Overview:

The Housing Opportunity Through Modernization Act (HOTMA) was signed into law on July 29, 2016, amending many aspects of Multifamily Housing programs (as well as programs administered through the Offices of Public and Indian Housing and Community Planning and Development). HOTMA was intended to streamline processes and reduce burdens on housing providers.

Now HUD has issues changes with the implementation of the final rule that is to be effective on January 1, 2024. The changes under HOTMA touch upon multiple areas, including standards for income determination, resident self-certification, and interim re-examinations.

The new rule helps raise the standard deduction for everyone but then also raises the threshold above which public housing and Section 8 residents can deduct additional medical expenses. It reduces the amount of paperwork and figuring out the medical deductions for those Households.

There are much more such comprehensive changes and all these will be covered in out 60-Minutes in-depth webinar with expert speaker Paul Flogstad.

Area covered in this Training:

-Learn what the changes are; all changes in detail will be covered

-How these affect the Property Owners & the Tenants

-What paperwork is reduced for both, the owners and the Tenants

-Asset limitations, verification and imputing income

-Income and Asset Inclusions/Exclusions

-Public Housing Income Limitation

-Medical Expense/Allowance

-Dependent Allowance

-Self-Certification of Assets\

-Elderly/Disabled Family Deduction

-Interim Recertification triggers

-Hardship Relief, Exemptions and Phase-ins

-Form changes

-Use of EIV

-You will identify which rules apply to which programs

-You will learn how the deadline could affect their current work

Why Attend this Training:

The Final Rule implementing Sections 102, 103, and 104 of the Housing Opportunity Through Modernization Act of 2016 (HOTMA) is a major change in a popular program whose mission is to simplify paperwork and make the program more functional. Since it is scheduled to go into effect at the first of the year it behoves us to understand the final rule and its ramifications of HOTMA.

On January 1, 2024, HUD will implement the most comprehensive changes to the way HUD properties determine eligibility and calculate income and rent since 1981 when Congress raised the rent cap from 25% to 30% of Adjusted Income. The changes are expected to have a ripple effect on other affordable housing programs including Rural Development and the Low-Income Housing Tax Credit and HOME programs. Find out the most significant changes, what guidance HUD has provided to date, and when you will need to start following the new rules.

Suggested Attendees

-Property Managers

-Property owners

-Leasing Consultants

-Housing Authority Staff

-Compliance staff

-Developers

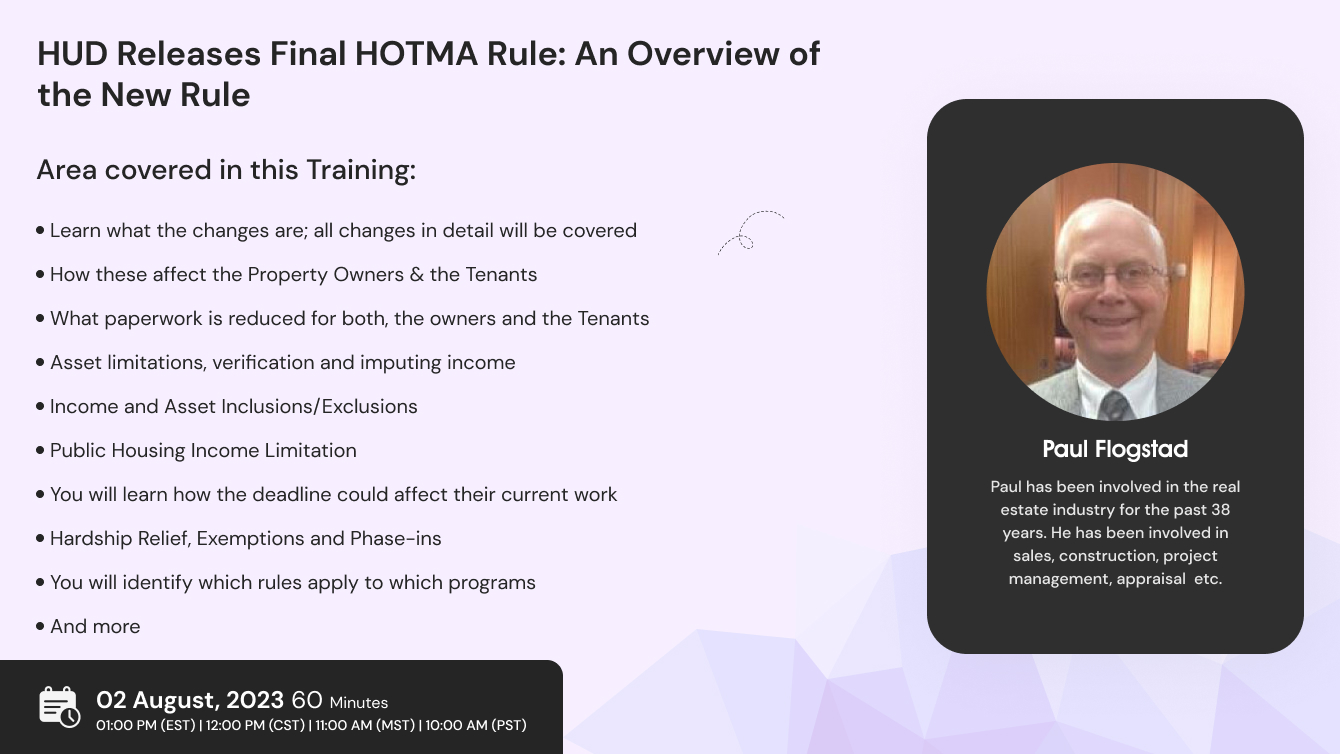

Paul Flogstad

Paul has been involved in the real estate industry for the past 38 years. He has been involved in sales, construction, project management, appraisal, property management, and property management consulting/training.

Through his consulting company, Property Management Solutions, he provides training and consulting services nationwide to owners, management companies, multi-housing associations, as well as state and federal agencies.

He specializes in fair housing issues and has developed fair housing and outreach programs for governmental agencies as well as conducting seminars which are presented to property management companies, apartment associations, and the general public nationwide. Most recently, he has been a consultant to the State of South DakotaSept

For over twenty years he was involved in the appraisal of residential, multi-family, farm, and commercial properties throughout the Midwest. Most recently, he was a consultant for affordable, multi-housing properties in 22 different states. This involved properties in HUD, Rural Development, HOME, and Tax Credit programs.

ACCREDITATIONS