Payroll in 2023: Tax Reporting, Deadlines and Penalties

As an Administrative Professional, you hold many hats. While you may not be processing the payroll, you may be gathering the data needed for processing. To do this, you must understand the process to gather the right data and help employees when they have questions. Without this understanding, you can not properly answer the employees questions or know what to gather for the person processing the payroll.

Having a good understanding of the payroll process will enhance your knowledge and help provide the right paperwork to your team members.

Join us on Standeagle this December to go into the details of all aspects of processing payroll in 2023. You will learn to calculate employees pay, deductions withheld from employee’s paychecks and what taxes are required. We will discuss in detail as how to report taxes and the deadlines and penalties that can be assessed in 2023 if they aren’t paid timely.

Beginning with the forms needed to process payroll we will then go into how to calculate the pay including the taxes that must be withheld. After processing there is the important part of paying in those taxes and withholding that you took from the employee’s pay. We will go into what that process looks like, how you report and file as well as paying the taxes. This is an important part of payroll processing and if not done correctly can result in fines and penalties.

Main Topics

-Items needed to process payroll

-Payroll calculations

-Withholdings

-Payroll tax calculations

-Reporting of Withholding Taxes

-2023 deadlines

-Penalties

What You will Learn

-What forms you need to process employee’s pay

-How to calculate your employee’s pay in 2023

-Learn and understand what taxes must be withheld from employees

-How and where to pay employee and employer taxes

-What your responsibilities are

-Better knowledge of deadlines

-Awareness of fines and penalties that can be assessed in 2023

Why You Should Attend

Paying employees is one of the most important parts of doing business. Employees work to be paid so making sure they are paid timely and correctly is crucial to your business. Whether you are new to processing payroll taxes or you are the Owner trying to understand more about what you are paying, you will want to attend and get a better understanding of the in’s and out’s of payroll.

How do you calculate their pay? How do you know how much to withhold? How often do you pay? Which taxes do you withhold?

Taxes are complex and making sure you are in compliance is very important. This is money that you are withholding from an employee’s wages and there are serious consequences for not paying these taxes. Fines and penalties can be assessed for companies who fail to pay taxes properly to the extent that their business can be shut down.

Laws constantly change and keeping up on payroll laws can be daunting. Attending this session will give you the basic knowledge of how and what items you need to pay your employees, how to calculate their pay, what taxes to withhold, how to pay in those taxes, and better knowledge of payroll in general to help keep you in compliance. Details on how to calculate taxes and what reports are required will be discussed along with how often they must be paid.

Who will Benefit

-Payroll Professionals

-Owners

-Tax Professionals

-Bookkeepers

-Managers

You may ask your Question directly to our expert during the Q&A session.

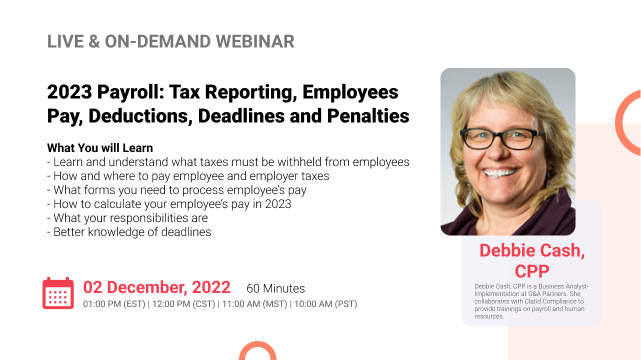

Debbie Cash

Debbie Cash, CPP is a Business Analyst-Implementation at G&A Partners. She collaborates with Clatid Compliance to provide trainings on payroll and human resources. She was formerly a Payroll Tax/Time and Attendance Specialist at Employer Advantage LLC. G&A Partners is a Professional Employer Organization (PEO) that offers payroll, human resources, benefits management, risk management, and accounting services for businesses and they recently acquired Employer Advantage LLC a former PEO. She has been with the organization since 2006.

Debbie earned an associate's degree in Accounting from MSSU in 1985 and a bachelor's degree in General Business from MSSU in 2006. She obtained her Certified Payroll Professional Certification in October 2006. She has 30+ years of experience processing payroll and payroll taxes for various different companies and professions.

Debbie worked as a Payroll Specialist at Missouri Southern State University from 1993 to March 2006. She attended the International Tax Conference in Wisconsin in 2005 and specialized in International Tax for Student Visa’s. She also worked for Joplin R-8 School District from 1990 to 1993.

Standeagle Webinar Certification - Standeagle rewards you with Standeagle Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Standeagle Courses and Webinars or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Standeagle doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

ACCREDITATIONS