Overview

Payroll departments submit and receive hundreds of thousands of bits of data each year. Employee master file data such as name and social security number, employee forms such the Form W-4, report to the IRS such as Form 941, state unemployment insurance quarterly returns, termination dates for employees, and even child support withholding orders. This webinar will review record retention requirements along with legislation that is commonly done incorrectly that can cause you company money. This webinar will give you tools and tips to stay compliant with existing and new legislation.

To be up to date on current legislation affecting payroll and legislation that has caused the payroll area to struggle and how to overcome those struggles, to make sure your up to date and are running a payroll that is in compliance for 2023, this webinar is definitely one should attend.

Areas Covered in this Training

Record Retention

-Payroll Record Keeping Requirements by agency

-IRS-Internal Revenue Service

-DOL-Department of Labor

-Record retention policies & procedures & the cost of a poor policy

-How to handle and be prepared for audits

-Special Retention Concerns

-Form I-9

-Sarbanes-Oxley

-Mergers & Acquisitions

-Unclaimed Properties

Legislative updates

-W-2 filing deadlines

-Information Return

-Annual Updates

Common Errors to avoid

-Worker Misclassification

-Overpayment Corrections

-Termination Errors

-Proper state taxation

-Taxing Fringe Benefits

-Obtaining proper substantiation

Why Attend this Training

-Review how to properly determine worker classification and what it will cost you for non-compliance.

-Understanding key recordkeeping practices

-Best practices on how other employers handle multi-state concerns

-Properly Fringe Benefit Taxation

Suggested Attendees

-Payroll Professionals

-HR professionals

-Owners

-Tax professionals

-Bookkeepers

-Managers

-Small Business Owners

You may ask your Question directly to our expert during the Q&A session.

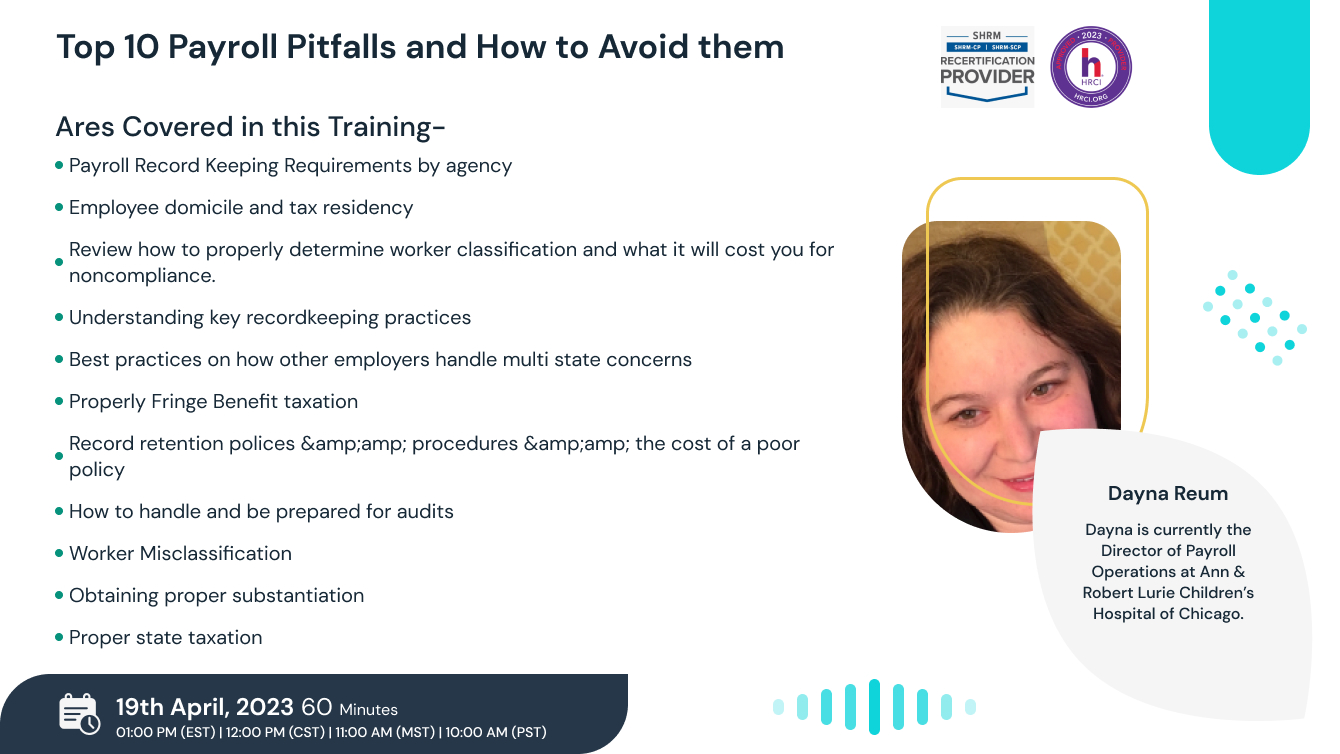

Dayna Reum

Dayna is currently the Director of Payroll Operations at Ann & Robert Lurie Children’s Hospital of Chicago. Dayna has been heavily involved in the payroll field for over 17 years. Starting as a payroll clerk at a small Tucson company, Dayna moved on to be a Payroll Team Leader at Honeywell Inc. During Dayna’s time at Honeywell she obtained her FPC (Fundamental Payroll Certification) through the American Payroll Association. She also received several merit awards for Customer Service and Acquisitions and Divestitures.

Dayna is no stranger to teaching she has taught at the Metro Phoenix American Payroll Association meetings and at the Arizona State Payroll Conference. Topics including Payroll Basics, Global/Cultural Awareness, Immigration Basics for the Payroll Professional, Multi-State and Local Taxation and Quality Control for Payroll, International and Canadian payroll. Dayna has her CPP (Certified Payroll Professional) through the APA. She also serves on the National American Payroll Association on the National Strategic Leadership Task Force, Government Affairs Task Force (PA Local tax subcommittee). Dayna has received a Citation of Merit for her service along with being a Gold Pin member of the APA. Besides her payroll accomplishments, Dayna is certified in HR hiring and firing practices and is a Six-Sigma Greenbelt.

SHRM-

Clatid is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM.

This program is valid for 1.5 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please visit - portal.shrm.org.

HRCI -

This webinar has been approved for 1.5 HR (General) re-certification credit hours toward California, GPHR, HRBP, HRMP, PHR, and SPHR recertification through the HR Certification Institute.

The use of this seal is not an endorsement by the HR Certification Institute of the quality of the activity. It means that this activity has met the HR Certification Institute’s criteria to be pre-approved for re-certification credit.

ACCREDITATIONS