Overview:

Congress just passed the “One Big Beautiful Bill”; —a sprawling piece of legislation that locks in dozens of tax changes for individuals, businesses, and compliance professionals. Some provisions make long-anticipated extensions permanent, while others add entirely new wrinkles, from tip and overtime deductions to a revamped 1099 reporting threshold.

This 2-hour session will break down what changed and when, then walk through real-world planning opportunities for the remainder of 2025 and beyond. We’ll cover the headline items (TCJA extensions, SALT limit changes, bonus depreciation) and the sleeper issues (Trump Accounts, ERTC clawbacks, and the return of the above-the-line charitable deduction). Expect practical insights, straight talk, and a strong dose of context for helping clients navigate what’s next.

Areas covered in this Training:

By the end of this session, participants will be able to:

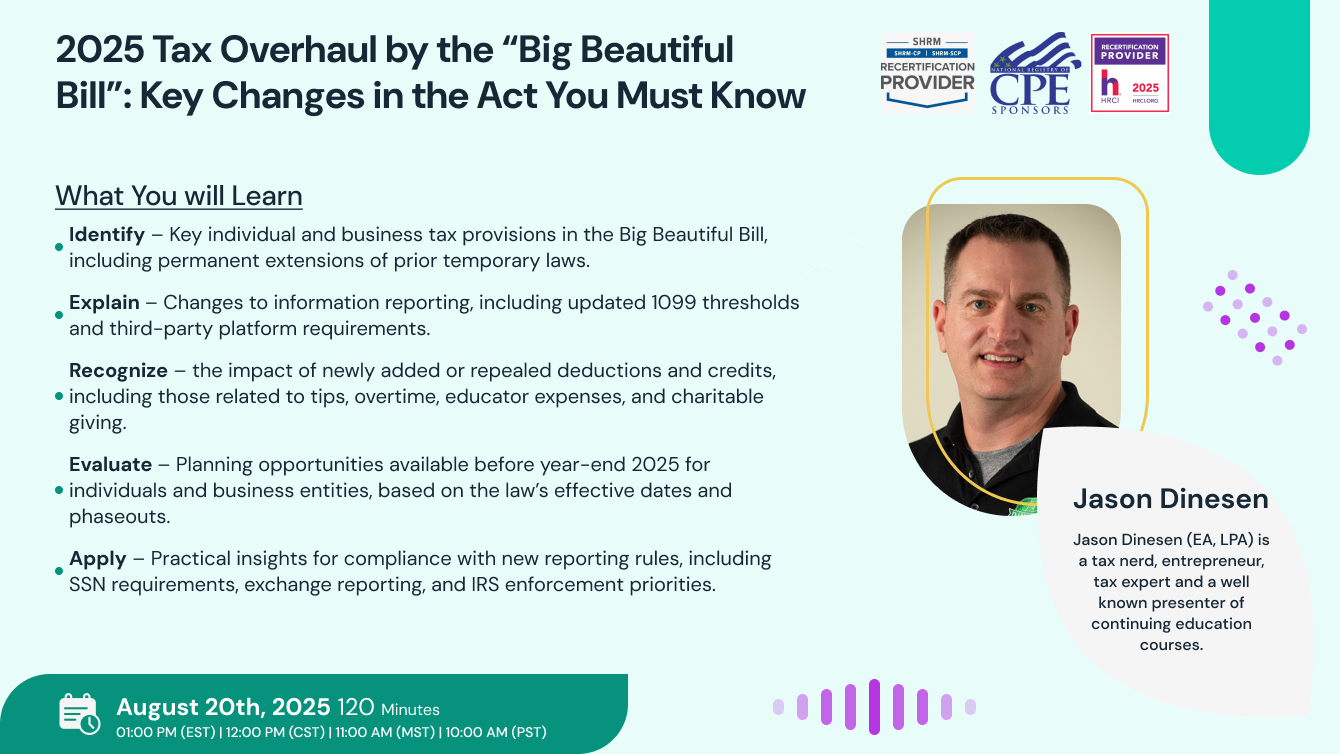

· Identify – Key individual and business tax provisions in the Big Beautiful Bill, including permanent extensions of prior temporary laws.

· Explain – Changes to information reporting, including updated 1099 thresholds and third-party platform requirements.

· Recognize – the impact of newly added or repealed deductions and credits, including those related to tips, overtime, educator expenses, and charitable giving.

· Evaluate – Planning opportunities available before year-end 2025 for individuals and business entities, based on the law’s effective dates and phaseouts.

· Apply – Practical insights for compliance with new reporting rules, including SSN requirements, exchange reporting, and IRS enforcement priorities.

Why Attend This Training:

With the recent passage of the expansive "Big Beautiful Bill," the tax landscape is undergoing significant shifts that affect individuals, businesses, and compliance professionals alike. This exclusive 2-hour webinar will provide a comprehensive breakdown of the law’s most important provisions—both the headline changes and the lesser-known updates that can have a big impact. From TCJA extensions and bonus depreciation to tip and overtime deductions, revamped 1099 thresholds, and even the return of above-the-line charitable deductions, you’ll walk away with the clarity and actionable strategies you need to stay compliant and optimize outcomes.

Whether you're navigating year-end planning, assisting clients, or ensuring compliance with new IRS enforcement trends, this session offers practical guidance, expert interpretation, and an edge in understanding the tax terrain for 2025 and beyond.

Suggested Attendees:

· Business Owners

· CPAs and Tax Advisors

· Enrolled Agents (EAs)

· Finance and Accounting Professionals

· Payroll and HR Professionals – affected by changes in overtime and tip deductions

· Compliance Officers – looking to understand new reporting thresholds and SSN mandates

· Lawyers and Legal Advisors – working in tax law, estate planning, or business law

Jason Dinesen

Jason Dinesen (EA, LPA) is a tax nerd, entrepreneur, tax expert and a well-known presenter of continuing education courses. Known for his sharp tax interpretations, he is one of the quickest to bring the analysis of the latest tax updates and IRS guidance to the professional community.

Jason has coached over 200,000 accounting, tax, and HR professionals on various topics of accounting, individual taxation, corporate taxation, professional ethics and much more. He has presented over dozens of webinars on Form 1099 (for 10 years on this subject!); marriage in the tax code; tax updates; the new Form W-4, payroll updates, filing status, tax credit and other issues relating to the modern-day household setting. He also teaches 2 classes at Simpson College, Individual Income Tax and Business Analytics.

Jason always had a knack for radio shows and has and regularly features as an anchor for Radio Iowa. He was born and raised in Iowa and has a degree in corporate communications from Simpson College in Indianola. He has a big family that includes his wife, two sons, 4 cats and 2 dogs. His other hobbies include being a season ticket holder to University of Iowa football.

NASBA -

StandEagle is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its web site: www.nasbaregistry.org.

.png)

SHRM -

StandEagle is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 2.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please visit - portal.shrm.org.

HRCI -

This webinar has been approved for 1.0 HR (General) re-certification credit hours toward California, GPHR, HRBP, HRMP, PHR, and SPHR recertification through the HR Certification Institute.

The use of this seal is not an endorsement by the HR Certification Institute of the quality of the activity. It means that this activity has met the HR Certification Institute’s criteria to be pre-approved for re-certification credit.

ACCREDITATIONS