Automating Bank Transactions Using QuickBooks Online in 2022

QuickBooks Online is one of the most used accounting software small businesses, freelancers and mid-sized businesses prefer to manage their income and expenses. It is a sought-after tool to track the financial health of your business. Businesses use it for paying bills, invoicing customers, generating reports and for even preparing their taxes.

QuickBooks has been exceptionally helpful in payroll, as you can use it to pay your employees with direct deposit or a check. It lets you automatically calculate your payroll taxes and fill in your payroll tax forms. Thereby, allowing you to electronically pay those payroll taxes without any hassle.

The focus of this session is to teach you how you can maximize the automation capabilities of downloaded bank transactions into QuickBooks Online. Using a combination of tools such as Importing CSV transaction file, Importing CSV vendor list, Importing Rules from other company files, Creating customized bank rules, and batching transactions can speed up your process in QuickBooks Online. Join us on Standeagle this October to learn how you can automate your bank transactions using QuickBooks Online.

What will You Learn?

-QuickBooks Online (all versions) using Bank Feeds

-Manual CSV/QBO file transaction import

-Bank Rules

-Batching/Matching transactions in bulk

-Advanced Tips and Tricks with QBO banking

Get Answers to

-What are the differences between a manual CSV import, a .QBO file import, and a direct connection within the context of Bank Feeds?

-How do the Bank Rules work, and how can they be programmed to automate data entry workflows?

-What are the tools available inside QuickBooks Online that can significantly improve efficiency, especially when categorizing transactions in bulk?

Why You Should Attend

Banking is the most common work QBO users do, and speeding up processes in this area is transformative. If you feel you spend too much time downloading, categorizing, and managing transactions from the bank, join us to learn how you can maximize the potential of QuickBooks Online to serve your business and yourself. This training is specifically designed to teach you a tom and more effective approach to your transaction management.

Who Will Benefit?

-CPA Professionals

-Tax Professionals

-Accounting Professionals

-Payroll Professionals

-Accountants

-Bookkeeper

You may ask your Question directly to our expert during the Q&A session.

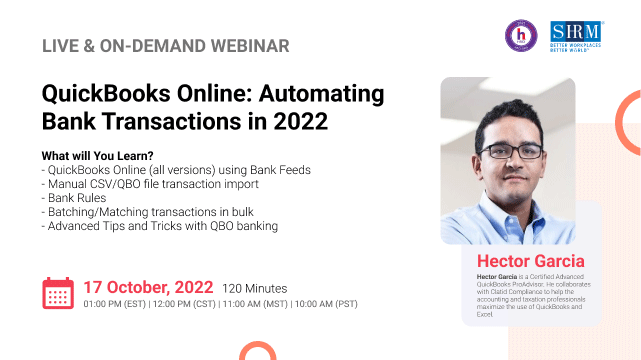

Hector Garcia

Hector Garcia is a Certified Advanced QuickBooks ProAdvisor. He collaborates with Clatid Compliance to help the accounting and taxation professionals maximize the use of QuickBooks and Excel. He is a member of Intuit Trainer/Writer NetworkCo-Host of QB Power Hour. He has created over 500 videos on QuickBooks, Accounting, Taxation, and/or Excel.

Standeagle is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 2.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org.

Standeagle is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 2.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org.

Standeagle Webinar Certification - Standeagle rewards you with Standeagle Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Standeagle Courses and Webinars or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Standeagle doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

ACCREDITATIONS