Overview:

Dec of 2017 The Tax Cuts and Jobs Act was passed, and it was one of the most significant tax changes in sometime. This webinar will prepare the payroll professional to understand the changes to the Form W-4 from 2018 to review the recently released draft 2024 W-4 Form. Before changes the Form W-4 was a critical form that all companies must obtain from employees and has had special processing requirements. A review of the IRS specific laws around processing of the Form W-4 and how they should be handled will be discussed. 2023 has continued to bring changes that this webinar will review.

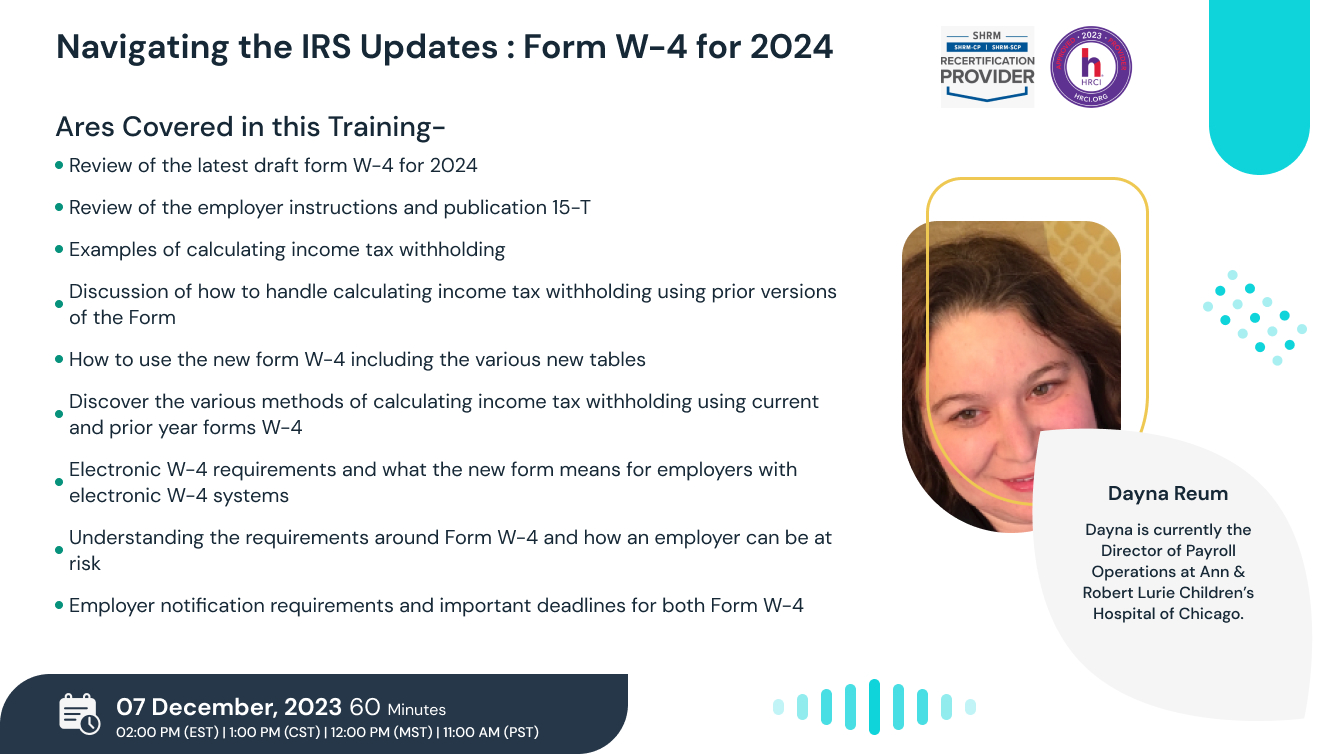

Areas Covered in this Training:

· Review of the latest draft form W-4 for 2024

· Understanding the proper way to process a Federal W-4

· What should be the proper process for an invalid W-4 in 2023

· Proper processing and maintenance of an IRS lock in letter

· Electronic W-4 requirements and what the new form means for employers with electronic W-4 systems

· Understanding the requirements around Form W-4 and how an employer can be at risk

· IRS Form W-4 change requirements and how it affects you as an employer

· Employer notification requirements and important deadlines for both Form W-4

· Review and examples on the new ways to calculate federal taxation in 2023

· Best Practices on how employers can better communicate W-4 changes to employees

· Review of the employer instructions and publication 15-T

· Discover the various methods of calculating income tax withholding using current and prior year forms W-4

Why attend this Training:

The importance of the Form W-4 is fundamental to the payroll department. It is the foundation for the taxation of an employee’s paycheck as well as a required IRS form. Failure to handle the form correctly and completely can open the door to serious problems not only in properly withholding from the employee’s gross wages but could extend beyond the regulations and affect payroll customer service or employee morale. It can also lead to costly expenditures of time and budget resources to correct non-compliance consequences.

This webinar takes a closer look at the IRS Form W-4 for 2024 and what’s in store for payroll in the new year. This includes the requirements for completing the form properly, handling non-resident aliens, state equivalent forms, record retention and processing the form electronically instead of on paper. We will also discuss best practices for processing more efficiently within the department.

Suggested Attendees:

· Payroll Executives/Managers/Administrators/Professionals/Practitioners/Entry Level Personnel

· Human Resources Executives/Managers/Administrators

· Accounting Personnel

· Business Owners/Executive Officers/Operations and Departmental Managers

· Any individual or entity that must deal with the complexities and requirements of Payroll compliance issues

Dayna Reum

Dayna is currently the Director of Payroll Operations at Ann & Robert Lurie Children’s Hospital of Chicago. Dayna has been heavily involved in the payroll field for over 17 years. Starting as a payroll clerk at a small Tucson company, Dayna moved on to be a Payroll Team Leader at Honeywell Inc. During Dayna’s time at Honeywell she obtained her FPC (Fundamental Payroll Certification) through the American Payroll Association. She also received several merit awards for Customer Service and Acquisitions and Divestitures.

Dayna is no stranger to teaching she has taught at the Metro Phoenix American Payroll Association meetings and at the Arizona State Payroll Conference. Topics including Payroll Basics, Global/Cultural Awareness, Immigration Basics for the Payroll Professional, Multi-State and Local Taxation and Quality Control for Payroll, International and Canadian payroll. Dayna has her CPP (Certified Payroll Professional) through the APA. She also serves on the National American Payroll Association on the National Strategic Leadership Task Force, Government Affairs Task Force (PA Local tax subcommittee). Dayna has received a Citation of Merit for her service along with being a Gold Pin member of the APA. Besides her payroll accomplishments, Dayna is certified in HR hiring and firing practices and is a Six-Sigma Greenbelt.

SHRM -

StandEagle is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please visit - portal.shrm.org.

HRCI -

This webinar has been approved for 1.0 HR (General) re-certification credit hours toward California, GPHR, HRBP, HRMP, PHR, and SPHR recertification through the HR Certification Institute.

The use of this seal is not an endorsement by the HR Certification Institute of the quality of the activity. It means that this activity has met the HR Certification Institute’s criteria to be pre-approved for re-certification credit.

ACCREDITATIONS