Overview-

An offer in compromise is an agreement between a taxpayer and the IRS that settles the tax debt owed for a set price. There are two types of offer I'm compromises that will be covered in this presentation. Everyone that requests an offer in compromise is not granted one. It is based on what the IRS believes the taxpayer is able to pay. We will cover how to determine what the IRS believes a taxpayer can pay and if they're eligible for an offer in compromise or another payment option.

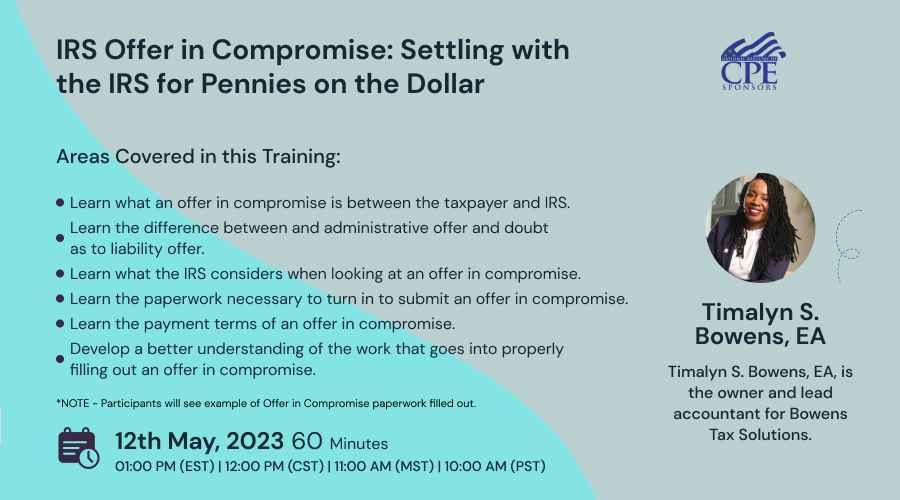

Areas covered in this Training –

-Learn what an offer in compromise is between the taxpayer and IRS.

-Learn the difference between and administrative offer and doubt as to liability offer.

-Learn what the IRS considers when looking at an offer in compromise.

-Learn the paperwork necessary to turn in to submit an offer in compromise.

-Learn the payment terms of an offer in compromise.

-Develop a better understanding of the work that goes into properly filling out an offer in compromise.

Why Attend this Training-

After the end of this event, participants will have an understanding of who qualifies for an Offer in Compromise. They will know what the IRS looks at to determine if they qualify or should look at another payment option. Participants will also know the appropriate paperwork to fill out based on the type of offer they are making on behalf of their client.

*NOTE - Participants will see example of Offer in Compromise paperwork filled out.

Suggested Attendees-

-Tax professionals that are authorized to present their clients before the IRS

-Tax professionals that are interested in the different services that can be offered under tax representation.

-Taxpayers who owe back taxes to the IRS and are struggling to pay the full amount owed.

-Tax professionals

-Enrolled Agents

-CPAs

-Tax Attorneys, who advise clients on tax matters

-Small business owners who have fallen behind on their tax obligations.

-Financial advisors who want to help their clients resolve tax debt issues.

-Anyone interested in learning more about the IRS Offer in Compromise program and how it works.

Timalyn S. Bowens

Timalyn S. Bowens, EA, is an IRS-licensed enrolled agent who has been working in the tax industry for 11 years. She started Bowens Tax & Bookkeeping Solutions in 2016, helping small businesses keep their records straight and compliant with the IRS.

After becoming an enrolled agent in 2018, she began to fully help her clients negotiate with the IRS and represent them in audits. In 2021, her company became Bowens Tax Solutions as their primary focus is now to represent taxpayers before the IRS.

Timalyn is a member of the National Association of Enrolled Agents (NAEA) and the American Society of Tax Problem Solvers (ASTPS). She will be a speaker at an NAEA event later this year to train other tax professionals on a representation topic. She was also a speaker at the Tax and Accounting Summit of 2021.

In addition, Timalyn is a member of the Bellarmine University Alumni Board of Directors, where she serves on the mentor committee. She is also a Bellarmine University Alumni Ambassador, helping prospective students learn more about the university.

She serves as the treasurer on the board of TECH-nique, a nonprofit that helps girls of color get hands-on exposure to STEM. Timalyn also serves on a committee, S.O.S., which helps unhoused women in the Louisville Metro area.

Her blog, “Tax Tips with Timalyn,” educates taxpayers avoid issues with the IRS.

NASBA-

Standeagle is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its web site: www.nasbaregistry.org.

ACCREDITATIONS