ChatGPT for Advanced Accounting and Tax Law Research in 2024

Join us to get a concise overview of how accounting and taxation research works in the AI age. Limitations of conventional search engines like Google have left professionals in search of more. Enter ChatGPT, a tool designed to redefine advanced accounting inquiries and analyses.

Using a combination of hands-on training and real-world case studies, this course reveals in plain language how to navigate complex financial landscapes using AI-powered insights. Discover how to bridge the gap between traditional research and innovative technology and become a more agile accounting researcher and confident business advisor. Join the innovative thinkers who have already made the shift. Your success awaits.

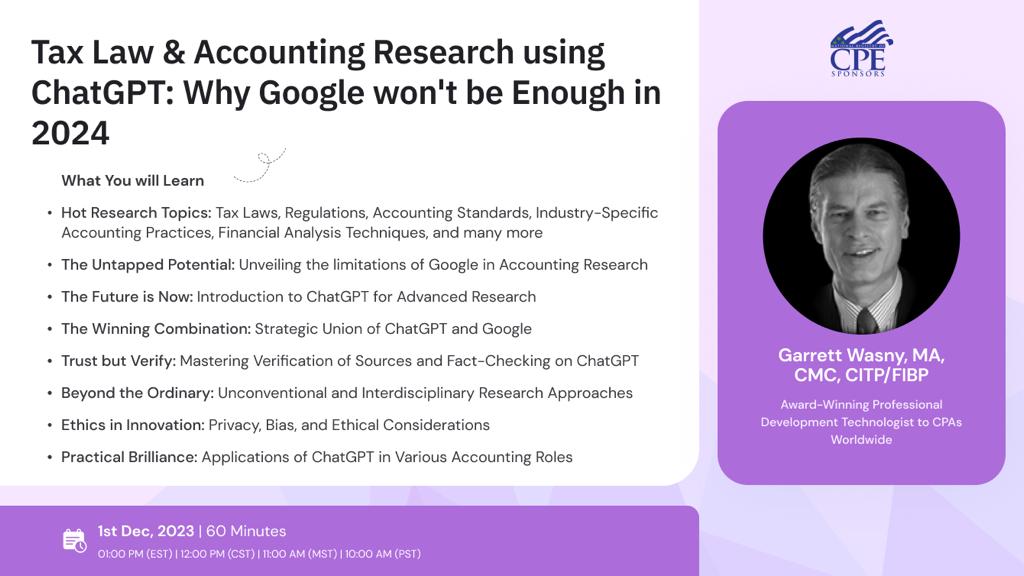

What You will Learn

- Hot Research Topics: Tax Laws, Regulations, Accounting Standards, Industry-Specific Accounting Practices, Financial Analysis Techniques, and many more

- The Untapped Potential: Unveiling the limitations of Google in Accounting Research

- The Future is Now: Introduction to ChatGPT for Advanced Research

- The Winning Combination: Strategic Union of ChatGPT and Google

- Trust but Verify: Mastering Verification of Sources and Fact-Checking on ChatGPT

- Beyond the Ordinary: Unconventional and Interdisciplinary Research Approaches

- Ethics in Innovation: Privacy, Bias, and Ethical Considerations

- Practical Brilliance: Applications of ChatGPT in Various Accounting Roles

What We will Discuss

- Learn about the hidden drawbacks of conventional online research

- Assess the untapped capabilities of ChatGPT for transformative accounting research

- Design unique research strategies using ChatGPT

- Leverage ChatGPT in real-world, impactful accounting scenarios

- Invent new methodologies and perspectives in accounting

- Navigate ethical considerations in this new frontier

- Demonstrate proficiency in using ChatGPT, setting yourself apart

Who Should Attend

- Leaders

- Accountants

- Accounting professionals

- Tax consultants

- Tax professionals

- Auditors

- Financial Analysts

- Compliance officers

- CFOs

- Educators

- Researchers

- Students

- Visionaries seeking to elevate their research capabilities

Garrett Wasny, MA, CMC, CITP/FIBP

Garrett Wasny, MA, CMC, CITP/FIBP is an award-winning Professional Development Technologist to CPAs Worldwide. Since 1995, he has delivered thousands of presentations on Internet strategy to hundreds of leading accounting institutes, industry associations, Fortune 500 companies, small and medium-sized enterprises, business schools and other legal, medical, engineering, pro sports and executive education organizations.

Garrett's writing credits include four books, dozens of e-books and hundreds of articles on online business for scores of leading business publishers, syndicates and magazines including McGraw Hill, John Wiley and Sons, Knight Ridder, the Financial Post, Journal of Commerce and World Trade.

Garrett has also won numerous awards for his writing, speaking and web design. His academic credentials include a Bachelor of Arts with Honors (BA Hons) degree and a Master of Arts (MA) degree. His professional accreditations include Certified Management Consultant (CMC), Certified International Trade Professional (CITP) and FITP (FITT International Business Professional).

In 2017, Garrett is scheduled to deliver 150+ professional development events across North America on a range of technology and accounting topics. The presentations are hosted by leading accounting CPE providers such as Thomson Reuters, CPE Solutions, CPA Crossings, CPE Link, Clear Law Institute and CPA Institutes. His courses cover online productivity, Internet search, digital transformation, mobile computing, social enterprise and tax.

Garrett is an independent Certified Management Consultant (CMC) who provides objective information based on his own impartial research and due diligence. He has more than 20 years experience in the Internet field and started his career at Price Waterhouse.

NASBA -

StandEagle is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its web site: www.nasbaregistry.org.

ACCREDITATIONS