Overview:

Payroll deductions remain one of the most high-risk and heavily regulated areas of payroll compliance. As new federal and state regulations take effect in 2026, employers and payroll professionals must ensure they are accurately deducting wages in accordance with evolving laws, documentation requirements, and employee consent standards.

This webinar delivers a comprehensive and compliance-focused review of payroll deductions in 2026, including both statutory and voluntary deductions. Participants will examine current regulatory requirements, recent legislative updates, and emerging trends that directly affect how deductions are calculated, authorized, and reported.

Areas Covered in this Training:

1. Understanding Wage/Payroll Deductions

· What are Payroll Deductions? – Definition and general concepts

· Types Of Deductions: Statutory vs. Voluntary deductions

· Why are Deductions Important? Legal compliance; Employee relations; Payroll accuracy

2. Key Payroll Deductions in 2026

· Statutory Deductions (Required by Law) – Federal income tax (with 2026 updates); State and local taxes (noting 2026 legislative changes); Social Security and Medicare (FICA); Unemployment insurance; Wage garnishments (e.g., child support, tax levies, creditor Garnishment)

· Voluntary Deductions – Retirement plans (401(k), Roth 401(k), etc.); Health, dental, and vision insurance premiums; Health Savings Accounts (HSA) and Flexible Spending Accounts (FSA); Union dues and other membership fees; Uniforms, Meals, Lodging, shortages, Breakages

· Overpayments — if employee was overpaid, can you just take the money back, or can you?

· Advance Vacation Pays, Loan to Employees, Employee Purchases, Anti wage Theft laws

3. Recent & Upcoming Changes for 2026

· Federal and State Legislation Updates – New laws/regulations effective in 2026; Adjusted tax rates and contribution limits; Emerging trends (e.g., remote work impact, gig economy

· Technology and Payroll Software – Automation and compliance tools; Data privacy and cybersecurity considerations

4. Best Practices for Employers

· Ensuring Compliance – Recordkeeping requirements; Regular audits and error prevention; Employee consent and communication

· Handling Employee Inquiries – Explaining deductions on pay stubs; Addressing disputes and correcting errors

Why You Should Attend

This webinar helps payroll, HR, and accounting professionals stay compliant with 2026 payroll deduction rules while earning continuing education credit. Attendees will gain a clear understanding of what deductions are permitted, required, or prohibited, learn how to avoid costly wage-and-hour errors, and improve confidence in managing employee inquiries. This session provides practical guidance to support accurate payroll processing, regulatory compliance, and audit readiness in 2026.

Suggested Attendees

· Payroll professionals and payroll managers

· Human resources professionals and HR leadership

· Accounting and finance professionals

· Compliance officers and internal auditors

· Business owners and operations managers

· Payroll service providers and consultants

· Professionals responsible for wage payment, deductions, payroll processing, or reporting

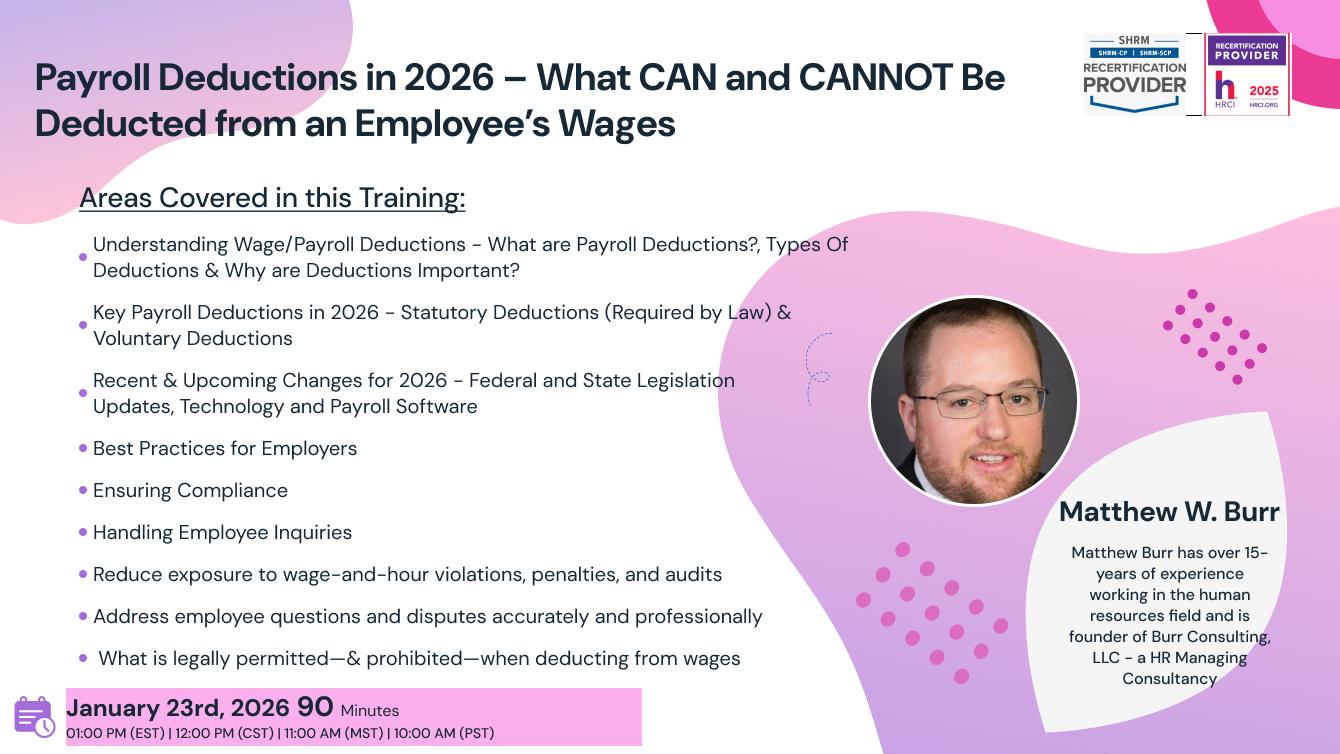

Matthew W. Burr

Matthew Burr has over 15-years of experience working in the human resources field, starting his career as an Industrial Relations Intern at Kennedy Valve Manufacturing to most recently founding and managing a human resource consulting company; Burr Consulting, LLC, Talentscape, LLC and Co-Owner of Labor Love, a Labor and Employment Law poster printing company. Prior to founding the consulting firm, the majority of his career was spent in manufacturing and healthcare. He specializes in labor and employment law, conflict resolution, performance management, labor, and employment relations. Matthew has a generalist background in HR and provides strategic HR services to his clients, focusing on small and medium sized organizations.

In July 2017, Matthew started as an Associate Professor of Business Administration at Elmira College and was promoted into the Continuing Education & Business Administration Department Liaison role in July 2018. He teaches both undergraduate and graduate level business courses at Elmira College, and successfully designed an HR Concentration in the business management major that is aligned with both SHRM and HRCI certifications. Matthew is also the SHRM Certification Exam Instructor, with a current pass rate of 89% on the SHRM-SCP and 100% pass rate on the SHRM-CP.

Matthew works as a trainer Tompkins Cortland Community College, Corning Community College, Broome Community College, Penn State University and HR Instructor for Certification Preparation for the Human Resource Certification Institute (HRCI). He also acts as an On-Call Mediator and Factfinder through the Public Employment Relations Board in New York State, working with public sector employers and labor unions.

SHRM -

Standeagle is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.5 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please visit - portal.shrm.org.

HRCI -

This webinar has been approved for 1.5 HR (General) re-certification credit hours toward California, GPHR, HRBP, HRMP, PHR, and SPHR recertification through the HR Certification Institute.

The use of this seal is not an endorsement by the HR Certification Institute of the quality of the activity. It means that this activity has met the HR Certification Institute’s criteria to be pre-approved for re-certification credit.

ACCREDITATIONS