FLSA 2025: DOL’s Final Ruling on Independent Contractor Classification

The Fair Labor Standards Act (FLSA) is a federal law that establishes minimum wage, overtime pay, equal pay, and recordkeeping standards to ensure fair treatment of employees. Notable developments in 2024 include the Department of Labor’s (DOL) final rule on independent contractor classification, effective March 11, 2024, which impacts how workers are categorized. Proposed changes to the salary level thresholds for overtime eligibility, originally set to take effect on July 1, 2024, have been blocked and will not proceed on January 1, 2025. Federal and state minimum wage proposals remain a critical area of focus, impacting pay equity and labor market conditions.

To determine FLSA exemptions, employers must evaluate the primary duties of a job and apply specific tests, including the Salary Level and Salary Basis tests.

Proper classification as exempt or non-exempt is essential to ensure compliance, as it determines overtime eligibility. Employers must also understand how to calculate overtime pay, adhere to minimum wage and equal pay provisions, and comply with and recordkeeping regulations. FLSA non-compliance can lead to significant legal and financial repercussions, making it crucial for organizations to stay informed and compliant with labor standards.

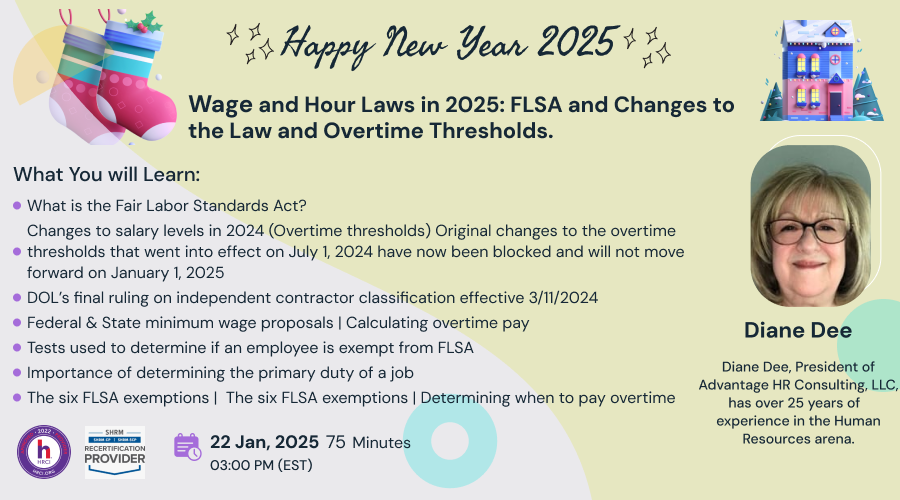

What You will Learn

- What is the Fair Labor Standards Act?

- Changes to salary levels in 2024 (Overtime thresholds) Original changes to the overtime thresholds that went into effect on July 1, 2024 have now been blocked and will not move forward on January 1, 2025)

- DOL’s final ruling on independent contractor classification effective 3/11/2024

- Federal & State minimum wage proposals

- Tests used to determine if an employee is exempt from FLSA

- Importance of determining the primary duty of a job

- The six FLSA exemptions

- Exempt vs. Non-Exempt status

- Salary Level and Salary Basis tests

- Determining when to pay overtime

- Calculating overtime pay

- Minimum wage provisions under FLSA

- Equal pay provisions under FLSA

- Child labor regulations

- Recordkeeping requirements

- Repercussions of FLSA non-compliance

Why Should You Attend

This webinar will lay the groundwork for determining whether your employees are properly classified as Exempt or Non-exempt and ensuring that wage and hour laws are being followed properly. Additionally, recent changes to the overtime thresholds will be discussed as these changes that took effect on July 1, 2024.

Who Will Benefit

-Human Resources Professionals

- Compensation Professionals

- Compliance professionals

- Managers

- Supervisors

- Employees

Diane L. Dee

Diane holds a Master Certificate in Human Resources from Cornell University’s School of Industrial and Labor Relations and has attained SPHR, SHRM-SCP, sHRBP, and HRPM® certification.

Diane is a member of the National Association of Women Business Owners and the Society for Human Resource Management. Additionally, Diane performs pro bono work through the Taproot Foundation, assisting non-profit clients by integrating their Human Resources goals with their corporate strategies.

SHRM -

StandEagle is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.25 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please visit - portal.shrm.org.

HRCI -

This webinar has been approved for 1.25 HR (General) re-certification credit hours toward California, GPHR, HRBP, HRMP, PHR, and SPHR recertification through the HR Certification Institute.

The use of this seal is not an endorsement by the HR Certification Institute of the quality of the activity. It means that this activity has met the HR Certification Institute’s criteria to be pre-approved for re-certification credit.

ACCREDITATIONS