Background:

The Department of Labor takes investigations of Wage and Hour violations very seriously! In recent years, agency-initiated investigations have increased dramatically. In FY2022 alone, agency-initiated investigations found violations that resulted in fines and penalties in excess of $213 million!

Civil lawsuits for Wage and Hour violations are always a threat to business. Penalties have been so severe that they have shaken the financial foundations of some of the world’s most successful companies.

Join Vicki M. Lambert, CPP “The Payroll Advisor” for this information packed webinar and get the information you need to help protect your company from financial jeopardy!

Learning Objectives:

By the end of this webinar the attendee will have:

· Gained knowledge of and skills in federal and applicable state wage and hour law as it pertains to payroll preparation

· An understanding of the proper calculation of gross pay

· And understand of the proper calculation of overtime pay

· A sound knowledge of the terminology used by the FLSA as it pertains to calculating overtime and hours worked

· Basic understanding what is considered hours worked and how to handle such working hours as travel pay and meeting times

· Gained knowledge of when an employee must be given a lunch and when an employer may dock for meal periods

· Knowledge of the requirements for paying employees including pay frequencies permitted and methods allowed under state laws

· The basic understanding of what must be included on a pay0020stub

Areas Covered in this Training:

· Federal minimum wage

· State minimum wage

· Tip credits

· Youth minimum wage (training wage)

· Board and lodging credits

· Defining the legal work week and work day

· How and when to pay for travel time

· What is considered hours worked and how do they affect overtime

· Is it covered under the FLSA or do I need to check the state?

· What to do when the FLSA and the state law differs

· How to handle the FLSA and union contracts

· What is regular rate of pay?

· How is overtime calculated under the FLSA

· Posting requirements

· Meal and rest periods

· State requirements

· Statements and payday notices

· Frequency of wage payments

· Method of payment

· Paying terminated employees

· Paying out accrued vacation

Why attend this Training:

This webinar concentrates on federal and state wage and hour requirements that must be followed in the payroll department. Also, What the upcoming Rules mean. Areas of discussion include calculating overtime, travel time, minimum wage, posting requirements, meal and rest periods, how often an employee must be paid and by what method and paying terminated employees.

Suggested Attendees:

· Payroll Executives/Managers/Administrators/Professionals/Practitioners/Entry Level Personnel

· Human Resources Executives/Managers/Administrators

· Accounting Personnel

· Business Owners/Executive Officers/Operations and Departmental Managers

· Lawmakers

· Attorneys/Legal Professionals

· Any individual or entity that must deal with the complexities and requirements of Wage and Hour Compliance

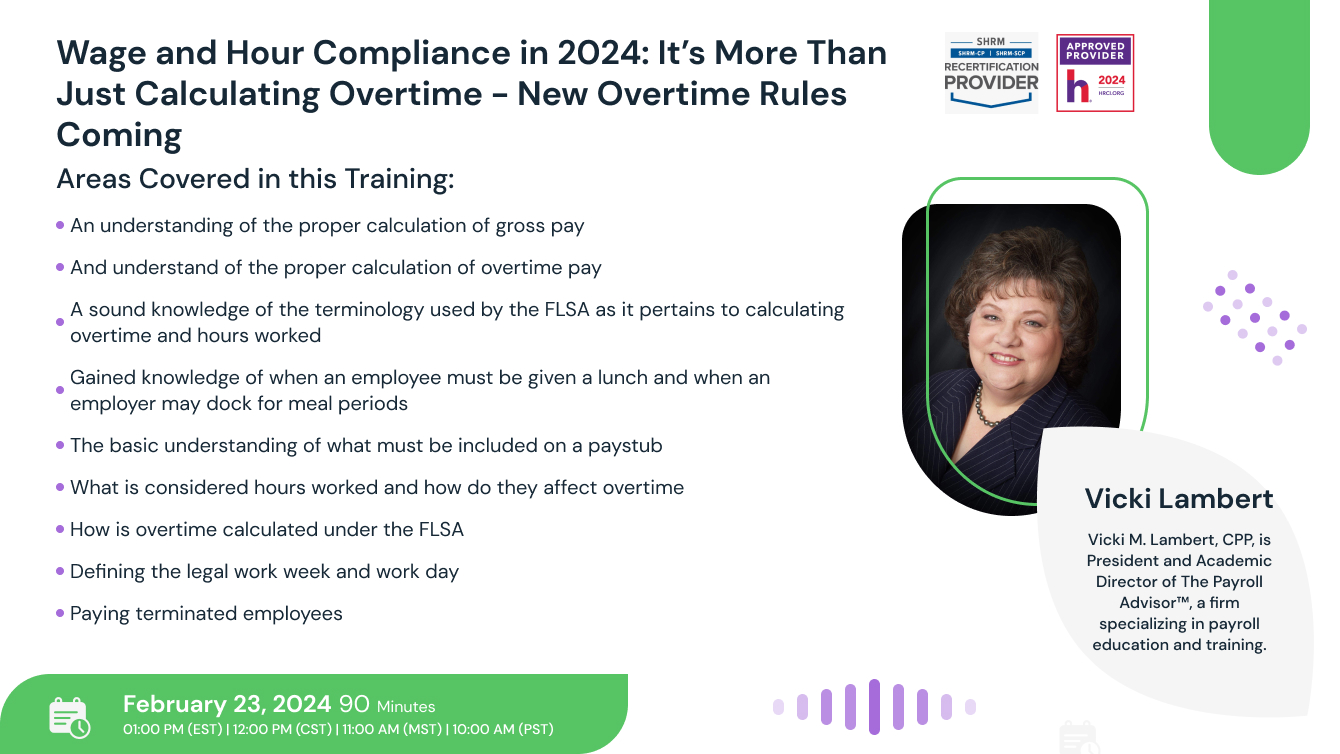

Vicki Lambert

Vicki M. Lambert, CPP, is President and Academic Director of The Payroll Advisor™, a firm specializing in payroll education and training. The company’s website www.thepayrolladvisor.com offers a payroll news service which keeps payroll professionals up-to-date on the latest rules and regulations.

With nearly 40 years of hands-on experience in all facets of payroll functions as well as over three decades as a trainer and author, Ms. Lambert has become the most sought-after and respected voice in the practice and management of payroll issues. She has conducted open market training seminars on payroll issues across the United States that have been attended by executives and professionals from some of the most prestigious firms in business today.

A pioneer in electronic and online education, Ms. Lambert produces and presents payroll-related audio seminars, webinars, and webcasts for clients, APA chapters, and business groups throughout the country. Ms. Lambert is an adjunct faculty member at Brandman University in Southern California and is the creator of and instructor for their Practical Payroll Online program, which is approved for recertification hours by the APA. She is also the instructor for the American Payroll Association’s “PayTrain” online program also offered by Brandman University.

SHRM -

StandEagle is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.5 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please visit - portal.shrm.org.

HRCI -

This webinar has been approved for 1.5 HR (General) re-certification credit hours toward California, GPHR, HRBP, HRMP, PHR, and SPHR recertification through the HR Certification Institute.

The use of this seal is not an endorsement by the HR Certification Institute of the quality of the activity. It means that this activity has met the HR Certification Institute’s criteria to be pre-approved for re-certification credit.

ACCREDITATIONS