Form 1099, 1099-MISC and 1099-K Reporting in 2023

Most businesses know that they need to issue 1099s to contractors, but did you know that payment to your attorney is considered contract labor, and you send one even if the law firm is a corporation? There are times when you don't issue 1099s to contractors -- paying them with a credit card and paying with many (but not all) payment apps such as Venmo and PayPal.

Using Form W-9 is an effective compliance tool for this and many other issues you face when it comes to issuing 1099s (or not needing to issue 1099s). Besides, backup withholding is something that is not happening -- the IRS estimates that over 400,000 payments are made each year where backup withholding should be done where it is not being done. The IRS now tries to enforce backup withholding.

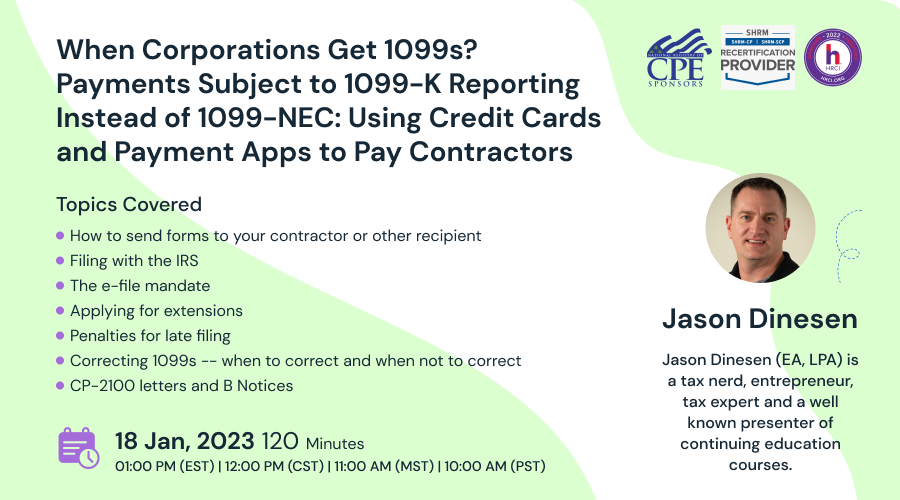

Join our taxation speaker, Mr. Jason Dinesen, on Standeagle this January to learn the most important aspects relating to issuing 1099s for situations other than regular contract labor. We will discuss how to effectively use Form W-9. We will also define what backup withholding is and how to do it.

January 31st is the deadline for filing Form 1099-NEC to contractors, and is also the deadline (in most cases) for providing Form 1099-MISC to the recipient as well. This session will cover filing issues, such as how to file, when to file, and what the penalties are. We will also cover a topic that doesn't get a lot of coverage -- or thought -- and that is, e-mailing 1099s to the recipient. Something that seems so simple actually has a lot of requirements under the regulations, and we will cover those hoops you need to jump through per the regulations. We will also cover the things you need to do after filing the 1099s: fixing errors and dealing with IRS letters.

Topics Covered

-How to send forms to your contractor or other recipient

-Filing with the IRS

-The e-file mandate

-Applying for extensions

-Penalties for late filing

-Correcting 1099s -- when to correct and when not to correct

-CP-2100 letters and B Notices

What You will Learn

-When do corporations get 1099s

-Form 1099-K: using credit cards and payment apps to pay contractors

-Backup withholding: when to do it and how to do it

Bonus Topics

-Effective use of Form W-9 for compliance

-In-depth on medical payments and legal payments

Who will Benefit

-Business owners

-Office managers

-Controllers

-Bookkeepers

-Managers

-CFOs

-Accountants

-EAs

Jason Dinesen

Jason Dinesen (EA, LPA) is a tax nerd, entrepreneur, tax expert and a well-known presenter of continuing education courses. Known for his sharp tax interpretations, he is one of the quickest to bring the analysis of the latest tax updates and IRS guidance to the professional community.

Jason has coached over 200,000 accounting, tax, and HR professionals on various topics of accounting, individual taxation, corporate taxation, professional ethics and much more. He has presented over dozens of webinars on Form 1099 (for 10 years on this subject!); marriage in the tax code; tax updates; the new Form W-4, payroll updates, filing status, tax credit and other issues relating to the modern-day household setting. He also teaches 2 classes at Simpson College, Individual Income Tax and Business Analytics.

Jason always had a knack for radio shows and has and regularly features as an anchor for Radio Iowa. He was born and raised in Iowa and has a degree in corporate communications from Simpson College in Indianola. He has a big family that includes his wife, two sons, 4 cats and 2 dogs. His other hobbies include being a season ticket holder to University of Iowa football.

Standeagle Webinar Certification - Standeagle rewards you with Standeagle Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Standeagle Courses and Webinars or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Standeagle doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

ACCREDITATIONS