Overview:

As more and more small businesses are using independent contractors, the need to file 1099s is increasing. Form 1099s are filed by businesses to report any non-employee compensation paid to a freelancer or independent contractor. There are separate deadlines for filing different 1099s, and businesses can be penalized if they don't file by the deadline. Learn more about the 1099s, types, deadlines and what happens if you miss them.

*NEW TAX LAW CHANGES*

The One Big Beautiful Bill that passed includes permanently extending tax cuts from the Tax Cuts and Jobs Act, including increasing the cap on the amount of state and local or sales tax and property tax (SALT) that you can deduct, makes cuts to energy credits passed under the Inflation Reduction Act, makes changes to taxes on tips and overtime for certain workers, reforms Medicaid, increases the Debt ceiling, and reforms Pell Grants and student loans.

Areas Covered in this Training:

· Learn Independent Contractor vs Employee classification

· Learn when to issue a 1099

· Understanding the Distinctions Between various 1099 Forms

· Learn the criteria for issuing different 1099s (NEC, MISC, K, DA, etc.)

· Learn how to properly fill out a 1099-NEC and 1099-MISC

· Reporting requirements and back-up withholding

· Recognize when to collect a W-9 vs a W-8

· Learn what the penalties are for not filing 1099s in a timely manner

· Penalties for Failure to Comply

· Electronic vs. Paperless Filin

· What are the penalties for not reporting Form 1099 income?

· Can you claim unreimbursed employee expenses again?

· What are the new tax benefits that one can claim?

· Are personal and dependent exemptions reinstated?

· Latest Form 1099-NEC, 1099-MISC, 1099-K, 1099-DA and any changes to other 1099 form reporting requirements with specifics.

· Best Practices – Form 1099 Compliances; Accurate and Timely Reporting

Why attend this Training:

The passing of the One Big Beautiful Bill brings significant changes to the tax code and beyond. The bill permanently extends certain provisions from the Tax Cuts and Jobs Act (TCJA) that were set to expire, including an increased state and local tax (SALT) deduction cap, and introduces changes to taxes on tips and overtime for certain workers. Impacts to energy credits, Medicaid, the debt ceiling, Deduction for auto loan interest for certain vehicles and Child Tax Credit, student loans are also included.

This webinar provides a comprehensive structure that covers everything from the basics of Form 1099 to the updates for 2025 OBBB Act, compliance, withholding, penalties, and a dedicated Q&A session to engage the audience directly.

Learn best practices for managing 1099 Form compliances.

Suggested Attendees:

· Small Business Owners

· Entrepreneurs

· Tax Professionals & Preparers

· Accountants

· Freelancers & Self-Employed Individuals

· Financial Managers

· Business Operators

· CPAs

· Bookkeepers

· Enrolled Agents

· Office Managers

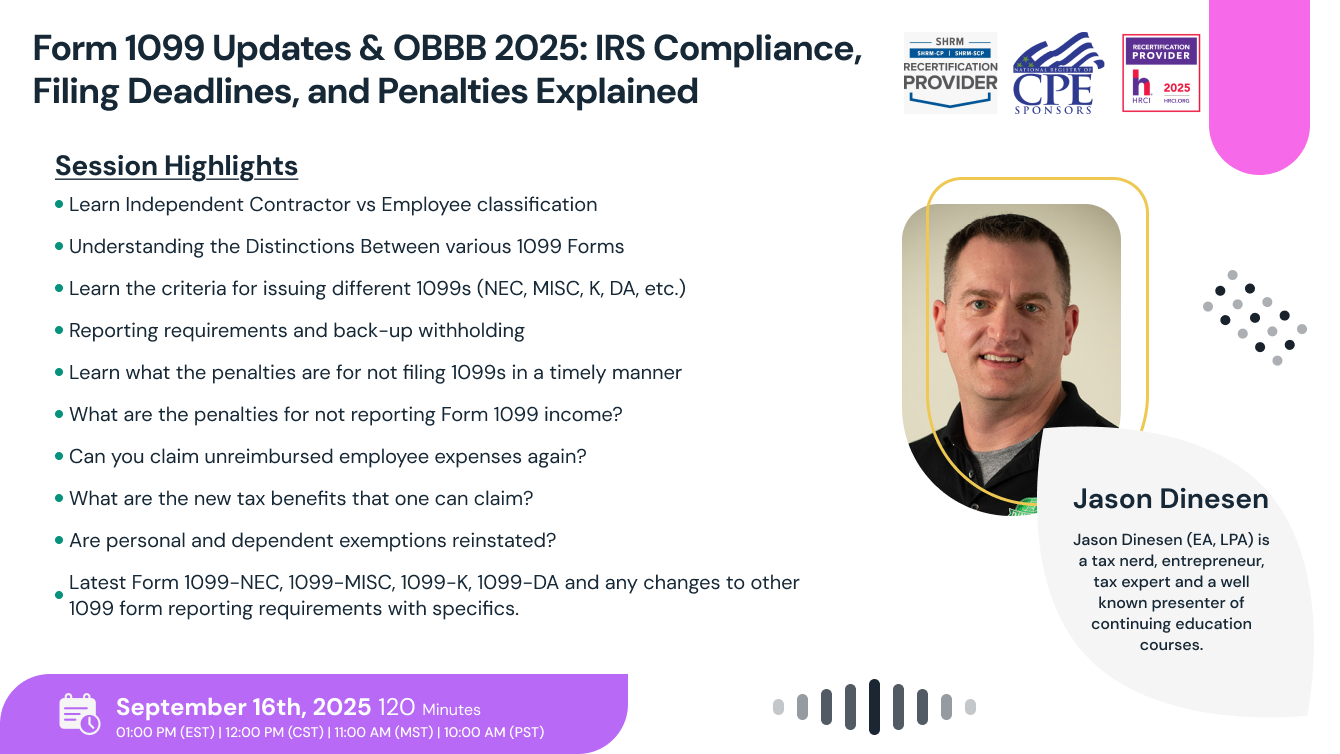

Jason Dinesen

Jason Dinesen (EA, LPA) is a tax nerd, entrepreneur, tax expert and a well-known presenter of continuing education courses. Known for his sharp tax interpretations, he is one of the quickest to bring the analysis of the latest tax updates and IRS guidance to the professional community.

Jason has coached over 200,000 accounting, tax, and HR professionals on various topics of accounting, individual taxation, corporate taxation, professional ethics and much more. He has presented over dozens of webinars on Form 1099 (for 10 years on this subject!); marriage in the tax code; tax updates; the new Form W-4, payroll updates, filing status, tax credit and other issues relating to the modern-day household setting. He also teaches 2 classes at Simpson College, Individual Income Tax and Business Analytics.

Jason always had a knack for radio shows and has and regularly features as an anchor for Radio Iowa. He was born and raised in Iowa and has a degree in corporate communications from Simpson College in Indianola. He has a big family that includes his wife, two sons, 4 cats and 2 dogs. His other hobbies include being a season ticket holder to University of Iowa football.

..

ACCREDITATIONS