Form 2441: Calculations, Limitations and Requirements

Form 2441 for Child and Dependent Care Credits on the 1040 Tax Return is a common credit for our clients. The taxpayer fills it out to declare the child and dependent care expenses incurred during the year. This form is essential if you intend to seek a credit for these care-related expenses.

While the form appears straight forward, it is more complicated than it seems, particularly when our clients lead complicated lives. There are a number of eligibility requirements they must satisfy before preparing Form 2441. Join us to discuss the completion of the form as well as scenarios and case studies highlighting credit calculations and common client complications.

What You will Learn

- What are dependent care expenses?

- Who is a qualifying person?

- What are qualifying expenses?

- Form 2441

- Receiving dependent care benefits from an employer

- Special issues of married filing separately

- Case Studies and Examples throughout

- Special issues based on filing status

- Limitations, qualifications and exclusions affecting dependent care credits

What We will Discuss

- Understand common limitations to and exclusions from dependent care credits.

- Successfully calculate dependent care credits for common and complicated scenarios.

- Accurately complete form 2441.

- Gain confidence in discussing dependent care credit requirements with your clients.

Why You Should Attend

Join us to navigate Form 2441 for Child and Dependent Care Credits on the 1040 Tax Return. This credit is often misunderstood and can be especially complex for individuals with intricate lifestyles. We aim to shed light on the intricacies of this form, covering its completion, various scenarios, and real-life case studies. Gain a deeper understanding of credit calculations and how to effectively navigate common complications that your clients may encounter.

Be a part of an in-depth discussion to enhance your expertise and knowledge, and to ensure you're maximizing the benefits of this tax credit.

Who will Benefit

- CPAs

- Accountants

- Enrolled Agents

- Tax Preparers

- Attorneys

- Tax Professionals

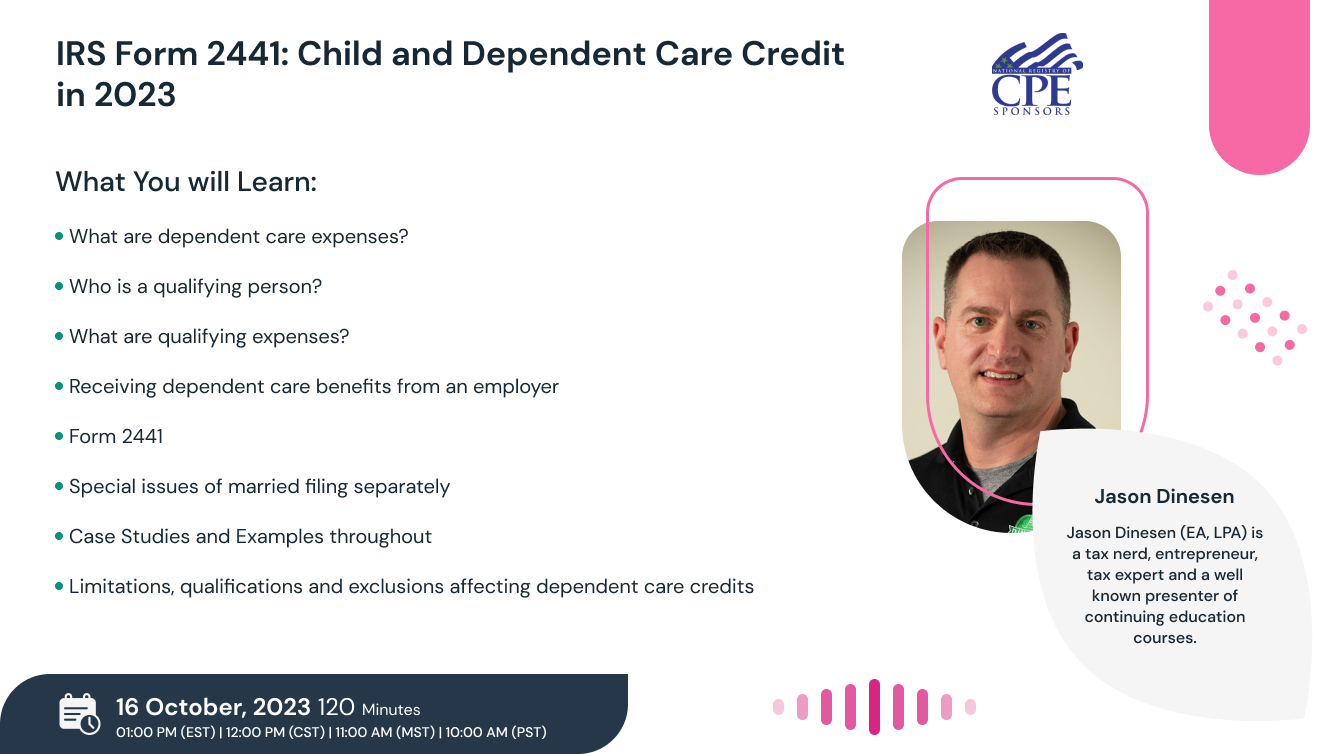

Jason Dinesen

Jason Dinesen (EA, LPA) is a tax nerd, entrepreneur, tax expert and a well-known presenter of continuing education courses. Known for his sharp tax interpretations, he is one of the quickest to bring the analysis of the latest tax updates and IRS guidance to the professional community.

Jason has coached over 200,000 accounting, tax, and HR professionals on various topics of accounting, individual taxation, corporate taxation, professional ethics and much more. He has presented over dozens of webinars on Form 1099 (for 10 years on this subject!); marriage in the tax code; tax updates; the new Form W-4, payroll updates, filing status, tax credit and other issues relating to the modern-day household setting. He also teaches 2 classes at Simpson College, Individual Income Tax and Business Analytics.

Jason always had a knack for radio shows and has and regularly features as an anchor for Radio Iowa. He was born and raised in Iowa and has a degree in corporate communications from Simpson College in Indianola. He has a big family that includes his wife, two sons, 4 cats and 2 dogs. His other hobbies include being a season ticket holder to University of Iowa football.

NASBA -

StandEagle is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its web site: www.nasbaregistry.org.

ACCREDITATIONS