Overview-

What happens when your company is located in one state and one or more of your employees work in another state? What if your company has multiple business locations, with employees in each? What happens when one or more of your employees performs services for your company in more than one state? The short answer: You have multi-state employment issues.

Understanding how to calculate tax for employees in 2 or more states can be confusing. Plus, what state laws for payroll need to be followed when employing employees in more than one state.

This webinar will be tailored to employers that have a large amount of employees that may telecommute across state borders and how employers can manage the tax liability for those employees. Especially when these employees perform work in multiple states. Discussion on market shifts and the impact the multi state taxation due to COVID-19 & aftermath and the need for employees to work from home. Along with what laws have been relaxed during the pandemic and what haven’t.

Ares Covered in this Training-

-Telecommuting and why it creates a tax liability for employers

-Employee domicile and tax residency

-Reciprocity Agreements and how they affect state income tax withholding

-Resident/Non-Resident Withholding Rules

-Evaluating taxation for multiple states

-What wages are subject to taxation?

-Withholding compliance issues

-Fringe benefit taxation - which states differ from federal rules

-State Unemployment Insurance

-How to handle state unemployment when employees work in several states

-Traveling Employees

- Administrative Concerns

-HR Concerns

-Local tax residency rules

-Case Studies

Why Attend this Training-

You better understand the laws in each state and the tax guidance on how to determine taxation when employees live in one state and work in another. Or for employees that work in multiple states for travel for work. Also, other state laws that affect payroll will be discussed along with the following areas.

-Review how to properly determine SUI state

-Understanding multi-state taxation and how to properly review the laws to stay compliant

-Best practices on how other employers handle multi state concerns

-Review of trends for work from home policies and how handle multi-state taxation.

Suggested Attendees:

-Payroll Professionals

-Payroll Supervisors and Personnel

-Payroll Consultants

-Payroll Service Providers

-Public Accountants

-Internal Auditors

-Tax Professionals

-Tax Compliance Officers

-Enrolled Agents

-Employee Benefits Administrators

-Officers and Managers with Payroll or Tax Compliance Oversight

-HR professionals

-Public Agency Managers

-Audit and Compliance Personnel /Risk Managers

-CFOs

-Bookkeepers

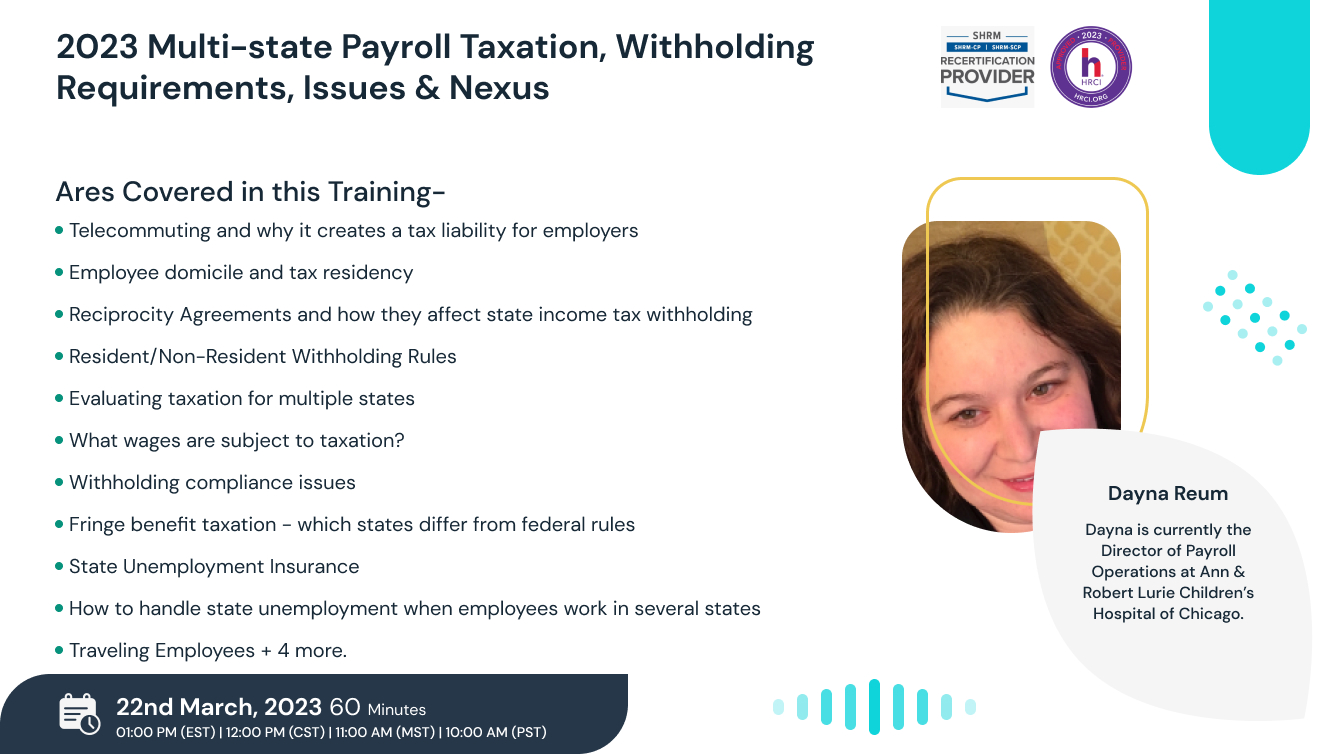

Dayna Reum

Dayna is currently the Director of Payroll Operations at Ann & Robert Lurie Children’s Hospital of Chicago. Dayna has been heavily involved in the payroll field for over 17 years. Starting as a payroll clerk at a small Tucson company, Dayna moved on to be a Payroll Team Leader at Honeywell Inc. During Dayna’s time at Honeywell she obtained her FPC (Fundamental Payroll Certification) through the American Payroll Association. She also received several merit awards for Customer Service and Acquisitions and Divestitures.

Dayna is no stranger to teaching she has taught at the Metro Phoenix American Payroll Association meetings and at the Arizona State Payroll Conference. Topics including Payroll Basics, Global/Cultural Awareness, Immigration Basics for the Payroll Professional, Multi-State and Local Taxation and Quality Control for Payroll, International and Canadian payroll. Dayna has her CPP (Certified Payroll Professional) through the APA. She also serves on the National American Payroll Association on the National Strategic Leadership Task Force, Government Affairs Task Force (PA Local tax subcommittee). Dayna has received a Citation of Merit for her service along with being a Gold Pin member of the APA. Besides her payroll accomplishments, Dayna is certified in HR hiring and firing practices and is a Six-Sigma Greenbelt.

Standeagle Webinar Certification - Standeagle rewards you with Standeagle Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Standeagle Courses and Webinars or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Standeagle doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

ACCREDITATIONS