Overview:

Basis in an S-Corporation directly impacts items such as taxability (or not) of distributions, and deductibility (or not) of corporate losses on individual/personal tax returns. To make these declarations, shareholders must use Form 7203 on individual tax returns. Shareholders are required to file the Form 7203, in most situations, to report their basis in the corporation.

At its most basic level, basis is straightforward to calculate — but real-world situations quickly complicate the rules. This webinar will simplify the process by explaining what basis is, how it is calculated, how shareholder loans affect basis, and how to accurately complete Form 7203. In addition, we’ll cover the most important IRS and Treasury updates for 2025 so you can stay compliant and protect your clients or business.

Areas covered in this Training:

After attending and participating in this webinar, attendees will be able to:

· Explain S-Corporation basis and how it differs from partnership basis.

· Calculate annual increases and decreases to stock and debt basis.

· Correctly report the taxability and deductibility of shareholder distributions.

· Understand when Form 7203 is required and complete it with confidence.

· Properly handle shareholder loans and repayments.

· Apply the 2025 updates, including:

o Notice 2025-23 and withdrawal of related-party basis-shifting regulations.

o IRS updates to Form 1120-S and Schedules K-2/K-3 that affect shareholder reporting.

o Practical compliance checklists to avoid errors and IRS scrutiny.

Why Attend this Training:

This session goes beyond theory — it gives you practical tools to apply immediately. By attending, you will:

· Gain clarity on complex S-Corp basis rules.

· Avoid common compliance mistakes and IRS red flags.

· Stay up to date with the latest 2025 tax law changes.

· Walk away with real-world examples, checklists, and a step-by-step approach to Form 7203.

Don’t miss this opportunity to strengthen your S-Corp compliance skills and master Form 7203 reporting for 2025.

Suggested Attendees:

· Accountants

· CPAs

· Tax Preparers

· Bookkeepers

· Enrolled Agents

· Office Managers

· Small Business Owners

· Entrepreneurs working with S-Corporations

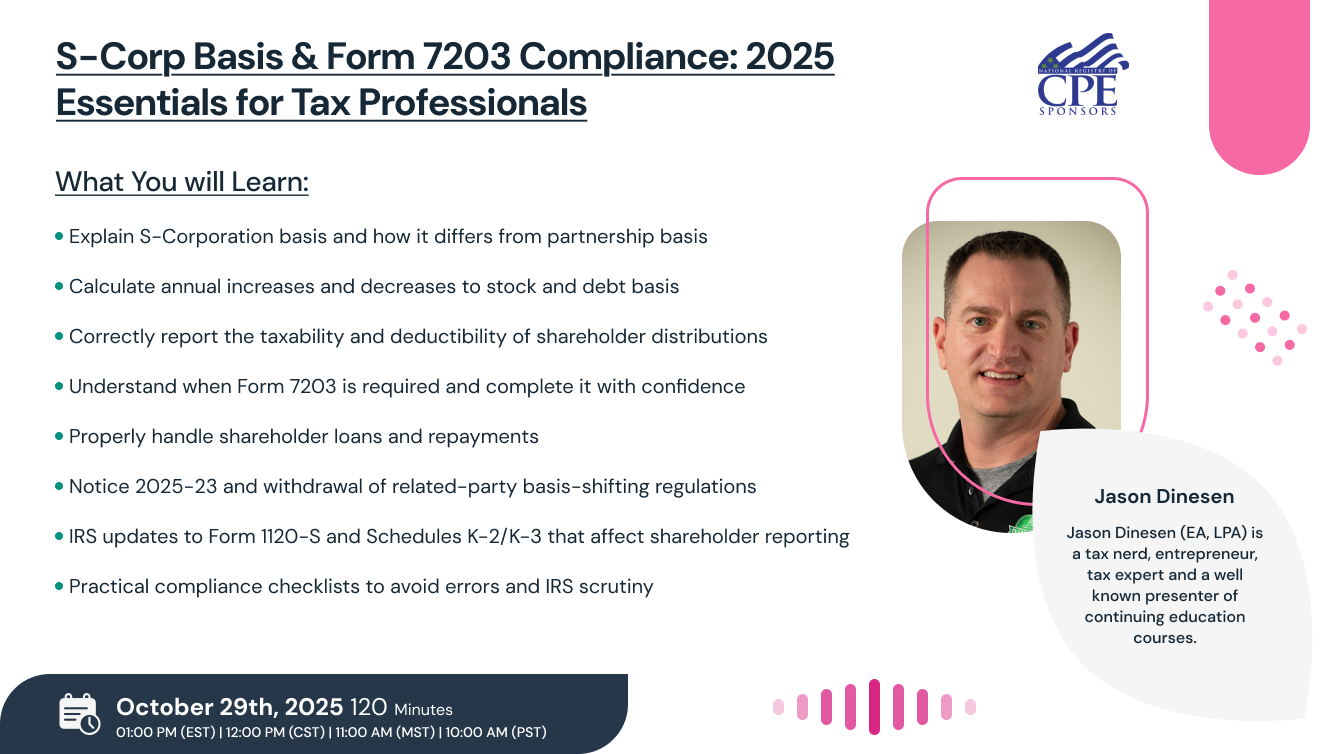

Jason Dinesen

Jason Dinesen (EA, LPA) is a tax nerd, entrepreneur, tax expert and a well-known presenter of continuing education courses. Known for his sharp tax interpretations, he is one of the quickest to bring the analysis of the latest tax updates and IRS guidance to the professional community.

Jason has coached over 200,000 accounting, tax, and HR professionals on various topics of accounting, individual taxation, corporate taxation, professional ethics and much more. He has presented over dozens of webinars on Form 1099 (for 10 years on this subject!); marriage in the tax code; tax updates; the new Form W-4, payroll updates, filing status, tax credit and other issues relating to the modern-day household setting. He also teaches 2 classes at Simpson College, Individual Income Tax and Business Analytics.

Jason always had a knack for radio shows and has and regularly features as an anchor for Radio Iowa. He was born and raised in Iowa and has a degree in corporate communications from Simpson College in Indianola. He has a big family that includes his wife, two sons, 4 cats and 2 dogs. His other hobbies include being a season ticket holder to University of Iowa football.

NASBA -

CPE Credits = 2.0

“In accordance with the standards of the National Registry of CPE Sponsors, CPE credits have been granted based on a 50 minute hour.”

StandEagle is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its web site: www.nasbaregistry.org.

ACCREDITATIONS