Overview:

The Fair Labor Standards Act (FLSA) is a federal law that establishes minimum wage, overtime pay, equal pay, and recordkeeping standards to ensure fair treatment of employees. Notable developments include the Department of Labor’s (DOL) final rule on independent contractor classification, which impacts how workers are categorized. Proper classification as exempt or non-exempt is essential to ensure compliance, as it determines overtime eligibility. Employers must also understand how to calculate overtime pay, adhere to minimum wage and equal pay provisions, and comply with and recordkeeping regulations. FLSA non-compliance can lead to significant legal and financial repercussions, making it crucial for organizations to stay informed and compliant with labor standards.

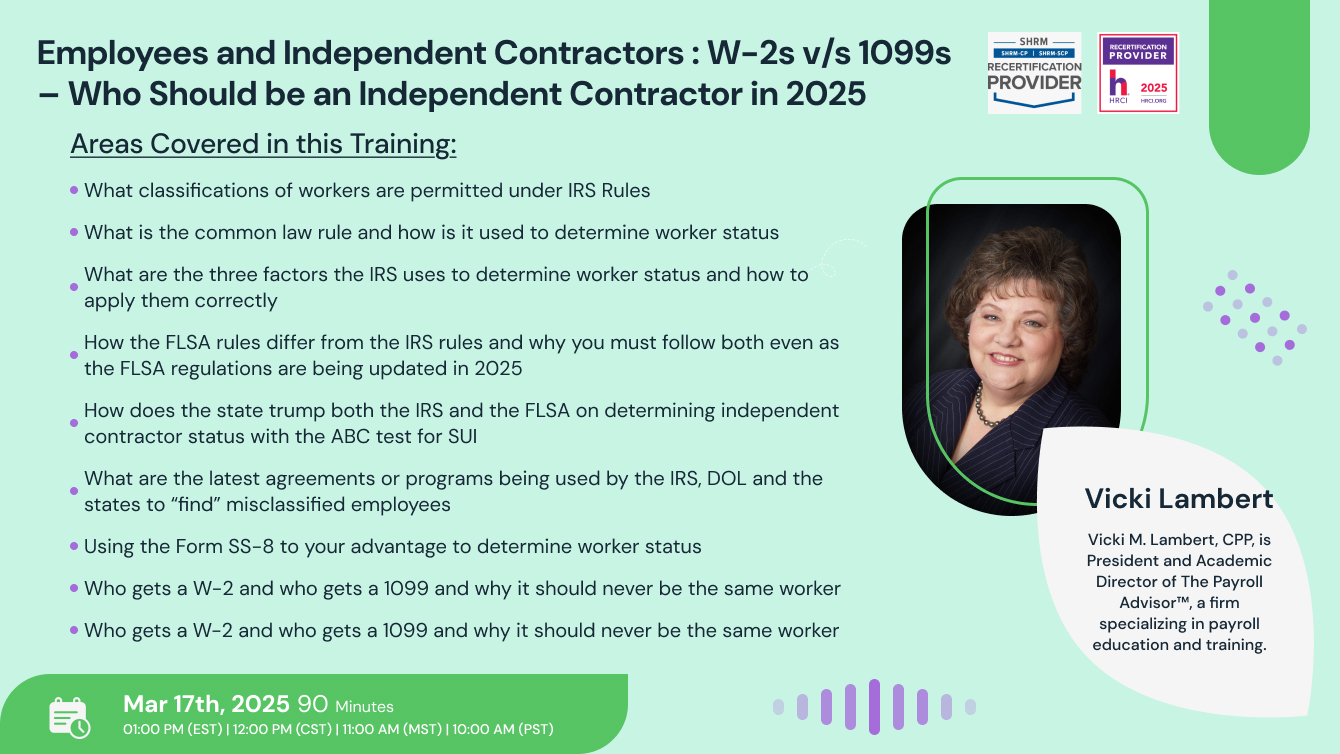

This webinar examines what the requirements are to correctly classify a worker as an independent contractor and also the requirements for when a worker must be classified as an employee.

Areas Covered in this Training:

• What classifications of workers are permitted under IRS Rules

• What is the common law rule and how is it used to determine worker status

• What are the three factors the IRS uses to determine worker status and how to apply them correctly

• How the FLSA rules differ from the IRS rules and why you must follow both even as the FLSA regulations are being updated in 2025

• How does the state trump both the IRS and the FLSA on determining independent contractor status with the ABC test for SUI

• What are the latest agreements or programs being used by the IRS, DOL and the states to “find” misclassified employees

• Using the Form SS-8 to your advantage to determine worker status

• Who gets a W-2 and who gets a 1099 and why it should never be the same worker

• Find out how easily a 1099 audit can be triggered and why the chances of getting one are on the rise

• What are the penalties for misclassifying an employee as an independent contractor and who assesses them. It is not just the IRS you have to worry about.

• You found out you have a misclassified employee—now what?

Why Attend this Training:

Misclassifying employees and independent contractors are getting costlier by the day. With federal and state agencies joining forces to combat misclassification, fines and penalties have skyrocketed. And every day the misclassification continues the penalties mount up and up until this ticking time bomb finally explodes! Find out how to defuse that ticking bomb by joining renowned payroll expert Vicki M. Lambert, CPP for this information packed webinar.

Suggested Attendees:

• Payroll Executives/Managers/Administrators/Professionals/Practitioners/Entry Level Personnel

• Human Resources Executives/Managers/Administrators

• Accounting Personnel

• Business Owners/Executive Officers/Operations and Departmental Managers

• Lawmakers

• Attorneys/Legal Professionals

• Any individual or entity that must deal with the complexities and requirements of Payroll compliance issues

Vicki Lambert

Vicki M. Lambert, CPP, is President and Academic Director of The Payroll Advisor™, a firm specializing in payroll education and training. The company’s website www.thepayrolladvisor.com offers a payroll news service which keeps payroll professionals up-to-date on the latest rules and regulations.

With nearly 40 years of hands-on experience in all facets of payroll functions as well as over three decades as a trainer and author, Ms. Lambert has become the most sought-after and respected voice in the practice and management of payroll issues. She has conducted open market training seminars on payroll issues across the United States that have been attended by executives and professionals from some of the most prestigious firms in business today.

A pioneer in electronic and online education, Ms. Lambert produces and presents payroll-related audio seminars, webinars, and webcasts for clients, APA chapters, and business groups throughout the country. Ms. Lambert is an adjunct faculty member at Brandman University in Southern California and is the creator of and instructor for their Practical Payroll Online program, which is approved for recertification hours by the APA. She is also the instructor for the American Payroll Association’s “PayTrain” online program also offered by Brandman University.

.png)

SHRM -

StandEagle is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.5 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please visit - portal.shrm.org.

HRCI -

This webinar has been approved for 1.5 HR (General) re-certification credit hours toward California, GPHR, HRBP, HRMP, PHR, and SPHR recertification through the HR Certification Institute.

The use of this seal is not an endorsement by the HR Certification Institute of the quality of the activity. It means that this activity has met the HR Certification Institute’s criteria to be pre-approved for re-certification credit.

ACCREDITATIONS