IRS Requirements for Schedules K-2 and K-3 in 2022

To report certain international income, credits, deductions and other miscellaneous items, the IRS has released the final versions of two new forms, which should be added to the tax returns of pass-through entities. For tax years beginning in 2021, if a partnership has items of international tax relevance, it must file Schedule K-2 and Schedule K-3. Schedule K-2 reports partners’ total international distributive share items, whereas partner’s share of international income, credits, deductions etc are reported using Schedule K-3.

Schedules K-2 and K-3, required for tax years 2021 onward, require partnerships, S corporations, and stakeholders in foreign partnerships to report items of “international tax relevance”. While this information has historically been required to be disclosed by reporting entities, formalization of these requirements through the Schedules has led to additional entity-level burdens. Buttressing these burdens is the expansive scope provided by the Service for the Schedules, necessitating reporting by entities without foreign activities or nonresident stakeholders. The information subject to reporting is expansive – arguably any item covered by an Internal Revenue Code international tax provision (directly or indirectly) is subject to disclosure by a reporting taxpayer.

Join us on Standeagle this October to learn everything you need to know before filing Schedules K-2 and K-3.

What will You Learn?

-Which entities are required to file Schedules K-2 and K-3?

-What are the specific parts of Schedules K-2 and K-3 and who is required to complete them?

-What are the relief options for failures to properly complete Schedules K-2 and K-3?

-What are the retroactive relief options for stakeholders who previously did not report foreign assets?

Get Answers to

-What are the items of international tax relevance?

-What are the parts of Schedules K-2 and K-3?

-Where do requirements exist even without international activities?

Why You Should Attend

If you are a practitioner that represents reporting entities – S corporations, partnerships, and Form 8865 filers, this training will be more than beneficial for you. This program will assist in ascertaining whether Schedules K-2 and K-3 are required to be filed, and which parts require completion if so.

Who Will Benefit

Practitioners with reporting entity clients will benefit as will stakeholders in those entities (or practitioners representing those stakeholders)

You may ask your Question directly to our expert during the Q&A session.

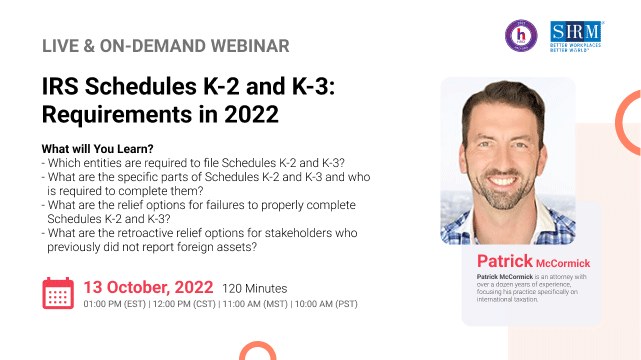

Patrick McCormick

Patrick McCormick is an attorney with over a dozen years of experience, focusing his practice specifically on international taxation. Mr. McCormick represents both business and individual clients on all aspects of United States international tax rules, both from an income tax and estate/gift tax perspective. He collaborates with Clatid Compliance to help the tax practitioners and professionals stay current and compliant.

Having previously served as a partner at a large law firm, a midsized accounting firm, and a boutique tax law firm, Patrick’s client exposures have covered every conceivable area of American-side international tax matters. Patrick has also represented every type of taxpayer – from multibillion-dollar business enterprises and ultra-high net worth individuals to startups and individuals with complex questions but limited budgets. Mr. McCormick has worked with clients located in over 90 countries on American tax considerations of multinational activities, cultivating specialized knowledge in every area of United States international tax rules.

Patrick's explicit practice focus has facilitated an unparalleled expertise in the field; he is trusted by clients and advisors around the world to obtain optimal results on international tax matters.

Standeagle is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 2.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org.

Standeagle is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 2.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org.

Standeagle Webinar Certification - Standeagle rewards you with Standeagle Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Standeagle Courses and Webinars or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Standeagle doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

ACCREDITATIONS