S-Corporation Reasonable Compensation in 2022

As an S Corporation, you can save on payroll taxes by dividing the business income into salaries and shareholder distributions. Consequently, you would not have to pay payroll taxes on shareholder distributions, but only on wages. However, the IRS ensures the corporation doesn't avoid the employment tax payment or disguises the compensation payments as dividend distributions. Thus, understanding and complying with the classification of reasonable compensation can save you penalties.

S-corporation reasonable compensation is one of the most misunderstood concepts in tax law. And that’s saying something, considering how mind-numbing U.S. tax laws are. The law says the corporation must pay a “reasonable” salary to the owner if the owner provides services to the business. The definition of “reasonable” will vary depending on the type of business and the type of services provided by the owner.

Ensuring that an S corporation pays reasonable compensation to a shareholder-employee in exchange for services provided by the shareholder-employee is important in protecting both from assessments of tax, penalties, and interest. S corporation shareholders must include in income their pro-rata share of the S corporation’s earnings for the year. A shareholder-employee is not subject to self-employment taxes on a deemed or actual distribution of S corporation income, and the corporation does not pay any employment-related taxes on the distribution (Sec. 1373; Rev. Rul. 59-221).

A shareholder-employee and the S corporation are subject to employment taxes on compensation payment for a shareholder-employee’s services. As a result, S corporations often try to disguise compensation payments for services as income distributions. Ultimately, the determination of whether payments to a shareholder represent compensation for services or constitute a distribution of profits is essentially a factual determination.

As the topic is fairly intricate, taxpayers have trouble understanding what constitutes a reasonable compensation and what role the payments paid to the officers, shareholders and non shareholders play. Getting familiar with nonwage distributions is also equally important. Join us on Standeagle this November to learn everything you need to know about S-corporation reasonable compensation.

Get Answers to

-What is reasonable compensation?

-What are the methods relating to determining reasonable compensation?

-What are the myths relating to determining reasonable compensation?

-How can you identify resources for determining reasonable compensation?

-What is the best way to understand the court cases relating to reasonable compensation?

-What's IRS guidance on reasonable compensation?

Who will Benefit

-CPA

-EA

-AFSP

-Tax professionals

-Tax practitioners

-Payroll professionals

You may ask your Question directly to our expert during the Q&A session

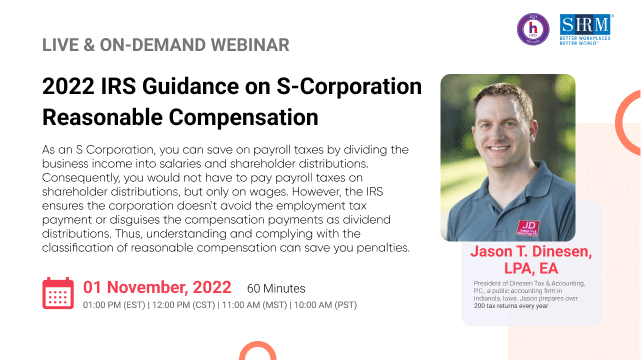

Jason Dinesen

Jason Dinesen (EA, LPA) is a tax nerd, entrepreneur, tax expert and a well-known presenter of continuing education courses. Known for his sharp tax interpretations, he is one of the quickest to bring the analysis of the latest tax updates and IRS guidance to the professional community.

Jason has coached over 200,000 accounting, tax, and HR professionals on various topics of accounting, individual taxation, corporate taxation, professional ethics and much more. He has presented over dozens of webinars on Form 1099 (for 10 years on this subject!); marriage in the tax code; tax updates; the new Form W-4, payroll updates, filing status, tax credit and other issues relating to the modern-day household setting. He also teaches 2 classes at Simpson College, Individual Income Tax and Business Analytics.

Jason always had a knack for radio shows and has and regularly features as an anchor for Radio Iowa. He was born and raised in Iowa and has a degree in corporate communications from Simpson College in Indianola. He has a big family that includes his wife, two sons, 4 cats and 2 dogs. His other hobbies include being a season ticket holder to University of Iowa football.

Standeagle is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org.

Standeagle is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org.

Standeagle Webinar Certification - Standeagle rewards you with Standeagle Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Standeagle Courses and Webinars or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Standeagle doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

ACCREDITATIONS