Overview:

Companies are offering more fringe benefits than ever before to attract and retain top talent, reduce costs, and boost employee morale. However, the IRS continues to increase scrutiny on the taxation of fringe benefits, making compliance more complex. With the passage of the One Big Beautiful Bill Act (OBBBA) of 2025, new rules have been introduced that directly impact employer-provided benefits—particularly in the areas of transportation, relocation/moving expenses, and executive perks.

This webinar will review the core IRS requirements for non-taxable fringe benefits, explain how to properly determine taxation, and highlight the latest OBBBA updates that employers must integrate into payroll and compliance practices. Participants will leave with a clear understanding of how to evaluate, report, and manage fringe benefits under the new regulatory landscape.

Areas covered in this Training:

· Understand Fair Market Value (FMV): Learn how the IRS determines FMV and how it applies to employer-provided perks.

· New OBBBA Updates:

o Reinstated/modified tax treatment of moving and relocation benefits

o Adjusted limits and reporting rules for qualified transportation and commuter benefits

o New compliance obligations for executive perks and high-value fringe items under IRS scrutiny

· Core Fringe Benefit Categories:

o No additional cost services

o Employee discounts

o Working condition fringe benefits

o De minimis fringe benefits

· Review Qualified Transportation Benefits — including OBBBA changes to parking and commuter benefit taxability.

· Explore Excludable Fringe Benefits: Retirement planning, achievement awards, on-site athletic facilities, and others.

· Identify Taxable Fringe Benefits: Clarify gray areas such as executive perks and employee gifts.

· Moving & Relocation Expenses: Updates under OBBBA and how they change employer reporting obligations.

· Executive Taxation Issues: Spousal travel, company aircraft usage, and other high-risk items.

· Handling Taxable Benefits: Step-by-step guidance on payroll and reporting once a benefit is determined taxable.

· Accounts Payable & Fringe Benefits: Brief overview of AP-handled fringe items.

Why Attend This Webinar?

· Stay ahead of IRS enforcement trends and avoid costly tax mistakes.

· Learn the new OBBBA compliance requirements impacting fringe benefits in 2025 and beyond.

· Ensure accurate payroll reporting and taxation of fringe benefits to reduce audit risks.

· Gain practical guidance on how to classify, calculate, and document benefits to meet substantiation rules.

· Walk away with actionable strategies to manage both traditional and executive fringe benefits under the latest regulations.

Who Should Attend?

This webinar is designed for professionals responsible for payroll, compliance, and employee benefits, including:

· HR Leaders

· Benefits Managers

· Payroll Professionals

· Tax Specialists

· Finance & Accounting Managers

· Compliance Officers

· Controllers

· CFOs

· Business Owners & Executives

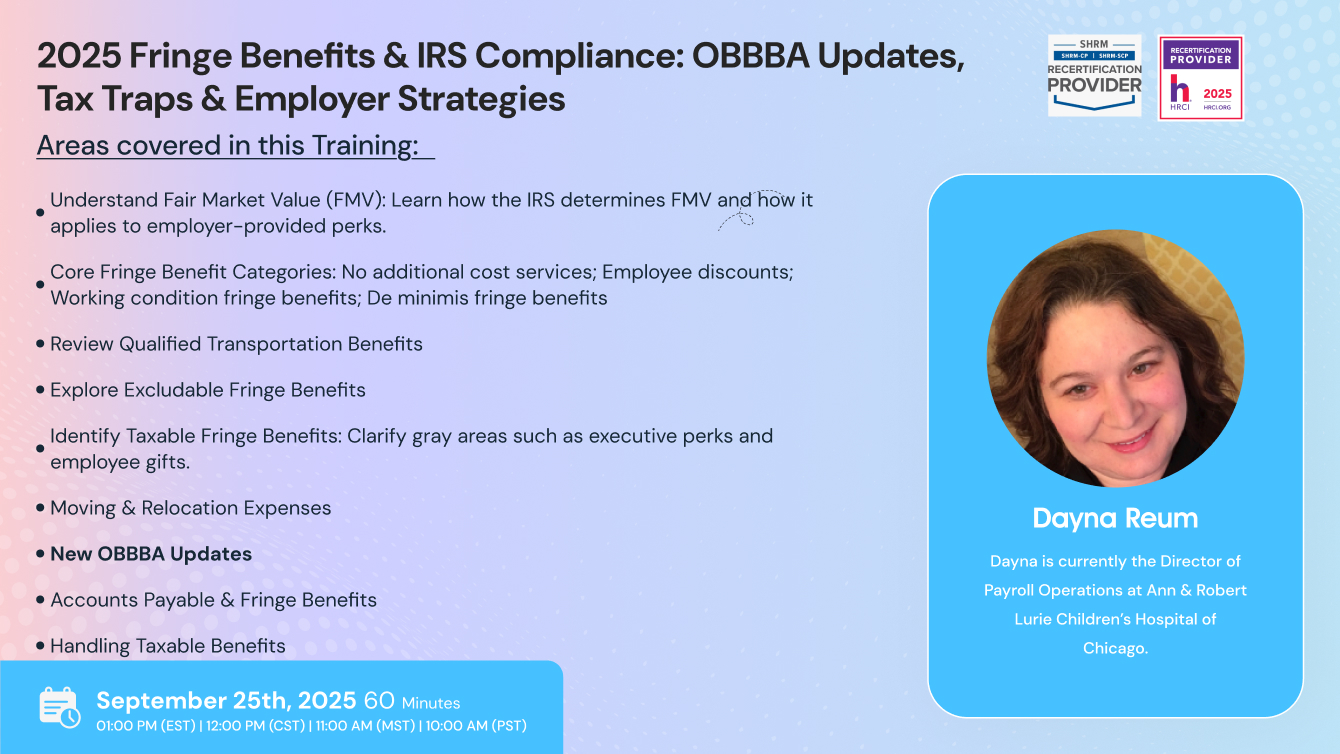

Dayna Reum

Dayna is currently the Director of Payroll Operations at Ann & Robert Lurie Children’s Hospital of Chicago. Dayna has been heavily involved in the payroll field for over 17 years. Starting as a payroll clerk at a small Tucson company, Dayna moved on to be a Payroll Team Leader at Honeywell Inc. During Dayna’s time at Honeywell she obtained her FPC (Fundamental Payroll Certification) through the American Payroll Association. She also received several merit awards for Customer Service and Acquisitions and Divestitures.

Dayna is no stranger to teaching she has taught at the Metro Phoenix American Payroll Association meetings and at the Arizona State Payroll Conference. Topics including Payroll Basics, Global/Cultural Awareness, Immigration Basics for the Payroll Professional, Multi-State and Local Taxation and Quality Control for Payroll, International and Canadian payroll. Dayna has her CPP (Certified Payroll Professional) through the APA. She also serves on the National American Payroll Association on the National Strategic Leadership Task Force, Government Affairs Task Force (PA Local tax subcommittee). Dayna has received a Citation of Merit for her service along with being a Gold Pin member of the APA. Besides her payroll accomplishments, Dayna is certified in HR hiring and firing practices and is a Six-Sigma Greenbelt.

SHRM -

Standeagle is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please visit - portal.shrm.org.

HRCI -

This webinar has been approved for 1.0 HR (General) re-certification credit hours toward California, GPHR, HRBP, HRMP, PHR, and SPHR recertification through the HR Certification Institute.

The use of this seal is not an endorsement by the HR Certification Institute of the quality of the activity. It means that this activity has met the HR Certification Institute’s criteria to be pre-approved for re-certification credit.

ACCREDITATIONS