Overview:

The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, is the most expansive federal legislation impacting employers since the Tax Cuts and Jobs Act. This sweeping law includes retroactive provisions to January 1, 2025, and will have cascading compliance effects through 2028. At its core, the OBBBA creates complex new reporting, tax, and benefits obligations for employers—especially those in industries with tipped workers, hourly employees, or high-turnover staffing models.

This session will provide you with key items from Trump’s One Big Beautiful Bill and how it impacts you as an Employer. We will discuss how to begin preparation for tax reporting to comply with the provisions of the Bill. While many items are tax deductions that are above the line deductions on employee’s tax returns, Employers will be impacted to provide information to employees for these deductions. This will require payroll systems to be updated to provide this data on W-2’s. Overtime deductions are for premium pay only so systems may need updated to calculate the correct amount. State Overtime laws do not apply as it only applies to Overtime premium pay under the FLSA.

Areas covered in this Training:

· Federal Payroll Tax Changes

o Overtime and Tip Income Deduction

· W-2 Reporting

o Payroll System updates for W-2 reporting

o New System requirements for Tip and Overtime reporting

o 2025 requirements

· 1099-MISC and 1099-NEC Changes

· Policy and Workforce Implications

· Other Impacts

o Boost employee retention & recruitment in Hospitality Industry

o Stricter Work Requirements for Medicaid Eligibility

· State Payroll Compliance Considerations

· Dependent Care Flex Spending Increase

· Enhanced Dependent Care Assistance Program

· Employee Portions of the Bill

Why attend this Training:

This session will decode the law’s complex provisions and focus exclusively on what HR, Payroll, Legal, and Operations professionals must do now to comply, adapt, and benefit. You’ll learn to –

· Identify and apply the new federal payroll tax deductions for overtime and tip income under OBBB.

· Update payroll systems and processes to ensure compliance with new federal and state reporting requirements.

· Communicate effectively with employees regarding changes to payroll deductions, eligibility, and tax impacts.

· Navigate state-specific payroll compliance issues, including differences in state adoption of OBBB provisions.

· Revise internal payroll and overtime policies to reflect the new regulatory environment.

· Implement best practices for documenting, reporting, and auditing overtime and tip compensation.

· Prepare for downstream effects on labor costs, employee classification, and workforce management.

Suggested Attendees:

· Payroll Professionals

· Owners

· Accountants

· CFO

· Tax Professionals

· Bookkeepers

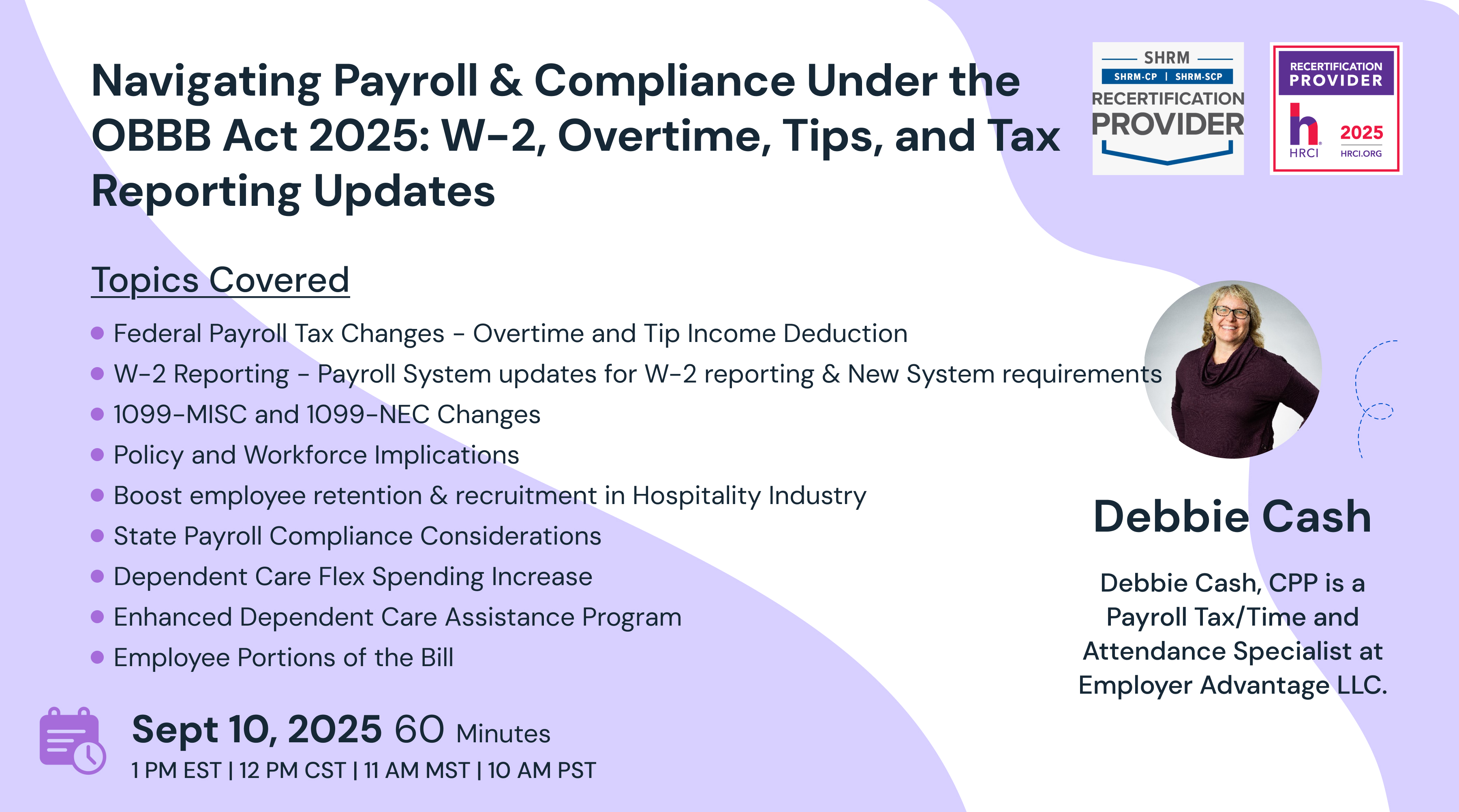

Debbie Cash

Debbie Cash, CPP is a Business Analyst-Implementation at G&A Partners. She collaborates with Clatid Compliance to provide trainings on payroll and human resources. She was formerly a Payroll Tax/Time and Attendance Specialist at Employer Advantage LLC. G&A Partners is a Professional Employer Organization (PEO) that offers payroll, human resources, benefits management, risk management, and accounting services for businesses and they recently acquired Employer Advantage LLC a former PEO. She has been with the organization since 2006.

Debbie earned an associate's degree in Accounting from MSSU in 1985 and a bachelor's degree in General Business from MSSU in 2006. She obtained her Certified Payroll Professional Certification in October 2006. She has 30+ years of experience processing payroll and payroll taxes for various different companies and professions.

Debbie worked as a Payroll Specialist at Missouri Southern State University from 1993 to March 2006. She attended the International Tax Conference in Wisconsin in 2005 and specialized in International Tax for Student Visa’s. She also worked for Joplin R-8 School District from 1990 to 1993.

SHRM -

StandEagle is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please visit - portal.shrm.org.

HRCI -

This webinar has been approved for 1.0 HR (General) re-certification credit hours toward California, GPHR, HRBP, HRMP, PHR, and SPHR recertification through the HR Certification Institute.

The use of this seal is not an endorsement by the HR Certification Institute of the quality of the activity. It means that this activity has met the HR Certification Institute’s criteria to be pre-approved for re-certification credit.

ACCREDITATIONS