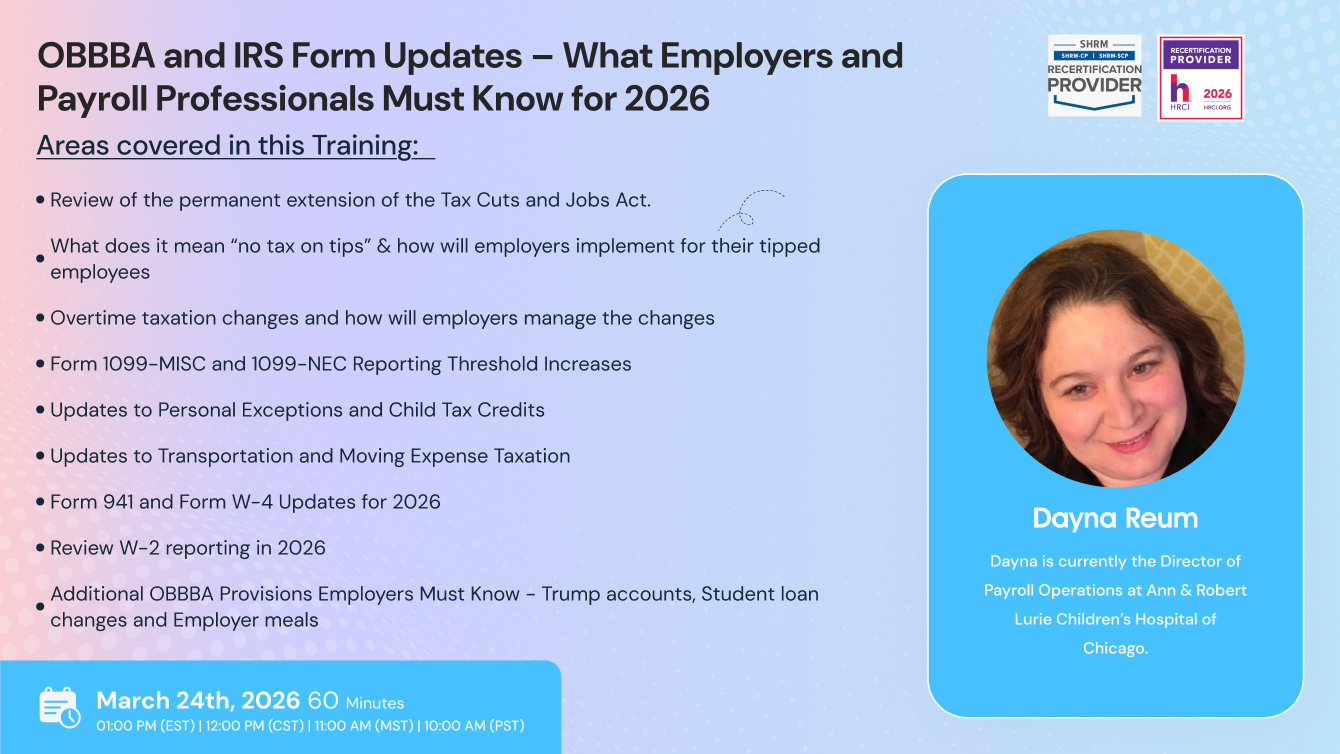

Areas covered in this Training:

· Review of the permanent extension of the Tax Cuts and Jobs Act.

· What does it mean “no tax on tips” & how will employers implement for their tipped employees

· Overtime taxation changes and how will employers manage the changes

· Form 1099-MISC and 1099-NEC Reporting Threshold Increases

· Updates to Personal Exceptions and Child Tax Credits

· Updates to Transportation and Moving Expense Taxation

· Form 941 and Form W-4 Updates for 2026

· Review W-2 reporting in 2026

· Additional OBBBA Provisions Employers Must Know - Trump accounts, Student loan changes and Employer meals

Why attend this training:

This session provides a full, practical walkthrough of the OBBBA, breaking down legislative intent, IRS implementation guidance, and the operational steps employers must take to remain compliant. Attendees will leave with a clear understanding of what changed, when it applies, and how to update payroll systems, policies, and reporting procedures accordingly.

By the end of this session, participants will:

· Understand the full scope of the OBBBA and its employer impact

· Know which changes are retroactive vs. prospective

· Be able to implement payroll and reporting updates confidently

· Reduce compliance risk and avoid costly IRS penalties

· Prepare systems and teams for 2026 reporting requirements

Suggested Attendees:

· Payroll professionals

· HR managers and directors

· Accounting and finance professionals

· Compliance officers

· Business owners and operations managers

· Tax preparers working with employer clients

Dayna Reum

Dayna is currently the Director of Payroll Operations at Ann & Robert Lurie Children’s Hospital of Chicago. Dayna has been heavily involved in the payroll field for over 17 years. Starting as a payroll clerk at a small Tucson company, Dayna moved on to be a Payroll Team Leader at Honeywell Inc. During Dayna’s time at Honeywell she obtained her FPC (Fundamental Payroll Certification) through the American Payroll Association. She also received several merit awards for Customer Service and Acquisitions and Divestitures.

Dayna is no stranger to teaching she has taught at the Metro Phoenix American Payroll Association meetings and at the Arizona State Payroll Conference. Topics including Payroll Basics, Global/Cultural Awareness, Immigration Basics for the Payroll Professional, Multi-State and Local Taxation and Quality Control for Payroll, International and Canadian payroll. Dayna has her CPP (Certified Payroll Professional) through the APA. She also serves on the National American Payroll Association on the National Strategic Leadership Task Force, Government Affairs Task Force (PA Local tax subcommittee). Dayna has received a Citation of Merit for her service along with being a Gold Pin member of the APA. Besides her payroll accomplishments, Dayna is certified in HR hiring and firing practices and is a Six-Sigma Greenbelt.

SHRM -

Standeagle is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please visit - portal.shrm.org.

HRCI -

This webinar has been approved for 1.0 HR (General) re-certification credit hours toward California, GPHR, HRBP, HRMP, PHR, and SPHR recertification through the HR Certification Institute.

The use of this seal is not an endorsement by the HR Certification Institute of the quality of the activity. It means that this activity has met the HR Certification Institute’s criteria to be pre-approved for re-certification credit.

ACCREDITATIONS