Child Tax Credit in 2022

The Child Tax Credit, or CTC, is an annual tax credit available to taxpayers with qualifying dependent children. To claim it, you use the U.S. Individual Income Tax Return Form 1040 and attach it with a complete Schedule 8812 along with other requirements. Although the Child Tax Credit was first introduced as part of the Taxpayer Relief Act of 1997, it has been playing an important role in providing financial support for American taxpayers with children and it continues to do so as 2023 is about to begin.

The IRS frequently releases updates to help those eligible to claim the credit. The American Rescue Plan, which was passed in March 2021, bumped the Child Tax Credit from $2,000 to $3,600 for each child under age 6 and to $3,000 for each child. This provision expired though and is not available for 2022. The amount rolls back to $2,000 for 2022.

Join us on Standeagle this November to learn everything you need to know about Child Tax Credit in 2022. We will cover the CTC rules, what’s new, and who qualifies. You will also learn the rules surrounding claiming a dependent as a qualifying child, as this is how one ultimately qualifies for the child tax credit.

Get Answers to

-What is the CTC?

-Where to put the CTC on Form 1040?

-Does the qualifying child needs to be blood-related?

-Is it applicable for U.S Resident Alien?

-What are the income thresholds to be eligible to claim the credit?

What You will Learn

-Claiming a qualifying child

-Child Tax Credit rules in 2022

Who will Benefit

-CPAs

-Enrolled Agents

-Tax Firms

-Tax Practitioners

-Other Tax Professionals

You may ask your Question directly to our expert during the Q&A session

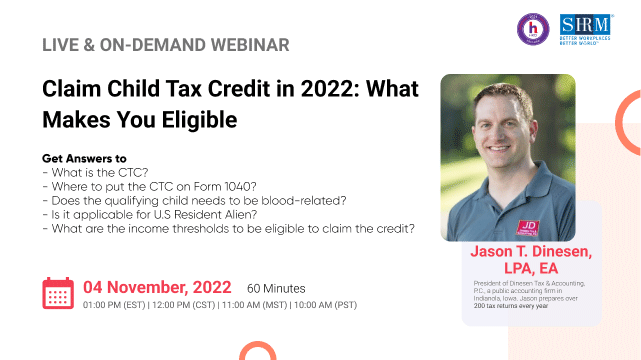

Jason Dinesen

Jason Dinesen (EA, LPA) is a tax nerd, entrepreneur, tax expert and a well-known presenter of continuing education courses. Known for his sharp tax interpretations, he is one of the quickest to bring the analysis of the latest tax updates and IRS guidance to the professional community.

Jason has coached over 200,000 accounting, tax, and HR professionals on various topics of accounting, individual taxation, corporate taxation, professional ethics and much more. He has presented over dozens of webinars on Form 1099 (for 10 years on this subject!); marriage in the tax code; tax updates; the new Form W-4, payroll updates, filing status, tax credit and other issues relating to the modern-day household setting. He also teaches 2 classes at Simpson College, Individual Income Tax and Business Analytics.

Jason always had a knack for radio shows and has and regularly features as an anchor for Radio Iowa. He was born and raised in Iowa and has a degree in corporate communications from Simpson College in Indianola. He has a big family that includes his wife, two sons, 4 cats and 2 dogs. His other hobbies include being a season ticket holder to University of Iowa football.

Standeagle is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org.

Standeagle is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org.

Standeagle Webinar Certification - Standeagle rewards you with Standeagle Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Standeagle Courses and Webinars or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Standeagle doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

ACCREDITATIONS